Kin SPAC Presentation Deck

kin.com | 21

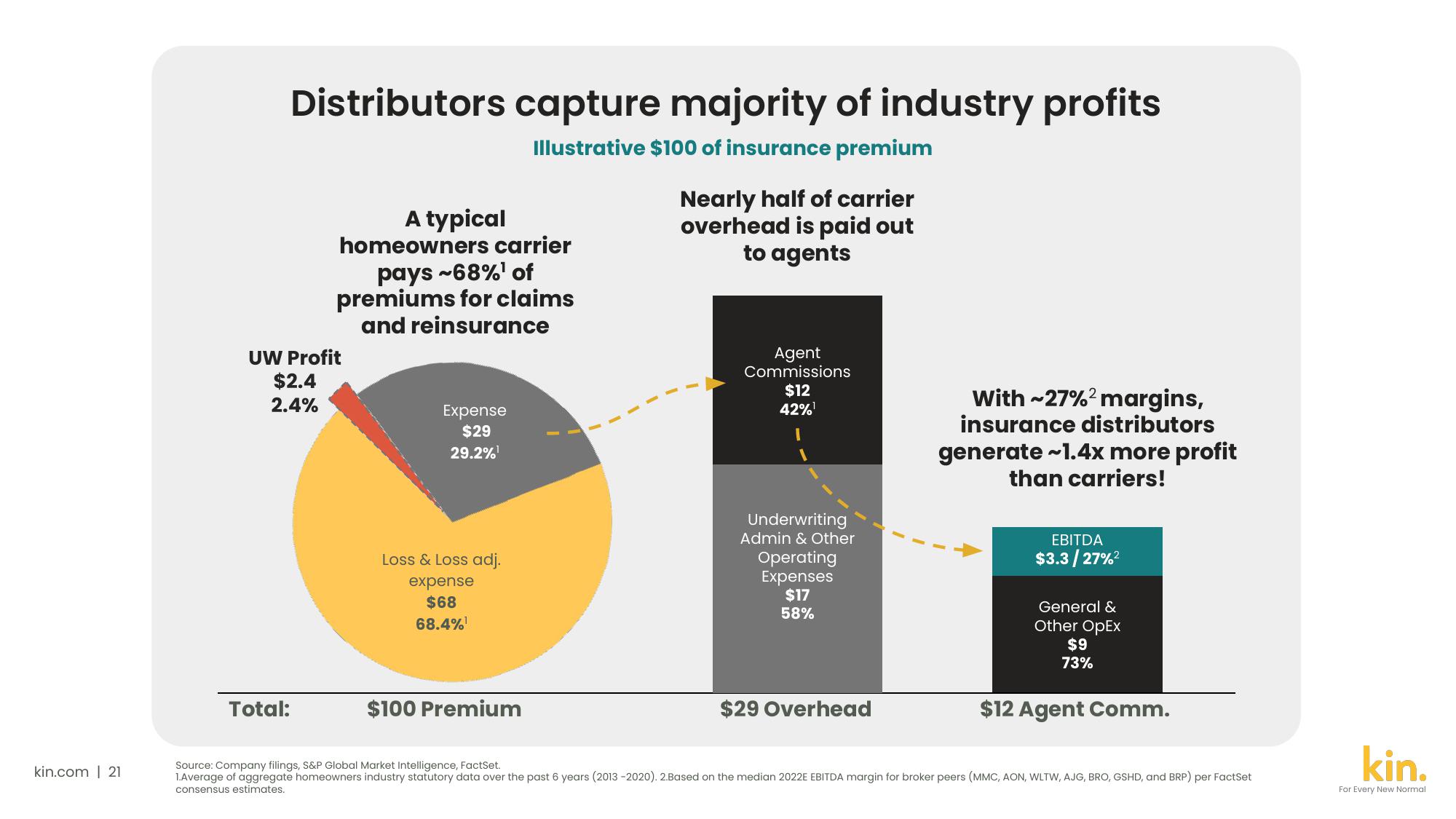

Distributors capture majority of industry profits

Illustrative $100 of insurance premium

A typical

homeowners carrier

pays ~68%' of

premiums for claims

and reinsurance

UW Profit

$2.4

2.4%

Total:

Expense

$29

29.2%¹

Loss & Loss adj.

expense

$68

68.4%¹

$100 Premium

Nearly half of carrier

overhead is paid out

to agents

Agent

Commissions

$12

42%¹

Underwriting

Admin & Other

Operating

Expenses

$17

58%

$29 Overhead

With ~27%² margins,

insurance distributors

generate ~1.4x more profit

than carriers!

EBITDA

$3.3/27%²

General &

Other OpEx

$9

73%

$12 Agent Comm.

Source: Company filings, S&P Global Market Intelligence, FactSet.

1.Average of aggregate homeowners industry statutory data over the past 6 years (2013-2020). 2.Based on the median 2022E EBITDA margin for broker peers (MMC, AON, WLTW, AJG, BRO, GSHD, and BRP) per FactSet

consensus estimates.

kin.

For Every New NormalView entire presentation