Grab SPAC Presentation Deck

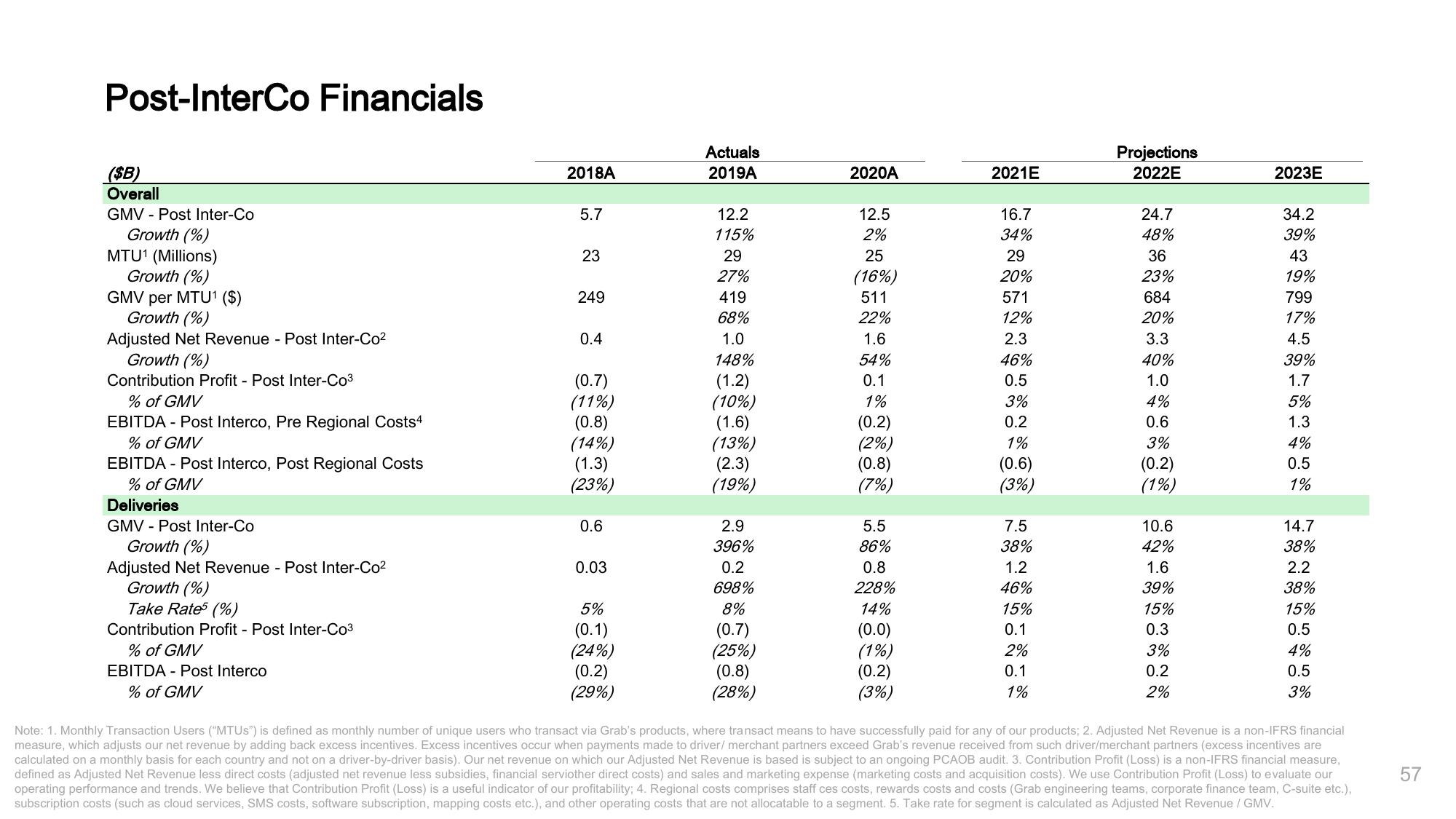

Post-InterCo Financials

($B)

Overall

GMV Post Inter-Co

Growth (%)

MTU¹ (Millions)

Growth (%)

GMV per MTU¹ ($)

Growth (%)

Adjusted Net Revenue - Post Inter-Co²

Growth (%)

Contribution Profit - Post Inter-Co³

% of GMV

EBITDA - Post Interco, Pre Regional Costs4

% of GMV

EBITDA - Post Interco, Post Regional Costs

% of GMV

Deliveries

GMV Post Inter-Co

Growth (%)

Adjusted Net Revenue - Post Inter-Co²

Growth (%)

Take Rates (%)

Contribution Profit - Post Inter-Co³

% of GMV

EBITDA - Post Interco

% of GMV

2018A

5.7

23

249

0.4

(0.7)

(11%)

(0.8)

(14%)

(1.3)

(23%)

0.6

0.03

5%

(0.1)

(24%)

(0.2)

(29%)

Actuals

2019A

12.2

115%

29

27%

419

68%

1.0

148%

(1.2)

(10%)

(1.6)

(13%)

(2.3)

(19%)

2.9

396%

0.2

698%

8%

(0.7)

(25%)

(0.8)

(28%)

2020A

12.5

2%

25

(16%)

511

22%

1.6

54%

0.1

1%

(0.2)

(2%)

(0.8)

(7%)

5.5

86%

0.8

228%

14%

(0.0)

(1%)

(0.2)

(3%)

2021E

16.7

34%

29

20%

571

12%

2.3

46%

0.5

3%

0.2

1%

(0.6)

(3%)

7.5

38%

1.2

46%

15%

0.1

2%

0.1

1%

Projections

2022E

24.7

48%

36

23%

684

20%

3.3

40%

1.0

4%

0.6

3%

(0.2)

(1%)

10.6

42%

1.6

39%

15%

0.3

3%

0.2

2%

2023E

34.2

39%

43

19%

799

17%

4.5

39%

1.7

5%

1.3

4%

0.5

1%

14.7

38%

2.2

38%

15%

0.5

4%

0.5

3%

Note: 1. Monthly Transaction Users ("MTUS") is defined as monthly number of unique users who transact via Grab's products, where transact means to have successfully paid for any of our products; 2. Adjusted Net Revenue is a non-IFRS financial

measure, which adjusts our net revenue by adding back excess incentives. Excess incentives occur when payments made to driver/ merchant partners exceed Grab's revenue received from such driver/merchant partners (excess incentives are

calculated on a monthly basis for each country and not on a driver-by-driver basis). Our net revenue on which our Adjusted Net Revenue is based is subject to an ongoing PCAOB audit. 3. Contribution Profit (Loss) is a non-IFRS financial measure,

defined as Adjusted Net Revenue less direct costs (adjusted net revenue less subsidies, financial serviother direct costs) and sales and marketing expense (marketing costs and acquisition costs). We use Contribution Profit (Loss) to evaluate our

operating performance and trends. We believe that Contribution Profit (Loss) is a useful indicator of our profitability; 4. Regional costs comprises staff ces costs, rewards costs and costs (Grab engineering teams, corporate finance team, C-suite etc.),

subscription costs (such as cloud services, SMS costs, software subscription, mapping costs etc.), and other operating costs that are not allocatable to a segment. 5. Take rate for segment is calculated as Adjusted Net Revenue / GMV.

57View entire presentation