Netstreit Investor Presentation Deck

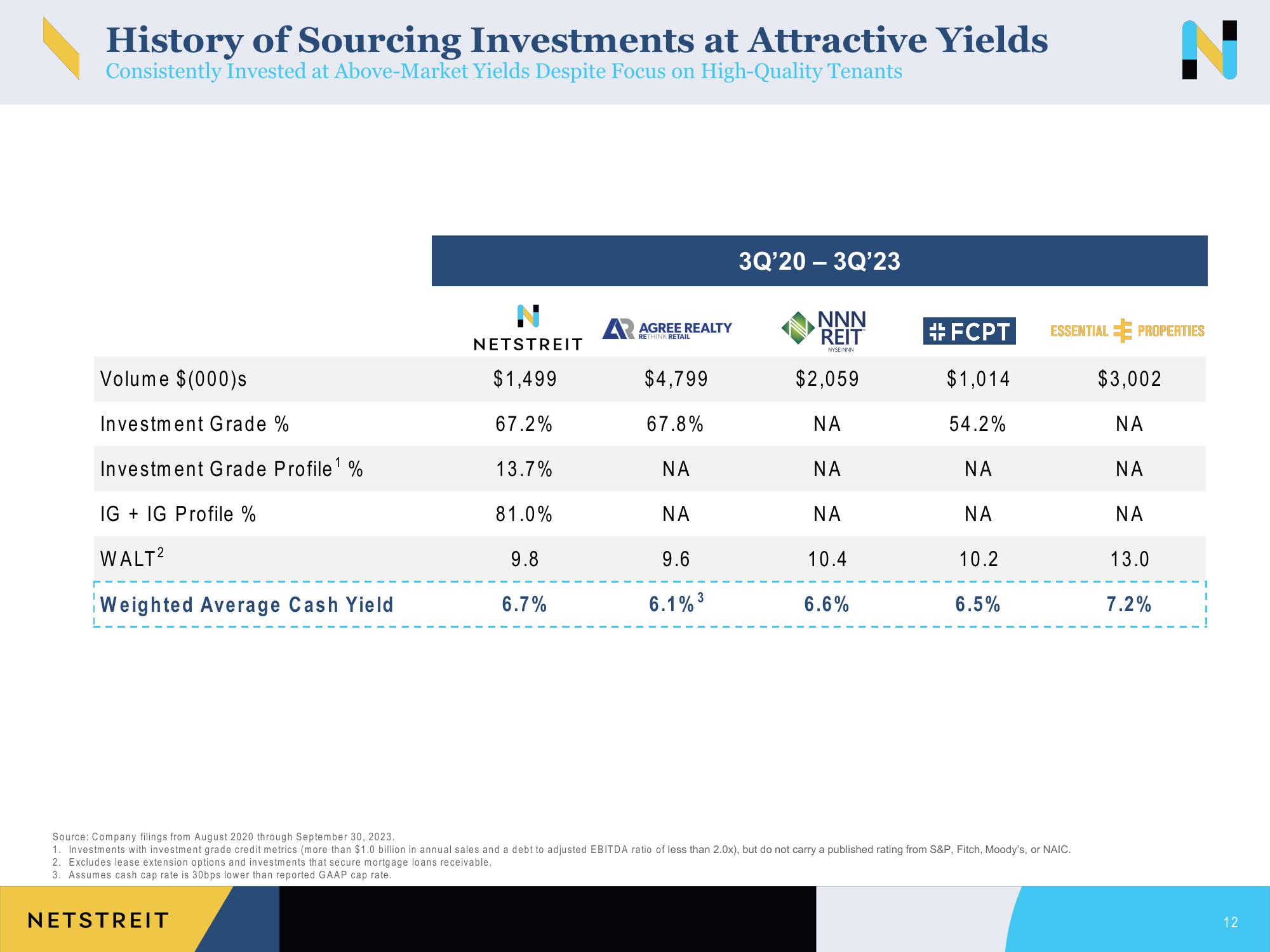

History of Sourcing Investments at Attractive Yields

Consistently Invested at Above-Market Yields Despite Focus on High-Quality Tenants

Volume $(000)s

Investment Grade %

Investment Grade Profile ¹ %

IG IG Profile %

WALT²

Weighted Average Cash Yield

N

NETSTREIT

$1,499

67.2%

13.7%

81.0%

9.8

6.7%

NETSTREIT

AR AGREE REALTY

RETHINK RETAIL

$4,799

67.8%

ΝΑ

ΝΑ

9.6

3

6.1% ³

3Q'20-3Q'23

NNN

REIT

NYSE:NNN

$2,059

ΝΑ

ΝΑ

ΝΑ

10.4

6.6%

#FCPT

$1,014

54.2%

ΝΑ

ΝΑ

10.2

6.5%

ESSENTIAL PROPERTIES

Source: Company filings from August 2020 through September 30, 2023.

1. Investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Fitch, Moody's, or NAIC.

2. Excludes lease extension options and investments that secure mortgage loans receivable.

3. Assumes cash cap rate is 30bps lower than reported GAAP cap rate.

$3,002

ΝΑ

ΝΑ

ΝΑ

13.0

7.2%

12View entire presentation