Yatsen Results Presentation Deck

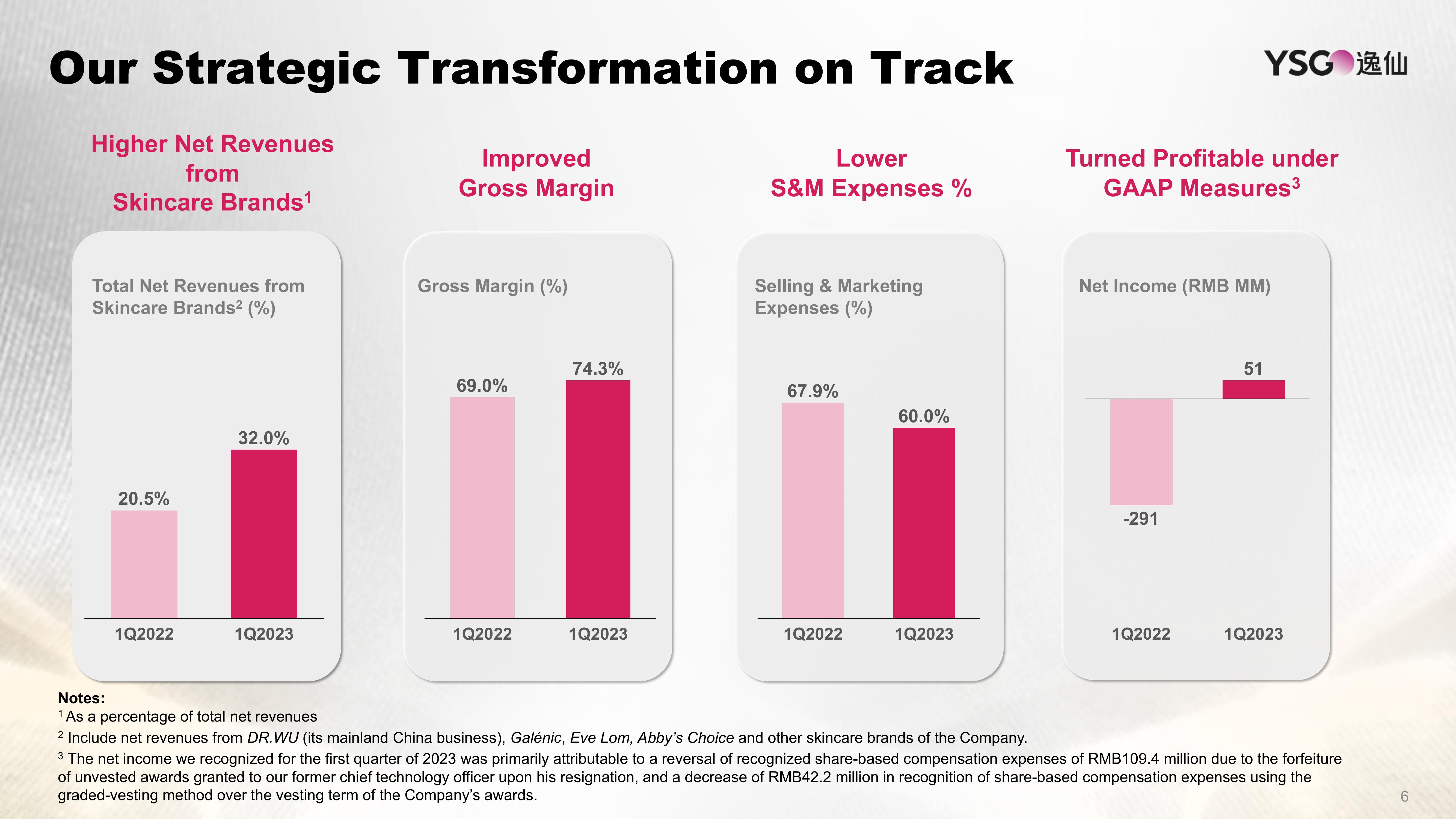

Our Strategic Transformation on Track

Higher Net Revenues

from

Skincare Brands¹

Total Net Revenues from

Skincare Brands² (%)

20.5%

1Q2022

32.0%

1Q2023

Improved

Gross Margin

Gross Margin (%)

69.0%

1Q2022

74.3%

1Q2023

Lower

S&M Expenses %

Selling & Marketing

Expenses (%)

67.9%

1Q2022

60.0%

1Q2023

Turned Profitable under

GAAP Measures³

Net Income (RMB MM)

-291

YSG1L

1Q2022

51

1Q2023

Notes:

¹ As a percentage of total net revenues

2 Include net revenues from DR. WU (its mainland China business), Galénic, Eve Lom, Abby's Choice and other skincare brands of the Company.

3 The net income we recognized for the first quarter of 2023 was primarily attributable to a reversal of recognized share-based compensation expenses of RMB109.4 million due to the forfeiture

of unvested awards granted to our former chief technology officer upon his resignation, and a decrease of RMB42.2 million in recognition of share-based compensation expenses using the

graded-vesting method over the vesting term of the Company's awards.

6View entire presentation