UBS ESG Presentation Deck

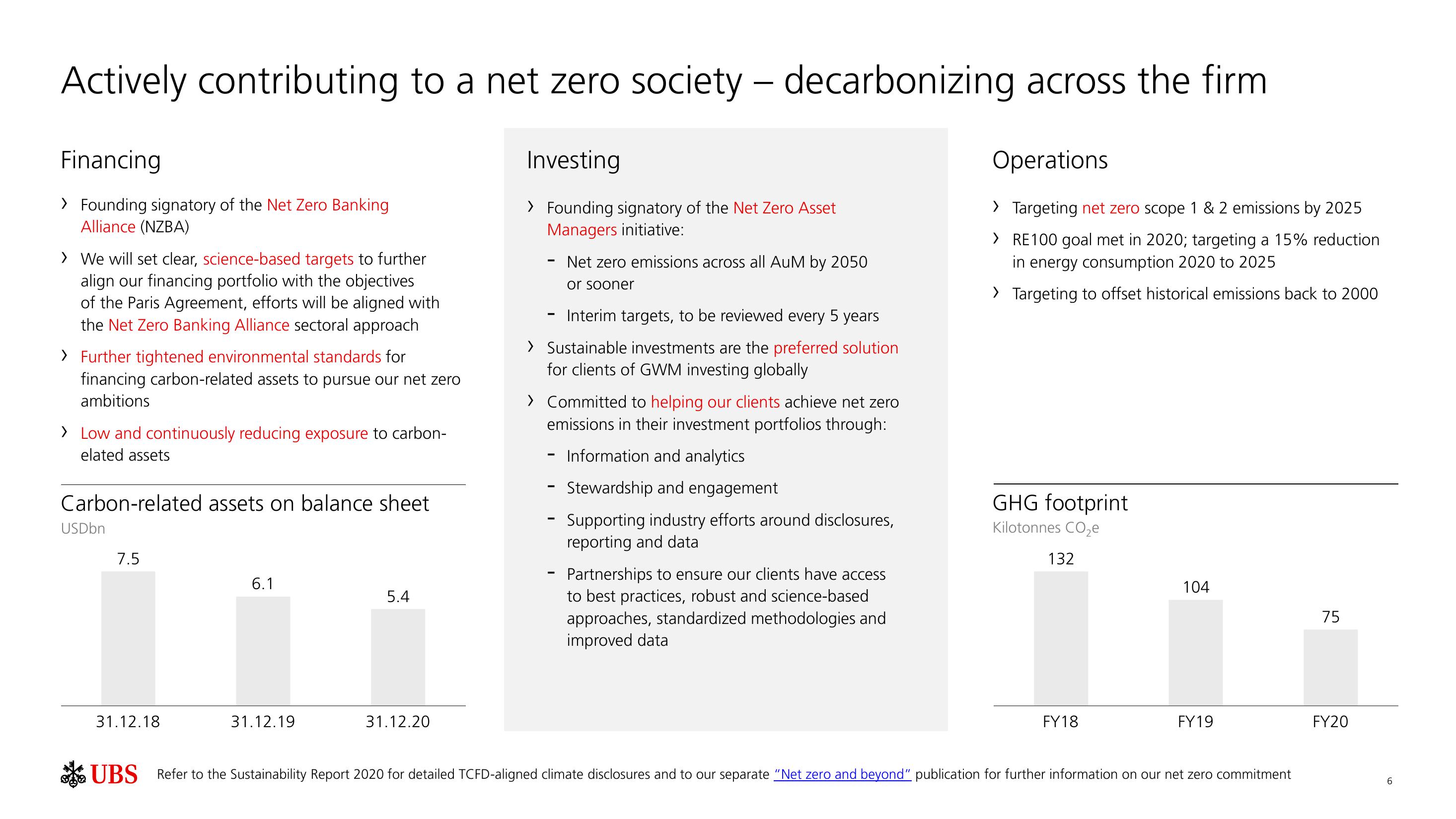

Actively contributing to a net zero society - decarbonizing across the firm

Financing

> Founding signatory of the Net Zero Banking

Alliance (NZBA)

> We will set clear, science-based targets to further

align our financing portfolio with the objectives

of the Paris Agreement, efforts will be aligned with

the Net Zero Banking Alliance sectoral approach

> Further tightened environmental standards for

financing carbon-related assets to pursue our net zero

ambitions

> Low and continuously reducing exposure to carbon-

elated assets

Carbon-related assets on balance sheet

USDbn

7.5

31.12.18

6.1

31.12.19

5.4

31.12.20

Investing

> Founding signatory of the Net Zero Asset

Managers initiative:

-

Interim targets, to be reviewed every 5 years

> Sustainable investments are the preferred solution

for clients of GWM investing globally

> Committed to helping our clients achieve net zero

emissions in their investment portfolios through:

Information and analytics

-

-

Net zero emissions across all AuM by 2050

or sooner

-

-

Stewardship and engagement

Supporting industry efforts around disclosures,

reporting and data

Partnerships to ensure our clients have access

to best practices, robust and science-based

approaches, standardized methodologies and

improved data

Operations

> Targeting net zero scope 1 & 2 emissions by 2025

> RE100 goal met in 2020; targeting a 15% reduction

in energy consumption 2020 to 2025

> Targeting to offset historical emissions back to 2000

GHG footprint

Kilotonnes CO₂e

132

FY18

104

FY19

UBS Refer to the Sustainability Report 2020 for detailed TCFD-aligned climate disclosures and to our separate "Net zero and beyond" publication for further information on our net zero commitment

75

FY20

01

6View entire presentation