Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

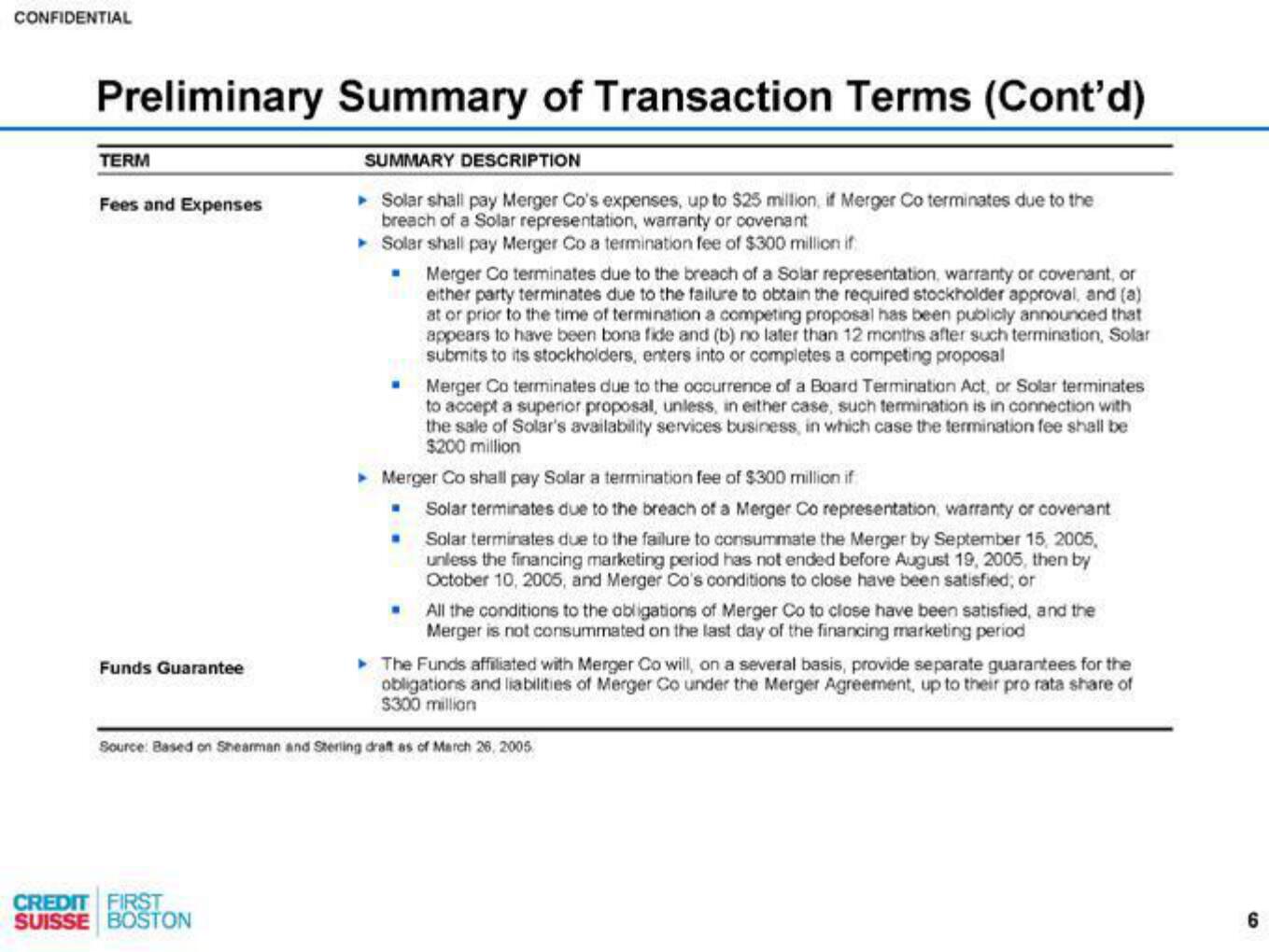

Preliminary Summary of Transaction Terms (Cont'd)

TERM

Fees and Expenses

Funds Guarantee

SUMMARY DESCRIPTION

▸ Solar shall pay Merger Co's expenses, up to $25 million, if Merger Co terminates due to the

breach of a Solar representation, warranty or covenant

▸

Solar shall pay Merger Co a termination fee of $300 million if

CREDIT FIRST

SUISSE BOSTON

.

.

Merger Co terminates due to the breach of a Solar representation, warranty or covenant, or

either party terminates due to the failure to obtain the required stockholder approval, and (a)

at or prior to the time of termination a competing proposal has been publicly announced that

appears to have been bona fide and (b) no later than 12 months after such termination, Solar

submits to its stockholders, enters into or completes a competing proposal

.

Merger Co terminates due to the occurrence of a Board Termination Act, or Solar terminates

to accept a superior proposal, unless, in either case, such termination is in connection with

the sale of Solar's availability services business, in which case the termination fee shall be

$200 million

▸ Merger Co shall pay Solar a termination fee of $300 million if

Solar terminates due to the breach of a Merger Co representation, warranty or covenant

Solar terminates due to the failure to consummate the Merger by September 15, 2005,

unless the financing marketing period has not ended before August 19, 2005, then by

October 10, 2005, and Merger Co's conditions to close have been satisfied; or

All the conditions to the obligations of Merger Co to close have been satisfied, and the

Merger is not consummated on the last day of the financing marketing period

▸ The Funds affiliated with Merger Co will, on a several basis, provide separate guarantees for the

obligations and liabilities of Merger Co under the Merger Agreement, up to their pro rata share of

$300 million

Source: Based on Shearman and Sterling draft as of March 26, 2005.

6View entire presentation