J.P.Morgan Results Presentation Deck

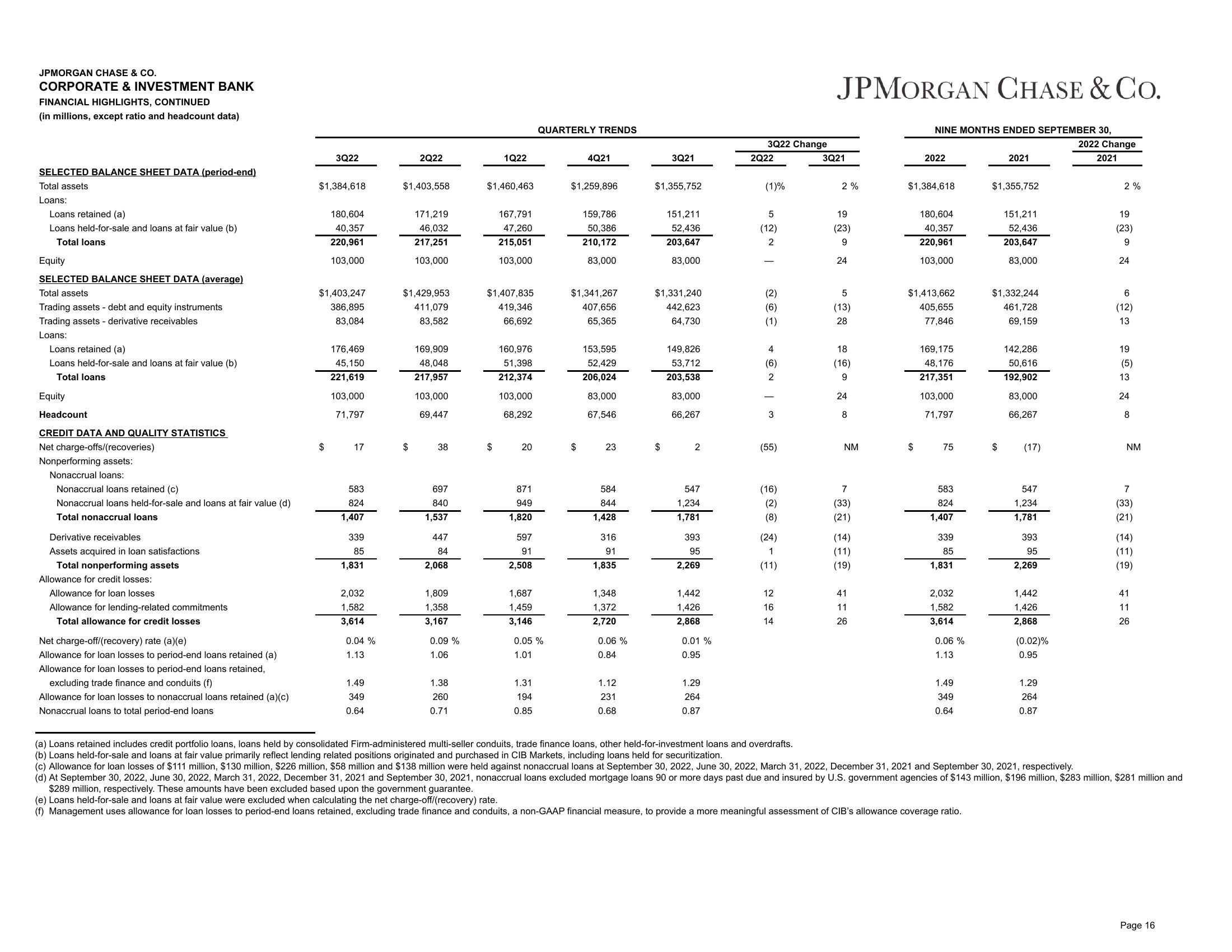

JPMORGAN CHASE & CO.

