Evercore Investment Banking Pitch Book

Why Evercore?

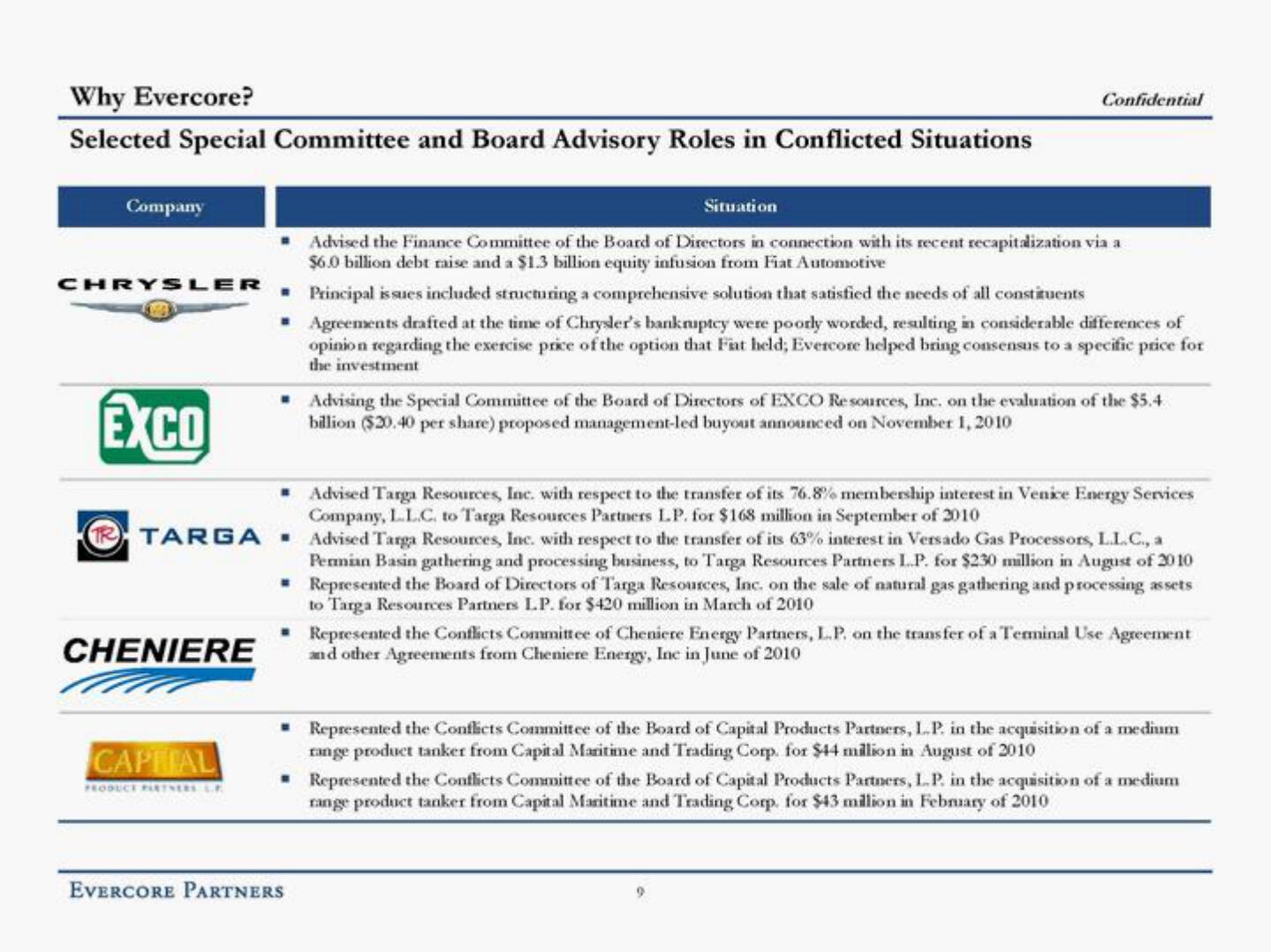

Selected Special Committee and Board Advisory Roles in Conflicted Situations

Company

CHRYSLER

EXCO

CHENIERE

■

■

CAPHIAL

PRODUCT PLETNERS OF

Confidential

Situation

Advised the Finance Committee of the Board of Directors in connection with its recent recapitalization via a

$6.0 billion debt raise and a $1.3 billion equity infusion from Fiat Automotive

■ Advised Targa Resources, Inc. with respect to the transfer of its 76.8% membership interest in Venice Energy Services

Company, L.L.C. to Targa Resources Partners L.P. for $168 million in September of 2010

TARGA Advised Targa Resources, Inc. with respect to the transfer of its 63% interest in Versado Gas Processors, L.L.C., a

Principal issues included structuring a comprehensive solution that satisfied the needs of all constituents

Agreements drafted at the time of Chrysler's bankruptcy were poorly worded, resulting in considerable differences of

opinion regarding the exercise price of the option that Fiat held; Evercore helped bring consensus to a specific price for

the investment

☐ Advising the Special Committee of the Board of Directors of EXCO Resources, Inc. on the evaluation of the $5.4

billion ($20.40 per share) proposed management-led buyout announced on November 1, 2010

■

Permian Basin gathering and processing business, to Targa Resources Partners L.P. for $230 million in August of 2010

Represented the Board of Directors of Targa Resources, Inc. on the sale of natural gas gathering and processing assets

to Targa Resources Partners L.P. for $420 million in March of 2010

EVERCORE PARTNERS

Represented the Conflicts Committee of Cheniere Energy Partners, L.P. on the transfer of a Terminal Use Agreement

and other Agreements from Cheniere Energy, Inc in June of 2010

■ Represented the Conflicts Committee of the Board of Capital Products Partners, L.P. in the acquisition of a medium

range product tanker from Capital Maritime and Trading Corp. for $44 million in August of 2010

■ Represented the Conflicts Committee of the Board of Capital Products Partners, L. P. in the acquisition of a medium

range product tanker from Capital Maritime and Trading Corp. for $43 million in February of 2010View entire presentation