Solid Power SPAC Presentation Deck

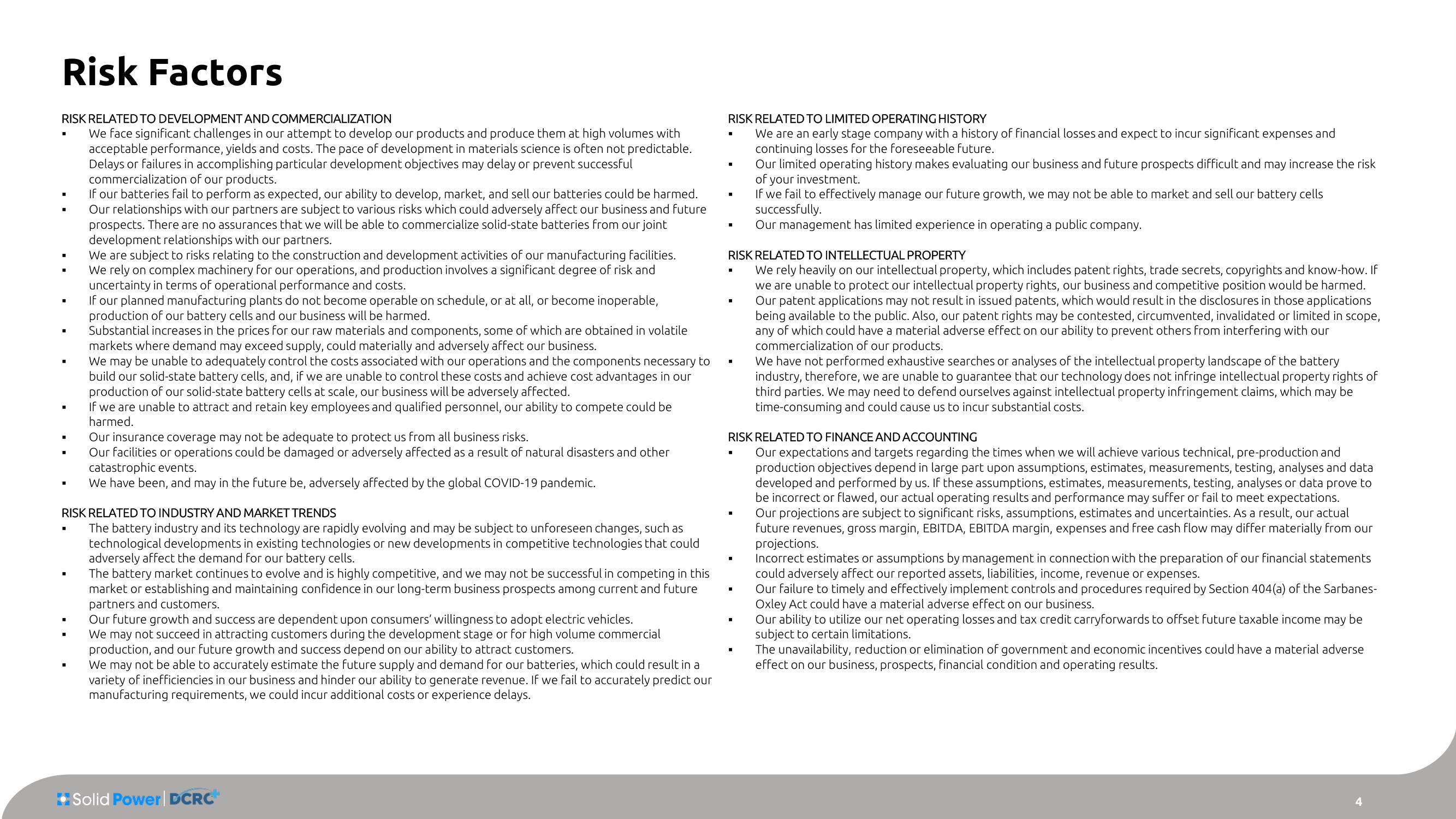

Risk Factors

RISK RELATED TO DEVELOPMENT AND COMMERCIALIZATION

We face significant challenges in our attempt to develop our products and produce them at high volumes with

acceptable performance, yields and costs. The pace of development in materials science is often not predictable.

Delays or failures in accomplishing particular development objectives may delay or prevent successful

commercialization of our products.