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio and headcount data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Loans retained (a)

Loans held-for-sale and loans at fair value (b)

Total loans

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Trading assets - debt and equity instruments

Trading assets - derivative receivables

Loans:

Loans retained (a)

Loans held-for-sale and loans at fair value (b)

Total loans

Equity

Headcount

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonperforming assets:

Nonaccrual loans:

Nonaccrual loans retained (c)

Nonaccrual loans held-for-sale and loans at fair value (d)

Total nonaccrual loans

Derivative receivables

Assets acquired in loan satisfactions

Total nonperforming assets

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate (a)(e)

Allowance for loan losses to period-end loans retained (a)

Allowance for loan losses to period-end loans retained,

excluding trade finance and conduits (f)

Allowance for loan losses to nonaccrual loans retained (a)(c)

Nonaccrual loans to total period-end loans

3Q22

$1,384,618

180,604

40,357

220,961

103,000

$1,403,247

386,895

83,084

176,469

45,150

221,619

103,000

71,797

$ 17

583

824

1,407

339

85

1,831

2,032

1,582

3,614

0.04 %

1.13

1.49

349

0.64

2Q22

$1,403,558

$

171,219

46,032

217,251

103,000

$1,429,953

411,079

83,582

169,909

48,048

217,957

103,000

69,447

38

697

840

1,537

447

84

2,068

1,809

1,358

3,167

0.09 %

1.06

1.38

260

0.71

1Q22

$1,460,463

$

167,791

47,260

215,051

103,000

$1,407,835

419,346

66,692

160,976

51,398

212,374

103,000

68,292

20

871

949

1,820

597

91

2,508

1,687

1,459

3,146

QUARTERLY TRENDS

0.05%

1.01

1.31

194

0.85

4Q21

$1,259,896

$

159,786

50,386

210,172

83,000

$1,341,267

407,656

65,365

153,595

52,429

206,024

83,000

67,546

23

584

844

1,428

316

91

1,835

1,348

1,372

2,720

0.06 %

0.84

1.12

231

0.68

3Q21

$1,355,752

$

151,211

52,436

203,647

83,000

$1,331,240

442,623

64,730

149,826

53,712

203,538

83,000

66,267

2

547

1,234

1,781

393

95

2,269

1,442

1,426

2,868

0.01 %

0.95

1.29

264

0.87

3Q22 Change

2Q22

(1)%

5

(12)

2

(2)

(6)

(1)

4

(6)

2

3

(55)

(16)

(2)

(8)

(24)

1

(11)

12

16

14

JPMORGAN CHASE & CO.

3Q21

2%

19

(23)

9

24

5

(13)

28

18

(16)

9

24

8

NM

7

(33)

(21)

(14)

(11)

(19)

41

11

26

NINE MONTHS ENDED SEPTEMBER 30,

2022

$1,384,618

$

180,604

40,357

220,961

103,000

$1,413,662

405,655

77,846

169, 175

48,176

217,351

103,000

71,797

75

583

824

1,407

339

85

1,831

2,032

1,582

3,614

0.06 %

1.13

1.49

349

0.64

2021

$1,355,752

$

151,211

52,436

203,647

83,000

$1,332,244

461,728

69,159

142,286

50,616

192,902

83,000

66,267

(17)

547

1,234

1,781

393

95

2,269

1,442

1,426

2,868

(0.02)%

0.95

1.29

264

0.87

2022 Change

2021

2%

19

(23)

9

24

6

(12)

13

19

(5)

13

24

8

NM

7

(33)

(21)

(14)

(11)

(19)

41

11

26

(a) Loans retained includes credit portfolio loans, loans held by consolidated Firm-administered multi-seller conduits, trade finance loans, other held-for-investment loans and overdrafts.

(b) Loans held-for-sale and loans at fair value primarily reflect lending related positions originated and purchased in CIB Markets, including loans held for securitization.

(c) Allowance for loan losses of $111 million, $130 million, $226 million, $58 million and $138 million were held against nonaccrual loans at September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, respectively.

(d) At September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, nonaccrual loans excluded mortgage loans 90 or more days past due and insured by U.S. government agencies of $143 million, $196 million, $283 million, $281 million and

$289 million, respectively. These amounts have been excluded based upon the government guarantee.

(e) Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate.

(f) Management uses allowance for loan losses to period-end loans retained, excluding trade finance and conduits, a non-GAAP financial measure, to provide a more meaningful assessment of CIB's allowance coverage ratio.

Page 16View entire presentation