Kinnevik Results Presentation Deck

2021 WAS A RECORD-BREAKING YEAR FOR GROWTH INVESTING

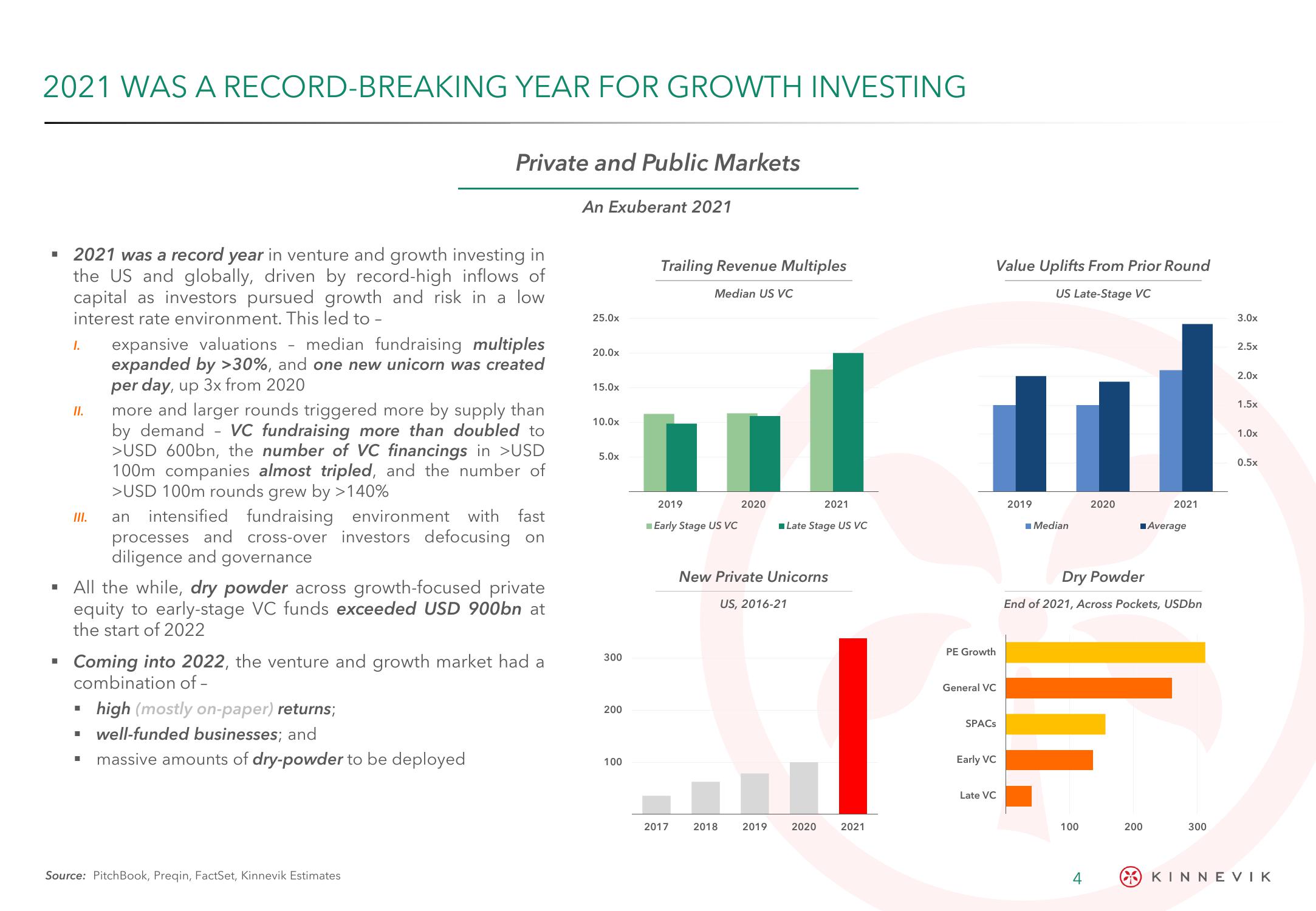

▪ 2021 was a record year in venture and growth investing in

the US and globally, driven by record-high inflows of

capital as investors pursued growth and risk in a low

interest rate environment. This led to -

H

■

1.

II.

III.

■

I

Private and Public Markets

expansive valuations - median fundraising multiples

expanded by >30%, and one new unicorn was created

per day, up 3x from 2020

All the while, dry powder across growth-focused private

equity to early-stage VC funds exceeded USD 900bn at

the start of 2022

■

more and larger rounds triggered more by supply than

by demand VC fundraising more than doubled to

>USD 600bn, the number of VC financings in >USD

100m companies almost tripled, and the number of

>USD 100m rounds grew by >140%

Coming into 2022, the venture and growth market had a

combination of -

an intensified fundraising environment with fast

processes and cross-over investors defocusing on

diligence and governance

high (mostly on-paper) returns;

well-funded businesses; and

massive amounts of dry-powder to be deployed

Source: PitchBook, Preqin, FactSet, Kinnevik Estimates

An Exuberant 2021

25.0x

20.0x

15.0x

10.0x

5.0x

300

200

100

Trailing Revenue Multiples

Median US VC

2019

Early Stage US VC

2017

2020

1

2018

New Private Unicorns

US, 2016-21

2019

2021

Late Stage US VC

2020

2021

Value Uplifts From Prior Round

US Late-Stage VC

1

2019

PE Growth

General VC

SPACs

Early VC

Late VC

■Median

2020

Dry Powder

100

4

■Average

End of 2021, Across Pockets, USDbn

2021

200

300

3.0x

2.5x

2.0x

1.5x

1.0x

0.5x

KINNEVIKView entire presentation