NVIDIA Investor Day Presentation Deck

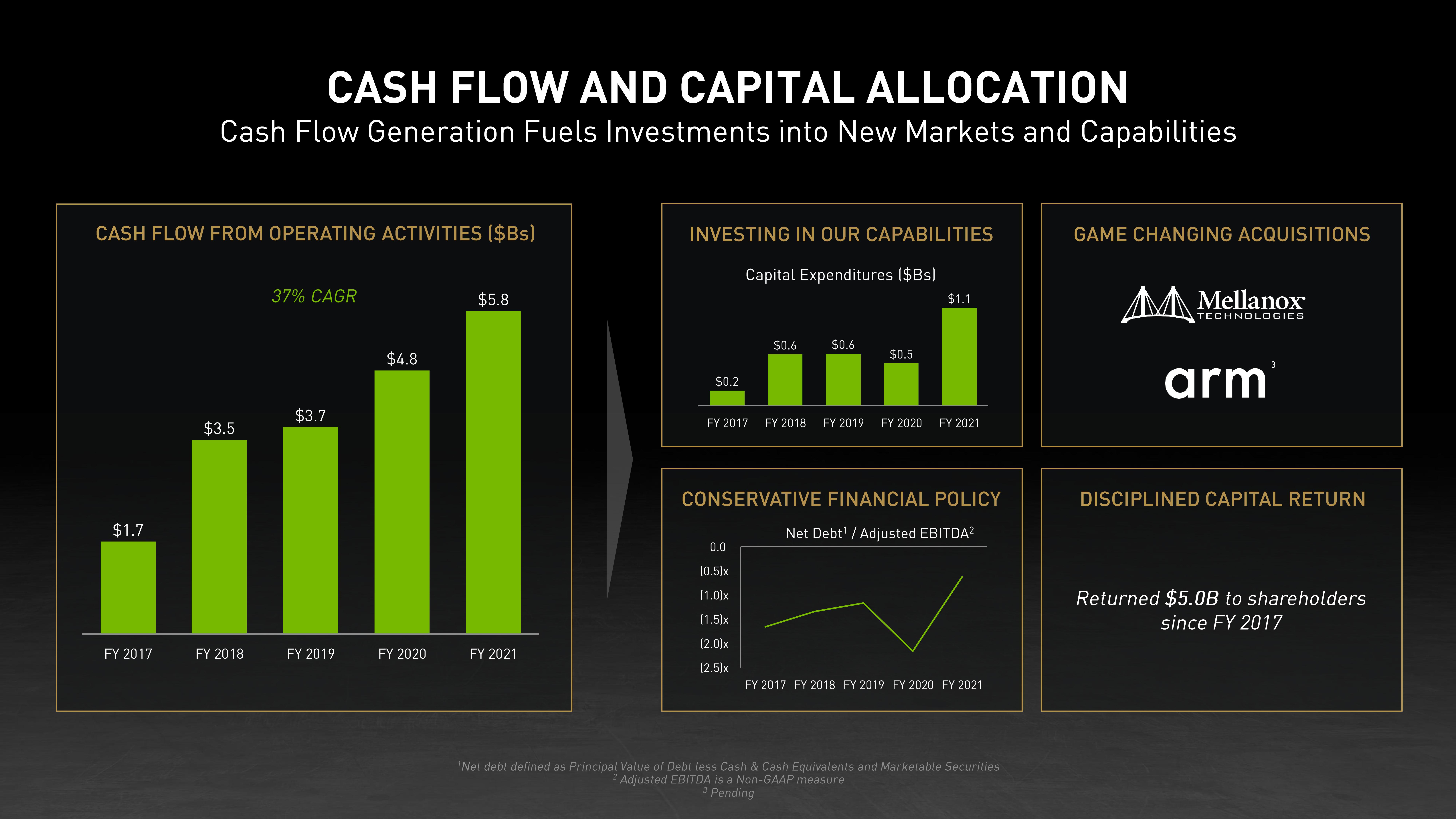

CASH FLOW FROM OPERATING ACTIVITIES ($Bs)

$1.7

CASH FLOW AND CAPITAL ALLOCATION

Cash Flow Generation Fuels Investments into New Markets and Capabilities

FY 2017

$3.5

FY 2018

37% CAGR

$3.7

FY 2019

$4.8

FY 2020

$5.8

FY 2021

INVESTING IN OUR CAPABILITIES

Capital Expenditures ($Bs)

$0.2

$0.6

FY 2017 FY 2018

0.0

(0.5)x

(1.0)x

(1.5)x

(2.0)x

(2.5)x

$0.6

$0.5

FY 2019 FY 2020

$1.1

FY 2021

CONSERVATIVE FINANCIAL POLICY

Net Debt¹ / Adjusted EBITDA²

FY 2017 FY 2018 FY 2019 FY 2020 FY 2021

¹Net debt defined as Principal Value of Debt less Cash & Cash Equivalents and Marketable Securities

2 Adjusted EBITDA is a Non-GAAP measure

3 Pending

GAME CHANGING ACQUISITIONS

M

TECHNOLOGIES

arm

DISCIPLINED CAPITAL RETURN

Returned $5.0B to shareholders

since FY 2017View entire presentation