Syniverse SPAC Presentation Deck

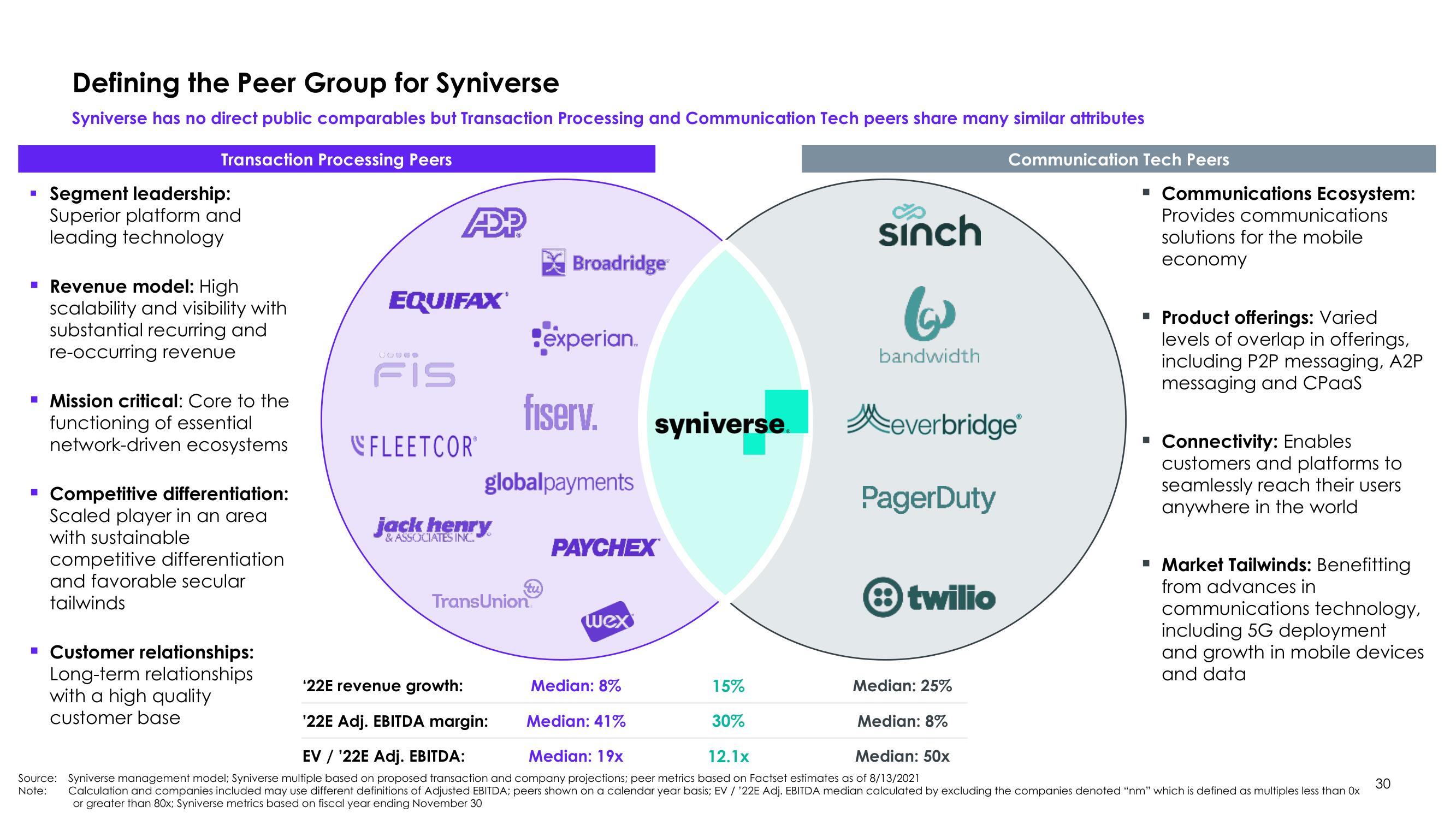

Defining the Peer Group for Syniverse

Syniverse has no direct public comparables but Transaction Processing and Communication Tech peers share many similar attributes

Transaction Processing Peers

▪ Segment leadership:

Superior platform and

leading technology

▪ Revenue model: High

scalability and visibility with

substantial recurring and

re-occurring revenue

▪ Mission critical: Core to the

functioning of essential

network-driven ecosystems

■

Competitive differentiation:

Scaled player in an area

with sustainable

competitive differentiation

and favorable secular

tailwinds

▪ Customer relationships:

Long-term relationships

with a high quality

customer base

ADP

EQUIFAX®

FIS

"FLEETCOR

jack henry

& ASSOCIATES INC.

Broadridge

experian.

fisery.

globalpayments

TransUnion

PAYCHEX

wex

syniverse.

Median: 8%

Median: 41%

sinch

6

bandwidth

15%

30%

everbridge®

PagerDuty

8 twilio

Communication Tech Peers

Median: 25%

Median: 8%

■ Communications Ecosystem:

Provides communications

solutions for the mobile

economy

▪ Product offerings: Varied

levels of overlap in offerings,

including P2P messaging, A2P

messaging and CPaaS

'22E revenue growth:

'22E Adj. EBITDA margin:

EV / '22E Adj. EBITDA:

Median: 19x

12.1x

Median: 50x

Source: Syniverse management model; Syniverse multiple based on proposed transaction and company projections; peer metrics based on Factset estimates as of 8/13/2021

Note: Calculation and companies included may use different definitions of Adjusted EBITDA; peers shown on a calendar year basis; EV / '22E Adj. EBITDA median calculated by excluding the companies denoted "nm" which is defined as multiples less than Ox

or greater than 80x; Syniverse metrics based on fiscal year ending November 30

▪ Connectivity: Enables

customers and platforms to

seamlessly reach their users

anywhere in the world

▪ Market Tailwinds: Benefitting

from advances in

communications technology,

including 5G deployment

and growth in mobile devices

and data

30View entire presentation