Mesirow Private Equity

($ in millions)

Core Strategy

Wealthsimple

Applitools

Alvaria

Mavis

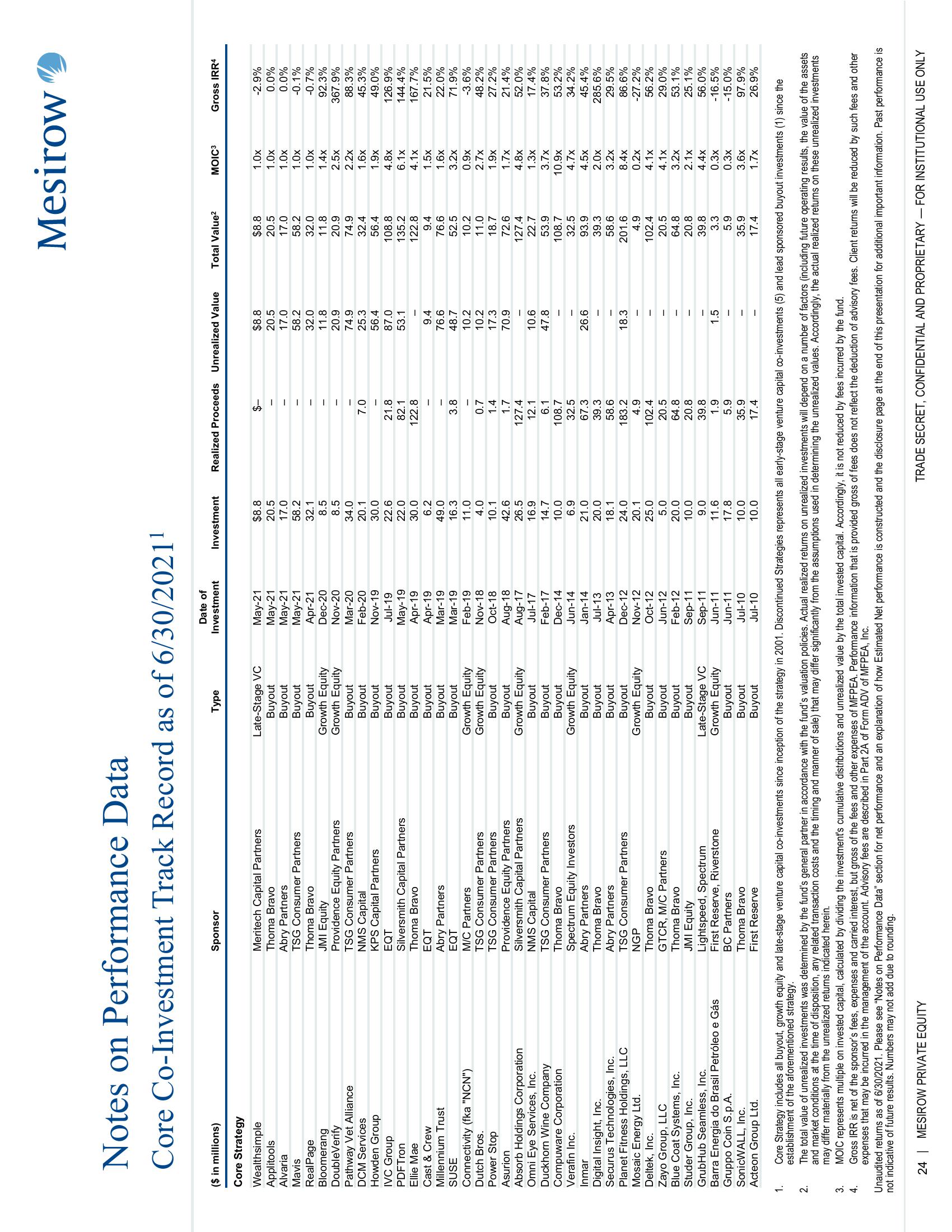

Notes on Performance Data

Core Co-Investment Track Record as of 6/30/2021¹

RealPage

Bloomerang

DoubleVerify

Pathway Vet Alliance

DCM Services

Howden Group

IVC Group

PDF Tron

Ellie Mae

Cast & Crew

Millennium Trust

SUSE

Connectivity (fka "NCN")

Dutch Bros.

Power Stop

Asurion

Absorb Holdings Corporation

Omni Eye Services, Inc.

Duckhorn Wine Company

Compuware Corporation

Verafin Inc.

Inmar

Digital Insight, Inc.

Securus Technologies, Inc.

Planet Fitness Holdings, LLC

Mosaic Energy Ltd.

Deltek, Inc.

Zayo Group, LLC

Blue Coat Systems, Inc.

Studer Group, Inc.

GrubHub Seamless, Inc.

Barra Energia do Brasil Petróleo e Gás

Gruppo Coin S.p.A.

SonicWALL, Inc.

Acteon Group Ltd.

1.

2.

3.

4.

