Benson Hill Investor Presentation Deck

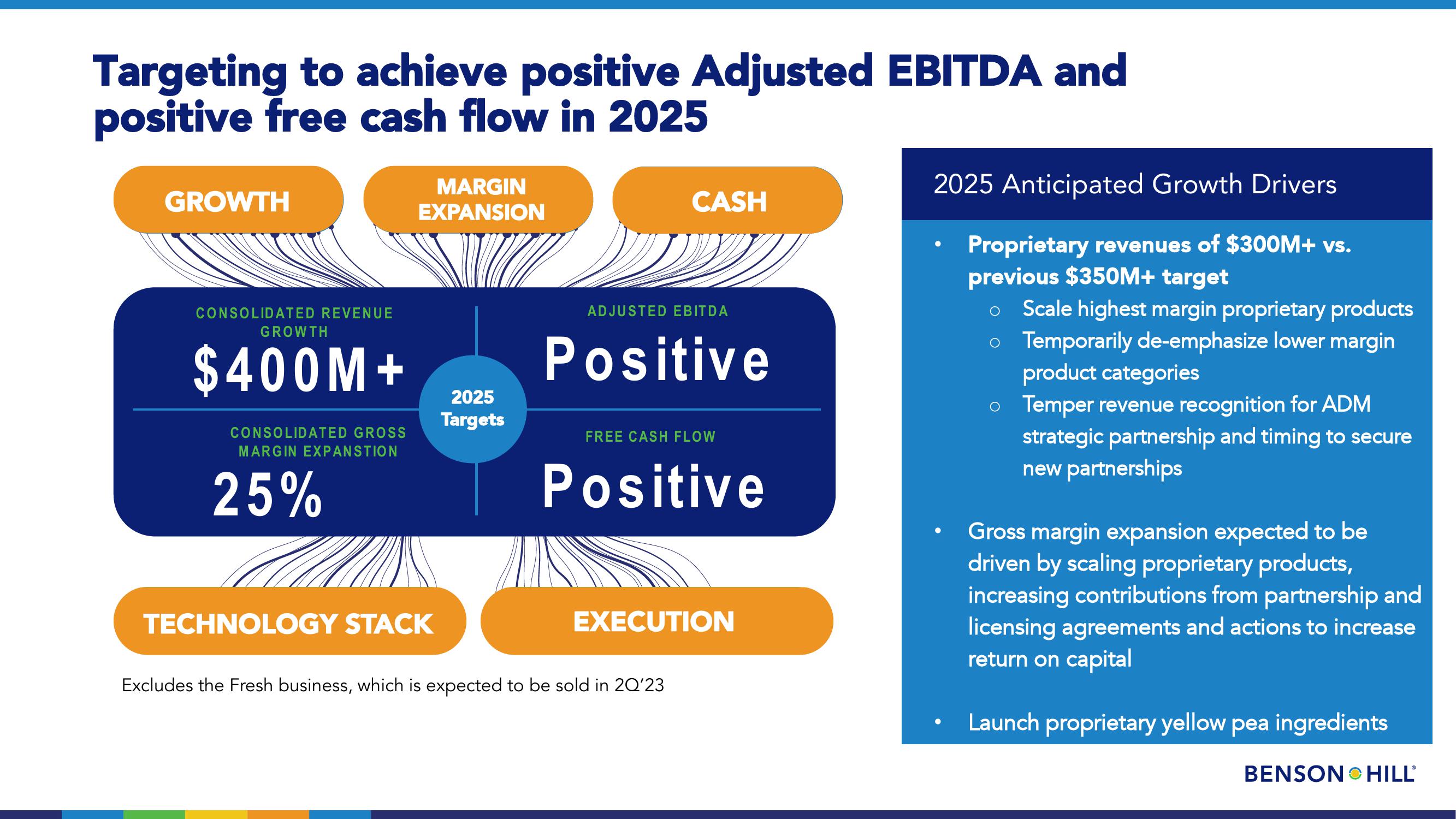

Targeting to achieve positive Adjusted EBITDA and

positive free cash flow in 2025

GROWTH

CONSOLIDATED REVENUE

GROWTH

$400M+

CONSOLIDATED GROSS

MARGIN EXPANSTION

25%

MARGIN

EXPANSION

TECHNOLOGY STACK

2025

Targets

CASH

ADJUSTED EBITDA

Positive

FREE CASH FLOW

Positive

EXECUTION

Excludes the Fresh business, which is expected to be sold in 2Q'23

2025 Anticipated Growth Drivers

Proprietary revenues of $300M+ vs.

previous $350M+ target

O Scale highest margin proprietary products

o Temporarily de-emphasize lower margin

product categories

o Temper revenue recognition for ADM

strategic partnership and timing to secure

new partnerships

●

●

Gross margin expansion expected to be

driven by scaling proprietary products,

increasing contributions from partnership and

licensing agreements and actions to increase

return on capital

Launch proprietary yellow pea ingredients

BENSON HILLView entire presentation