Bank of America Investment Banking Pitch Book

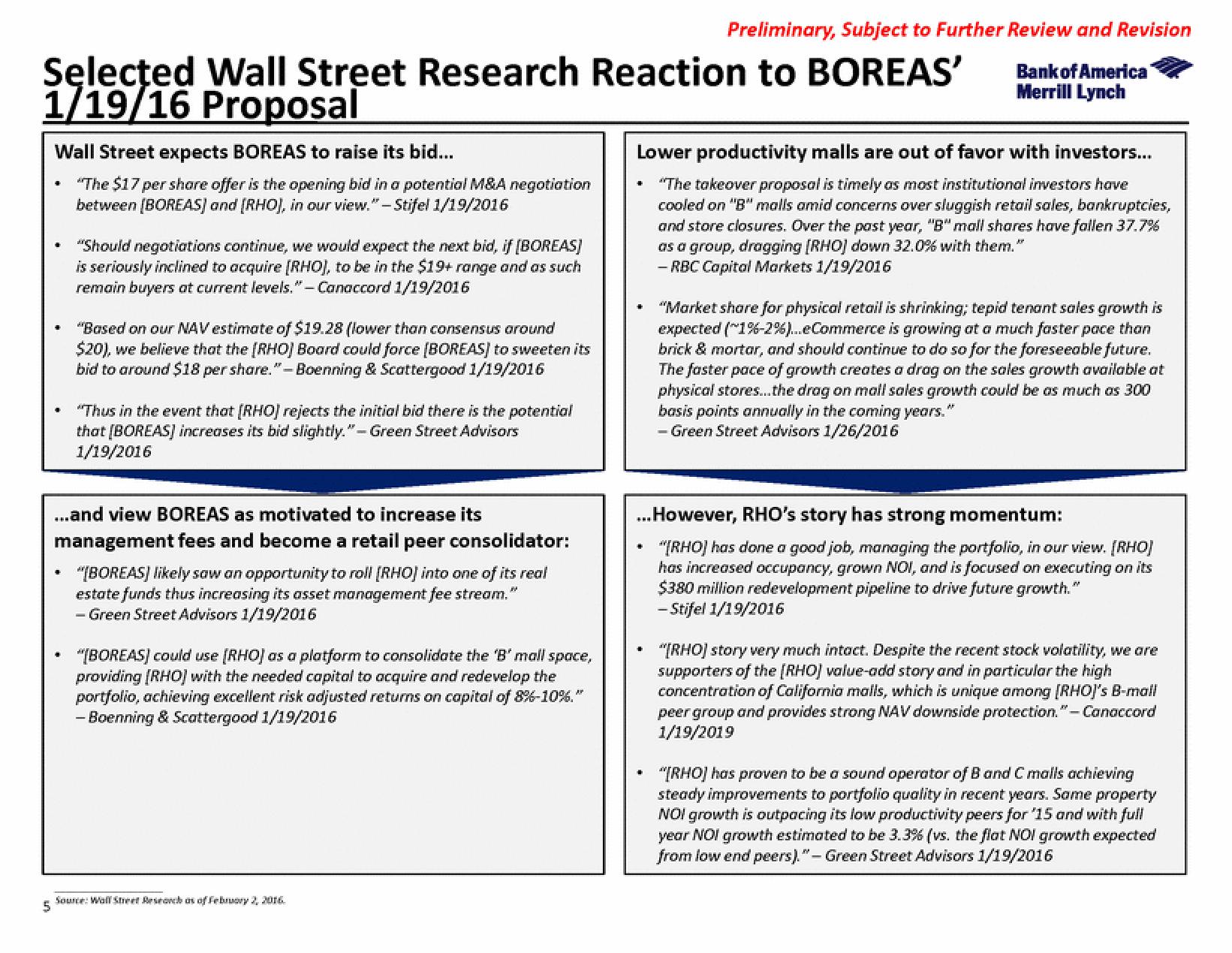

Selected Wall Street Research Reaction to BOREAS'

1/19/16 Proposal

Wall Street expects BOREAS to raise its bid...

"The $17 per share offer is the opening bid in a potential M&A negotiation

between [BOREAS] and [RHO], in our view." -Stifel 1/19/2016

#

·

+

+

"Should negotiations continue, we would expect the next bid, if [BOREAS]

is seriously inclined to acquire [RHO], to be in the $19+ range and as such

remain buyers at current levels." - Canaccord 1/19/2016

-

"Based on our NAV estimate of $19.28 (lower than consensus around

$20), we believe that the [RHO] Board could force [BOREAS) to sweeten its

bid to around $18 per share."-Boenning & Scattergood 1/19/2016

...and view BOREAS as motivated to increase its

management fees and become a retail peer consolidator:

"Thus in the event that [RHO] rejects the initial bid there is the potential

that [BOREAS] increases its bid slightly." - Green Street Advisors

1/19/2016

"[BOREAS] likely saw an opportunity to roll [RHO) into one of its real

estate funds thus increasing its asset management fee stream."

- Green Street Advisors 1/19/2016

"[BOREAS) could use [RHO) as a platform to consolidate the 'B' mall space,

providing [RHO] with the needed capital to acquire and redevelop the

portfolio, achieving excellent risk adjusted returns on capital of 8%-10%."

- Boenning & Scattergood 1/19/2016

Source: Wall Street Research as of February 2, 2016.

5

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

Lower productivity malls are out of favor with investors...

"The takeover proposal is timely as most institutional investors have

cooled on "B" malls amid concerns over sluggish retail sales, bankruptcies,

and store closures. Over the past year, "B" mall shares have fallen 37.7%

as a group, dragging [RHO] down 32.0% with them."

- RBC Capital Markets 1/19/2016

+

"Market share for physical retail is shrinking; tepid tenant sales growth is

expected ("1% -2%)...eCommerce is growing at a much faster pace than

brick & mortar, and should continue to do so for the foreseeable future.

The faster pace of growth creates a drag on the sales growth available at

physical stores...the dragon mall sales growth could be as much as 300

basis points annually in the coming years."

- Green Street Advisors 1/26/2016

...However, RHO's story has strong momentum:

"[RHO] has done a good job, managing the portfolio, in our view. (RHO)

has increased occupancy, grown NOI, and is focused on executing on its

$380 million redevelopment pipeline to drive future growth."

-Stifel 1/19/2016

"[RHO] story very much intact. Despite the recent stock volatility, we are

supporters of the [RHO) value-add story and in particular the high

concentration of California malls, which is unique among [RHO]'s B-mail

peer group and provides strong NAV downside protection."- Canaccord

1/19/2019

"[RHO] has proven to be a sound operator of B and C malls achieving

steady improvements to portfolio quality in recent years. Same property

NOI growth is outpacing its low productivity peers for '15 and with full

year NOI growth estimated to be 3.3 % (vs. the flat NOI growth expected

from low end peers)."- Green Street Advisors 1/19/2016View entire presentation