J.P.Morgan Investment Banking Pitch Book

TRANSACTION OVERVIEW

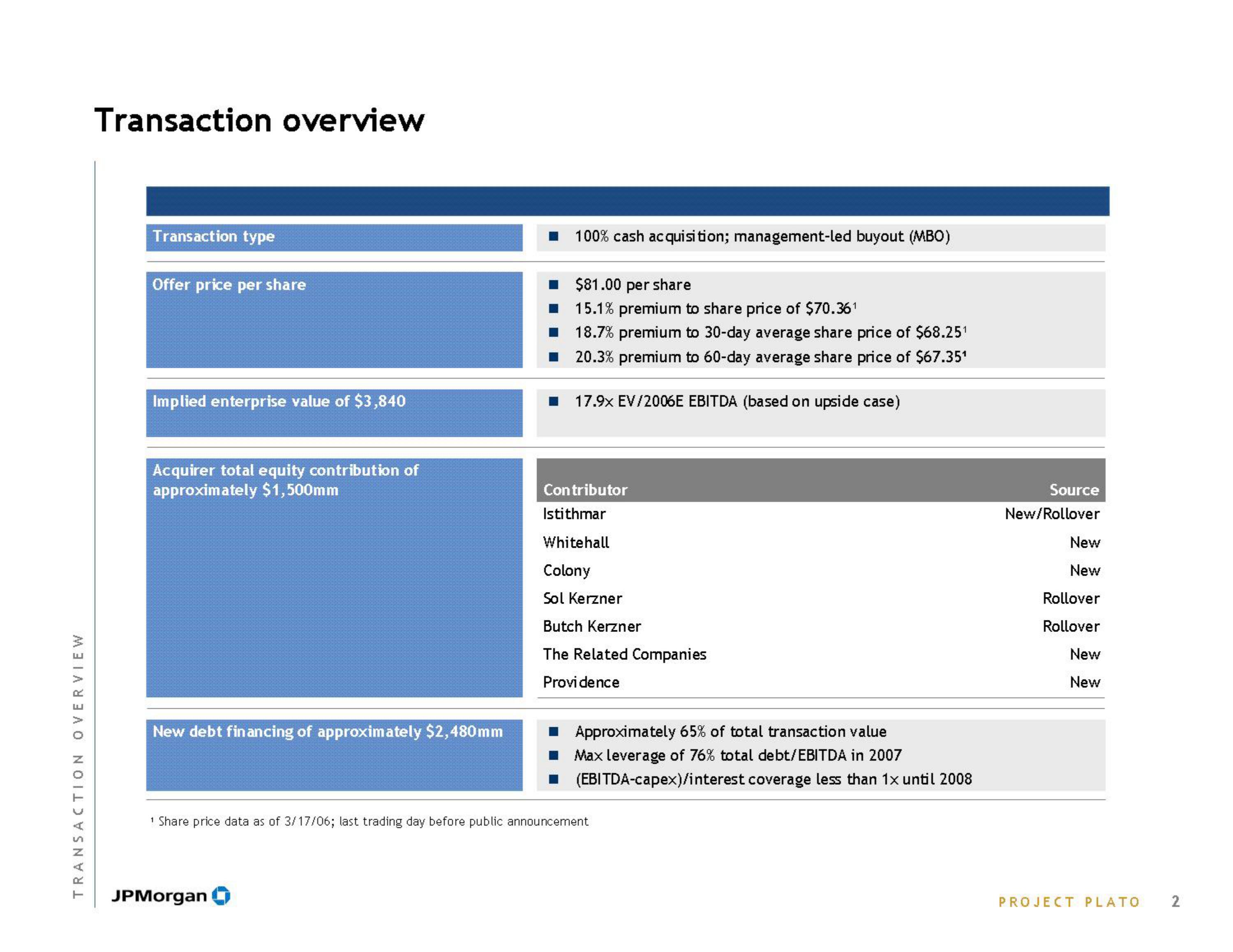

Transaction overview

Transaction type

Offer price per share

Implied enterprise value of $3,840

Acquirer total equity contribution of

approximately $1,500mm

New debt financing of approximately $2,480mm

100% cash acquisition; management-led buyout (MBO)

JPMorgan

$81.00 per share

15.1% premium to share price of $70.36¹

18.7% premium to 30-day average share price of $68.25¹

■ 20.3% premium to 60-day average share price of $67.35¹

17.9X EV/2006E EBITDA (based on upside case)

Contributor

Istithmar

Whitehall

Colony

Sol Kerzner

Butch Kerzner

The Related Companies

Providence

■ Approximately 65% of total transaction value

Max leverage of 76% total debt/EBITDA in 2007

(EBITDA-capex)/interest coverage less than 1x until 2008

1 Share price data as of 3/17/06; last trading day before public announcement

Source

New/Rollover

New

New

Rollover

Rollover

New

New

PROJECT PLATO

2View entire presentation