Evercore Investment Banking Pitch Book

Summary Trading Analysis

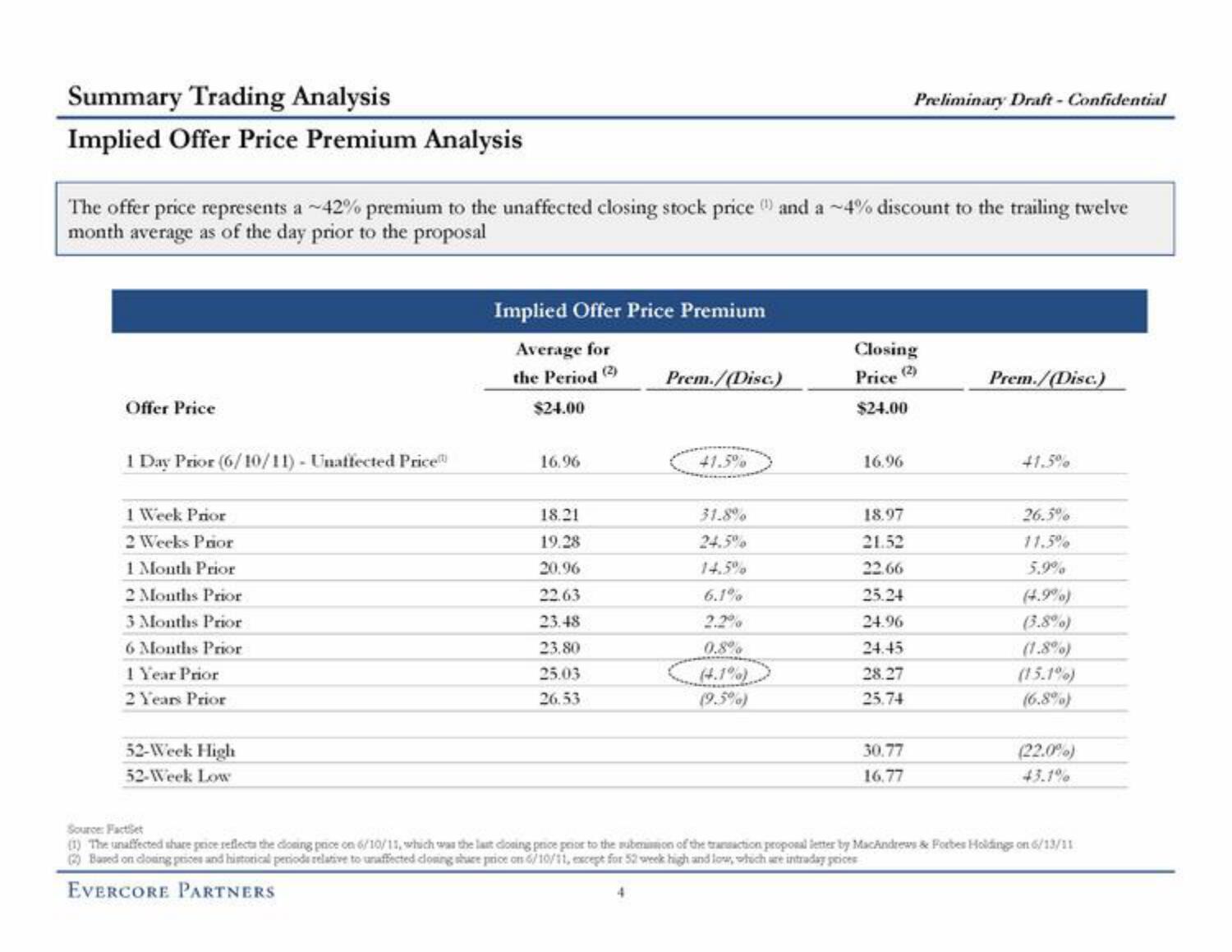

Implied Offer Price Premium Analysis

The offer price represents a ~42% premium to the unaffected closing stock price (1) and a ~4% discount to the trailing twelve

month average as of the day prior to the proposal

Offer Price

1 Day Prior (6/10/11) - Unaffected Price

1 Week Prior

2 Weeks Prior

1 Month Prior

2 Months Prior

3 Months Prior

6 Months Prior

1 Year Prior

2 Years Prior

52-Week High

52-Week Low

Implied Offer Price Premium

Average for

the Period (2)

$24.00

16.96

18.21

19.28

20.96

22.63

23.48

23.80

25.03

26.53

Prem./(Disc.)

41.5%

31.8%

24.5%

6.1%

2.2%

0.8%

(4.1%)

(9.5%)

Closing

Price (2)

$24.00

16.96

Preliminary Draft-Confidential

18.97

21.52

22.66

25.24

24.96

24.45

28.27

25.74

30.77

16.77

Prem./(Disc.)

41.5%

26.5%

11.5%

5.9%

(4.9%)

(3.8%)

(1.8%)

(15.1%)

(6.8%)

(22.0%)

43.1%

Source: FactSet

(1) The unaffected share price reflects the closing price on 6/10/11, which was the last closing price prior to the submission of the transaction proposal letter by MacAndrews & Forbes Holdings on 6/13/11

(2) Based on closing prices and historical periods relative to unaffected closing share price on 6/10/11, except for 52 week high and low, which are intraday prices

EVERCORE PARTNERSView entire presentation