Sponsor

Meritech Capital Partners

Thoma Bravo

Abry Partners

TSG Consumer Partners

Thoma Bravo

JMI Equity

Providence Equity Partners

TSG Consumer Partners

NMS Capital

KPS Capital Partners

EQT

Silversmith Capital Partners

Thoma Bravo

EQT

Abry Partners

EQT

M/C Partners

TSG Consumer Partners

TSG Consumer Partners

Providence Equity Partners

Silversmith Capital Partners

NMS Capital

TSG Consumer Partners

Thoma Bravo

Spectrum Equity Investors

Abry Partners

Thoma Bravo

Abry Partners

TSG Consumer Partners

NGP

Thoma Bravo

GTCR, M/C Partners

Thoma Bravo

JMI Equity

Lightspeed, Spectrum

First Reserve, Riverstone

BC Partners

Thoma Bravo

First Reserve

Type

Late-Stage VC

Buyout

Buyout

Buyout

Buyout

Growth Equity

Growth Equity

Buyout

Buyout

Buyout

Buyout

Buyout

Buyout

Buyout

Buyout

Buyout

Growth Equity

Growth Equity

Buyout

Buyout

Growth Equity

Buyout

Buyout

Buyout

Growth Equity

Buyout

Buyout

Buyout

Buyout

Growth Equity

Buyout

Buyout

Buyout

Buyout

Late-Stage VC

Growth Equity

Buyout

Buyout

Buyout

Date of

Investment

May-21

May-21

May-21

May-21

Apr-21

Dec-20

Nov-20

Mar-20

Feb-20

Nov-19

Jul-19

May-19

Apr-19

Apr-19

Mar-19

Mar-19

Feb-19

Nov-18

Oct-18

Aug-18

Aug-17

Jul-17

Feb-17

Dec-14

Jun-14

Jan-14

Jul-13

Apr-13

Dec-12

Nov-12

Oct-12

Jun-12

Feb-12

Sep-11

Sep-11

Jun-11

Jun-11

Jul-10

Jul-10

Investment Realized Proceeds Unrealized Value Total Value²

$8.8

20.5

17.0

58.2

32.1

8.5

8.5

34.0

20.1

30.0

22.6

22.0

30.0

6.2

49.0

16.3

11.0

4.0

10.1

42.6

26.5

16.9

14.7

10.0

6.9

21.0

20.0

18.1

24.0

20.1

25.0

5.0

20.0

10.0

9.0

11.6

17.8

10.0

10.0

$-

ATTITI11101000 1100

7.0

21.8

82.1

122.8

3.8

OFEN

0.7

7474

1.4

1.7

127.4

12.1

6.1

108.7

32.5

67.3

39.3

58.6

183.2

4.9

102.4

20.5

64.8

20.8

39.8

1.9

5.9

35.9

17.4

$8.8

20.5

17.0

58.2

32.0

11.8

20.9

74.9

25.3

56.4

87.0

53.1

9.4

76.6

48.7

10.2

10.2

17.3

70.9

10.6

47.8

ITIGIII|||||0||

26.6

18.3

Mesirow

1.5

$8.8

20.5

17.0

58.2

32.0

11.8

20.9

74.9

32.4

56.4

108.8

135.2

122.8

9.4

76.6

52.5

10.2

11.0

18.7

72.6

127.4

22.7

53.9

108.7

32.5

93.9

39.3

58.6

201.6

4.9

102.4

20.5

64.8

20.8

39.8

3.3

5.9

35.9

17.4

MOIC³

1.0x

1.0x

1.0x

1.0x

1.0x

1.4x

2.5x

2.2x

1.6x

1.9x

4.8x

6.1x

4.1x

1.5x

1.6x

3.2x

0.9x

2.7x

1.9x

1.7x

4.8x

1.3x

3.7x

10.9x

4.7x

4.5x

2.0x

3.2x

8.4x

0.2x

4.1x

4.1x

3.2x

2.1x

4.4x

0.3x

0.3x

3.6x

1.7x

Gross IRR4

-2.9%

0.0%

0.0%

-0.1%

-0.7%

92.3%

367.9%

88.3%

45.3%

49.0%

126.9%

144.4%

167.7%

21.5%

22.0%

71.9%

-3.6%

48.2%

27.2%

21.4%

52.0%

17.4%

37.8%

53.2%

34.2%

45.4%

285.6%

29.5%

86.6%

-27.2%

56.2%

29.0%

53.1%

25.1%

56.0%

-16.5%

-15.0%

97.9%

26.9%

Core Strategy includes all buyout, growth equity and late-stage venture capital co-investments since inception of the strategy in 2001. Discontinued Strategies represents all early-stage venture capital co-investments (5) and lead sponsored buyout investments (1) since the

establishment of the aforementioned strategy.

The total value of unrealized investments was determined by the fund's general partner in accordance with the fund's valuation policies. Actual realized returns on unrealized investments will depend on a number of factors (including future operating results, the value of the assets

and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale) that may differ significantly from the assumptions used in determining the unrealized values. Accordingly, the actual realized returns on these unrealized investments

may differ materially from the unrealized returns indicated herein.

MOIC represents multiple on invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total invested capital. Accordingly, it is not reduced by fees incurred by the fund.

Gross IRR is net of the sponsor's fees, expenses and carried interest, but gross of the fees and other expenses of MFPEA. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other

expenses that may be incurred in the management of the account. Advisory fees are described in Part 2A of Form ADV of MFPEA, Inc.

Unaudited returns as of 6/30/2021. Please see "Notes on Performance Data" section for net performance and an explanation of how Estimated Net performance is constructed and the disclosure page at the end of this presentation for additional important information. Past performance is

not indicative of future results. Numbers may not add due to rounding.

24 | MESIROW PRIVATE EQUITY

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation