Zegna Results Presentation Deck

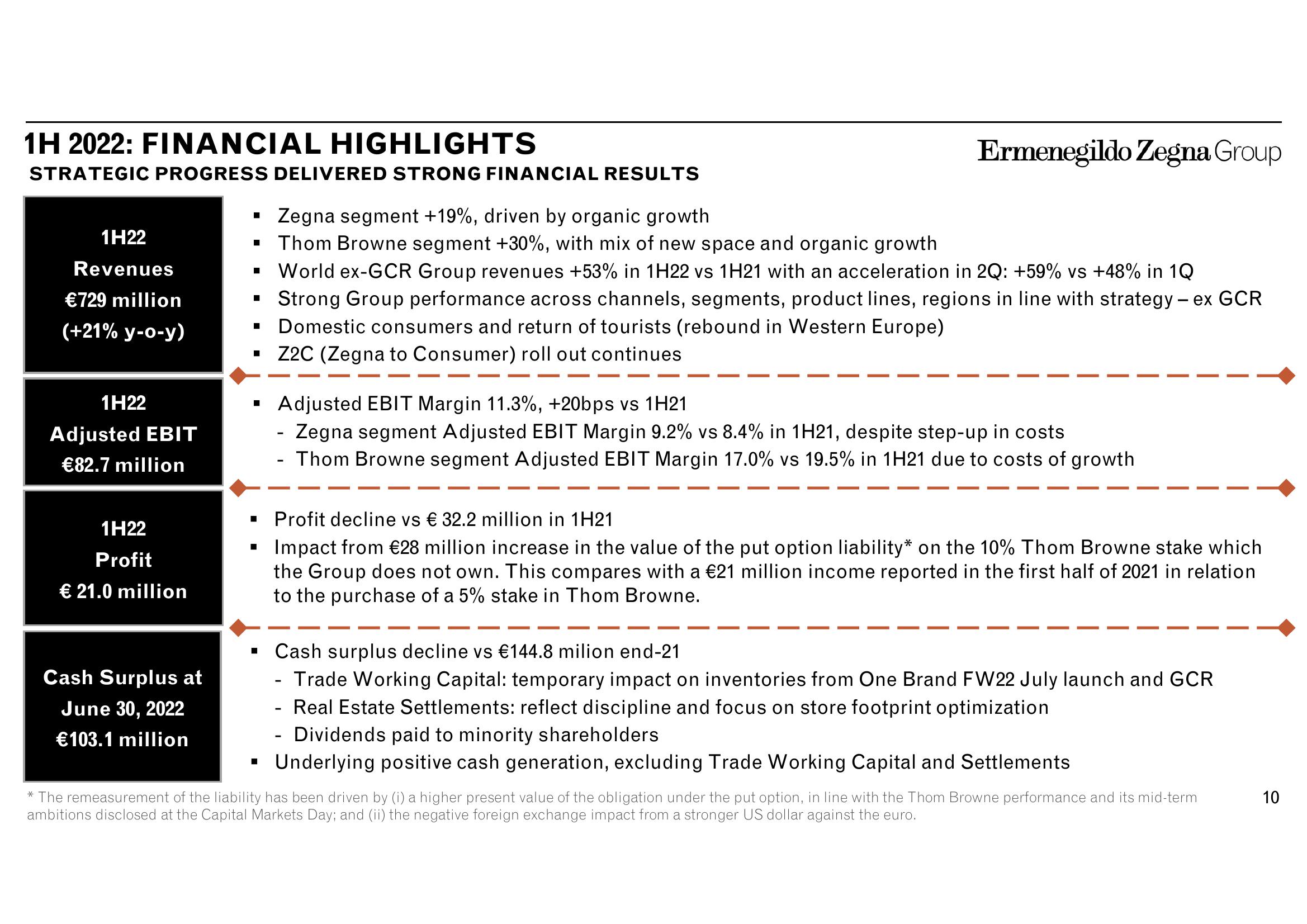

1H 2022: FINANCIAL HIGHLIGHTS

STRATEGIC PROGRESS DELIVERED STRONG FINANCIAL RESULTS

1H22

Revenues

€729 million

(+21% y-o-y)

1H22

Adjusted EBIT

€82.7 million

1H22

Profit

€ 21.0 million

Cash Surplus at

June 30, 2022

€103.1 million

Zegna segment +19%, driven by organic growth

Thom Browne segment +30%, with mix of new space and organic growth

▪ World ex-GCR Group revenues +53% in 1H22 vs 1H21 with an acceleration in 2Q: +59% vs +48% in 1Q

■

■

■

■

I

Ermenegildo Zegna Group

■

Strong Group performance across channels, segments, product lines, regions in line with strategy - ex GCR

Domestic consumers and return of tourists (rebound in Western Europe)

Z2C (Zegna to Consumer) roll out continues

Adjusted EBIT Margin 11.3%, +20bps vs 1H21

- Zegna segment Adjusted EBIT Margin 9.2% vs 8.4% in 1H21, despite step-up in costs

Thom Browne segment Adjusted EBIT Margin 17.0% vs 19.5% in 1H21 due to costs of growth

Profit decline vs € 32.2 million in 1H21

Impact from €28 million increase in the value of the put option liability* on the 10% Thom Browne stake which

the Group does not own. This compares with a €21 million income reported in the first half of 2021 in relation

to the purchase of a 5% stake in Thom Browne.

Cash surplus decline vs €144.8 milion end-21

- Trade Working Capital: temporary impact on inventories from One Brand FW22 July launch and GCR

- Real Estate Settlements: reflect discipline and focus on store footprint optimization

Dividends paid to minority shareholders

Underlying positive cash generation, excluding Trade Working Capital and Settlements

* The remeasurement of the liability has been driven by (i) a higher present value of the obligation under the put option, in line with the Thom Browne performance and its mid-term

ambitions disclosed at the Capital Markets Day; and (ii) the negative foreign exchange impact from a stronger US dollar against the euro.

10View entire presentation