OpenText Investor Presentation Deck

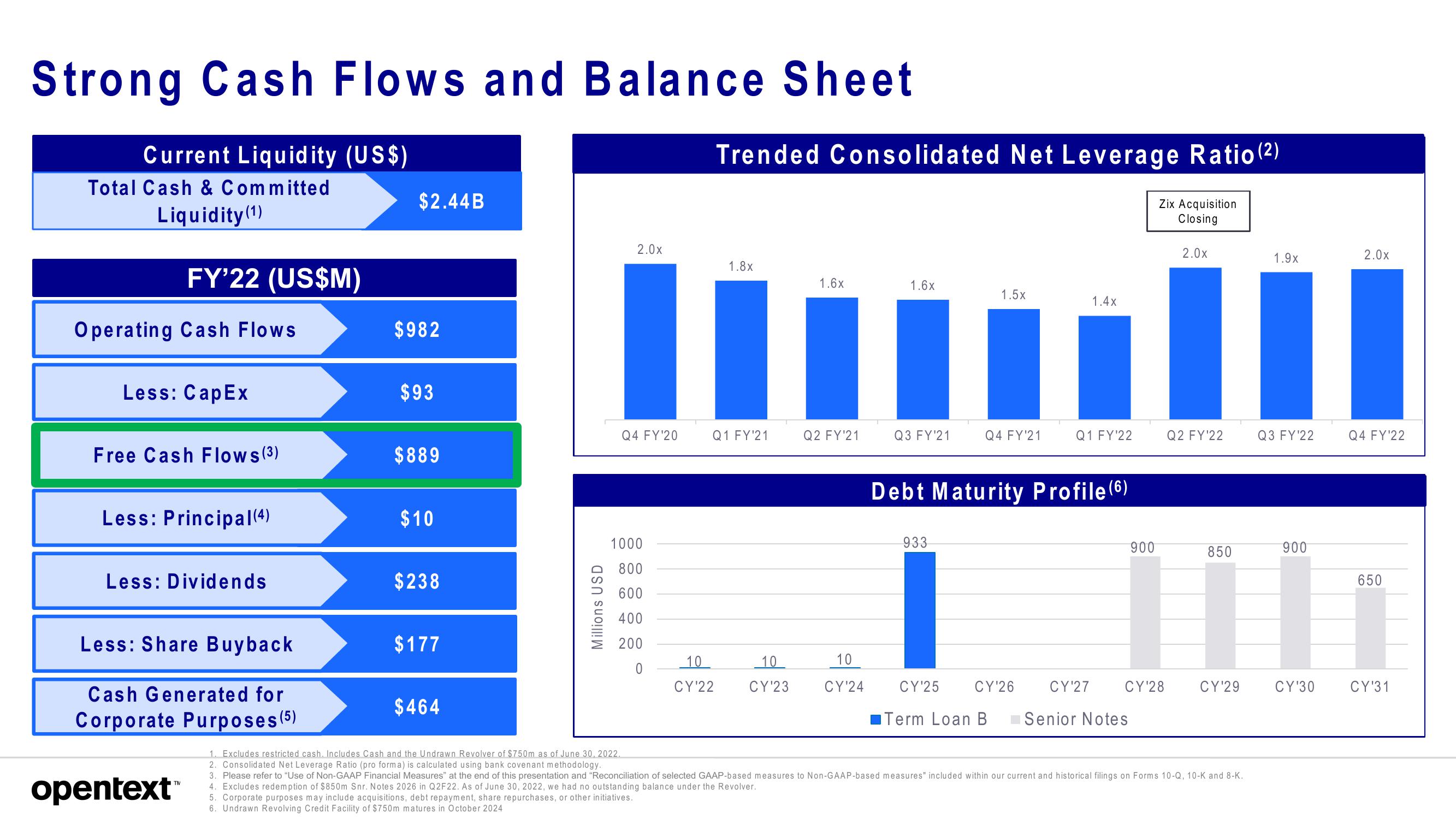

Strong Cash Flows and Balance Sheet

Current Liquidity (US$)

Total Cash & Committed

Liquidity (1)

FY'22 (US$M)

Operating Cash Flows

Less: CapEx

Free Cash Flows (³)

Less: Principal(4)

Less: Dividends

Less: Share Buyback

Cash Generated for

Corporate Purposes (5)

opentext™

$2.44B

$982

$93

$889

$10

$238

$177

$464

Millions USD

2.0x

Q4 FY'20

1000

800

600

400

200

0

Trended Consolidated Net Leverage Ratio (2)

Zix Acquisition

Closing

1.8x

Q1 FY'21

10

CY'22

10

CY¹23

1.6x

Q2 FY'21

10

CY'24

1.6x

Q3 FY¹21

1.5x

933

Q4 FY'21

Debt Maturity Profile (6)

CY'25 CY'26

Term Loan B

1.4x

Q1 FY'22

CY'27

900

CY'28

Senior Notes

2.0x

Q2 FY'22

850

CY¹29

1. Excludes restricted cash. Includes Cash and the Undrawn Revolver of $750m as of June 30, 2022.

2. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology.

3. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

4. Excludes redemption of $850m Snr. Notes 2026 in Q2F22. As of June 30, 2022, we had no outstanding balance under the Revolver.

5. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

6. Undrawn Revolving Credit Facility of $750m matures in October 2024

1.9x

Q3 FY'22

900

CY'30

2.0x

Q4 FY¹22

650

CY'31View entire presentation