If our batteries fail to perform as expected, our ability to develop, market, and sell our batteries could be harmed.

Our relationships with our partners are subject to various risks which could adversely affect our business and future

prospects. There are no assurances that we will be able to commercialize solid-state batteries from our joint

development relationships with our partners.

We are subject to risks relating to the construction and development activities of our manufacturing facilities.

We rely on complex machinery for our operations, and production involves a significant degree of risk and

uncertainty in terms of operational performance and costs.

If our planned manufacturing plants do not become operable on schedule, or at all, or become inoperable,

production of our battery cells and our business will be harmed.

Substantial increases in the prices for our raw materials and components, some of which are obtained in volatile

markets where demand may exceed supply, could materially and adversely affect our business.

■

■

■

▪

We may be unable to adequately control the costs associated with our operations and the components necessary to

build our solid-state battery cells, and, if we are unable to control these costs and achieve cost advantages in our

production of our solid-state battery cells at scale, our business will be adversely affected.

If we are unable to attract and retain key employees and qualified personnel, our ability to compete could be

harmed.

Our insurance coverage may not be adequate to protect us from all business risks.

Our facilities or operations could be damaged or adversely affected as a result of natural disasters and other

catastrophic events.

We have been, and may in the future be, adversely affected by the global COVID-19 pandemic.

RISK RELATED TO INDUSTRY AND MARKET TRENDS

The battery industry and its technology are rapidly evolving and may be subject to unforeseen changes, such as

technological developments in existing technologies or new developments in competitive technologies that could

adversely affect the demand for our battery cells.

The battery market continues to evolve and is highly competitive, and we may not be successful in competing in this

market or establishing and maintaining confidence in our long-term business prospects among current and future

partners and customers.

Our future growth and success are dependent upon consumers' willingness to adopt electric vehicles.

:

We may not succeed in attracting customers during the development stage or for high volume commercial

production, and our future growth and success depend on our ability to attract customers.

We may not be able to accurately estimate the future supply and demand for our batteries, which could result in a

variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our

manufacturing requirements, we could incur additional costs or experience delays.

Solid Power | DCRC+

RISK RELATED TO LIMITED OPERATING HISTORY

We are an early stage company with a history of financial losses and expect to incur significant expenses and

continuing losses for the foreseeable future.

■

■

RISK RELATED TO INTELLECTUAL PROPERTY

We rely heavily on our intellectual property, which includes patent rights, trade secrets, copyrights and know-how. If

we are unable to protect our intellectual property rights, our business and competitive position would be harmed.

Our patent applications may not result in issued patents, which would result in the disclosures in those applications

being available to the public. Also, our patent rights may be contested, circumvented, invalidated or limited in scope,

any of which could have a material adverse effect on our ability to prevent others from interfering with our

commercialization of our products.

.

■

Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk

of your investment.

If we fail to effectively manage our future growth, we may not be able to market and sell our battery cells

successfully.

Our management has limited experience in operating a public company.

■

We have not performed exhaustive searches or analyses of the intellectual property landscape of the battery

industry, therefore, we are unable to guarantee that our technology does not infringe intellectual property rights of

third parties. We may need to defend ourselves against intellectual property infringement claims, which may be

time-consuming and could cause us to incur substantial costs.

RISK RELATED TO FINANCE AND ACCOUNTING

Our expectations and targets regarding the times when we will achieve various technical, pre-production and

production objectives depend in large part upon assumptions, estimates, measurements, testing, analyses and data

developed and performed by us. If these assumptions, estimates, measurements, testing, analyses or data prove to

be incorrect or flawed, our actual operating results and performance may suffer or fail to meet expectations.

Our projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, our actual

future revenues, gross margin, EBITDA, EBITDA margin, expenses and free cash flow may differ materially from our

projections.

Incorrect estimates or assumptions by management in connection with the preparation of our financial statements

could adversely affect our reported assets, liabilities, income, revenue or expenses.

Our failure to timely and effectively implement controls and procedures required by Section 404(a) of the Sarbanes-

Oxley Act could have a material adverse effect on our business.

Our ability to utilize our net operating losses and tax credit carryforwards to offset future taxable income may be

subject to certain limitations.

The unavailability, reduction or elimination of government and economic incentives could have a material adverse

effect on our business, prospects, financial condition and operating results.View entire presentation