Bigbear AI SPAC Presentation Deck

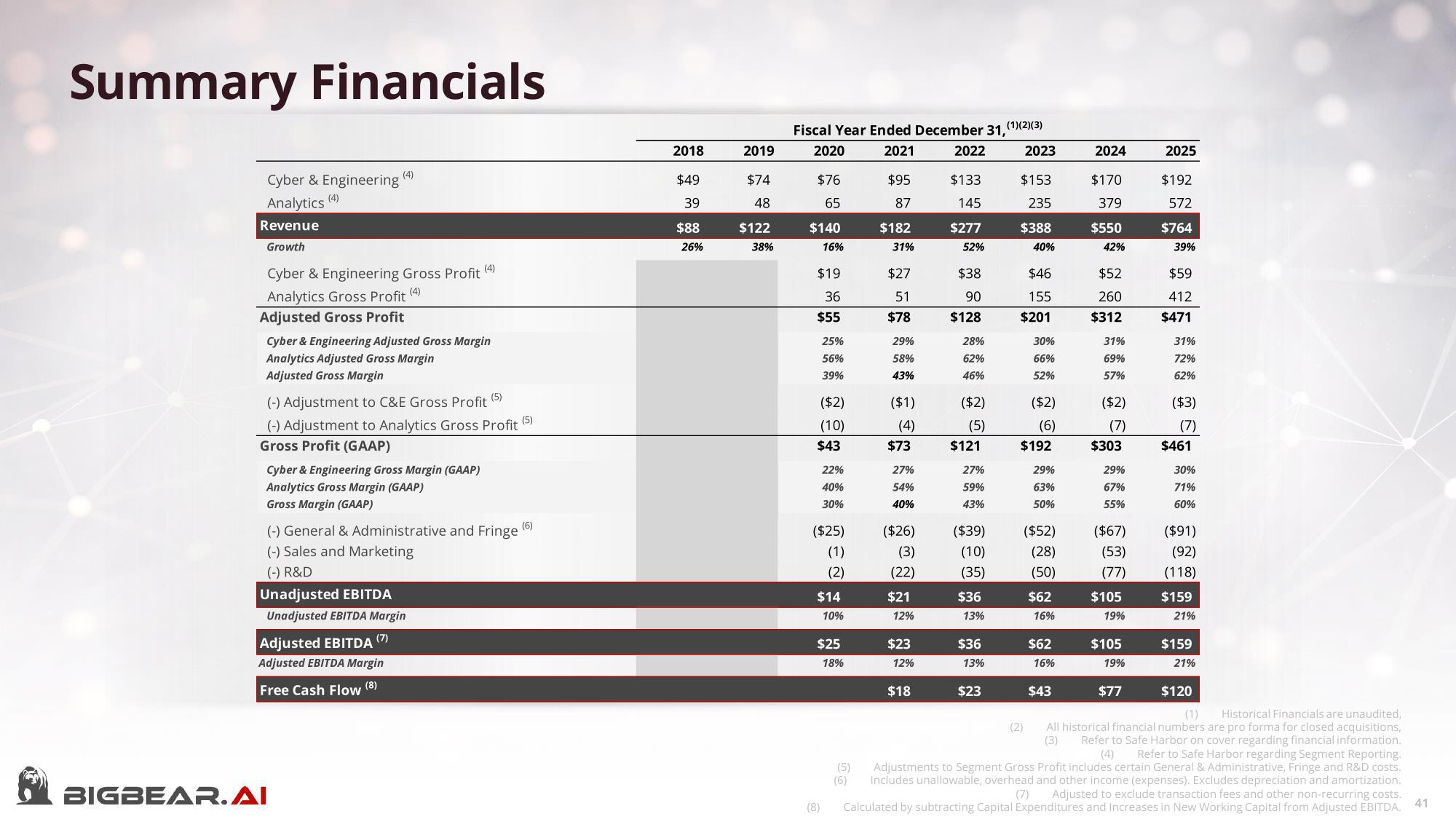

Summary Financials

Cyber & Engineering

Analytics

Revenue

Growth

(4)

(4)

Cyber & Engineering Gross Profit

(4)

(4)

Analytics Gross Profit

Adjusted Gross Profit

Cyber & Engineering Adjusted Gross Margin

Analytics Adjusted Gross Margin

Adjusted Gross Margin

(5)

(-) Adjustment to C&E Gross Profit

(-) Adjustment to Analytics Gross Profit (5)

Gross Profit (GAAP)

Cyber & Engineering Gross Margin (GAAP)

Analytics Gross Margin (GAAP)

Gross Margin (GAAP)

(-) General & Administrative and Fringe

(-) Sales and Marketing

(-) R&D

BIGBEAR. AI

Unadjusted EBITDA

Unadjusted EBITDA Margin

(7)

Adjusted EBITDA

Adjusted EBITDA Margin

Free Cash Flow (8)

(6)

2018

$49

39

$88

26%

2019

$74

48

$122

38%

Fiscal Year Ended December 31,

2020

2022

2021

$95

87

$182

31%

$76

65

$140

16%

$19

36

$55

25%

56%

39%

($2)

(10)

$43

22%

40%

30%

($25)

(1)

(2)

$14

(8)

10%

$25

18%

$27

51

$78

(5)

(6)

29%

58%

43%

($1)

(4)

$73

27%

54%

40%

($26)

(3)

(22)

$21

12%

$23

12%

$18

$133

145

$277

52%

$38

90

$128

28%

62%

46%

($2)

(5)

$121

27%

59%

43%

($39)

(10)

(35)

$36

13%

$36

13%

$23

(1)(2)(3)

2023

$153

235

$388

40%

$46

155

$201

30%

66%

52%

(2)

($2)

(6)

$192

29%

63%

50%

($52)

(28)

(50)

$62

16%

$62

16%

$43

2024

$170

379

$550

42%

$52

260

$312

31%

69%

57%

($2)

(7)

$303

29%

67%

55%

($67)

(53)

(77)

$105

19%

$105

19%

$77

2025

$192

572

$764

39%

$59

412

$471

31%

72%

62%

($3)

(7)

$461

30%

71%

60%

($91)

(92)

(118)

$159

21%

$159

21%

(1) Historical Financials are unaudited,

All historical financial numbers are pro forma for closed acquisitions,

(3) Refer to Safe Harbor on cover regarding financial information.

(4) Refer to Safe Harbor regarding Segment Reporting.

Adjustments to Segment Gross Profit includes certain General & Administrative, Fringe and R&D costs.

Includes unallowable, overhead and other income (expenses). Excludes depreciation and amortization.

Adjusted to exclude transaction fees and other non-recurring costs.

Calculated by subtracting Capital Expenditures and Increases in New Working Capital from Adjusted EBITDA.

$120

41View entire presentation