Granite Ridge Investor Presentation Deck

Overview

Strategy & Execution

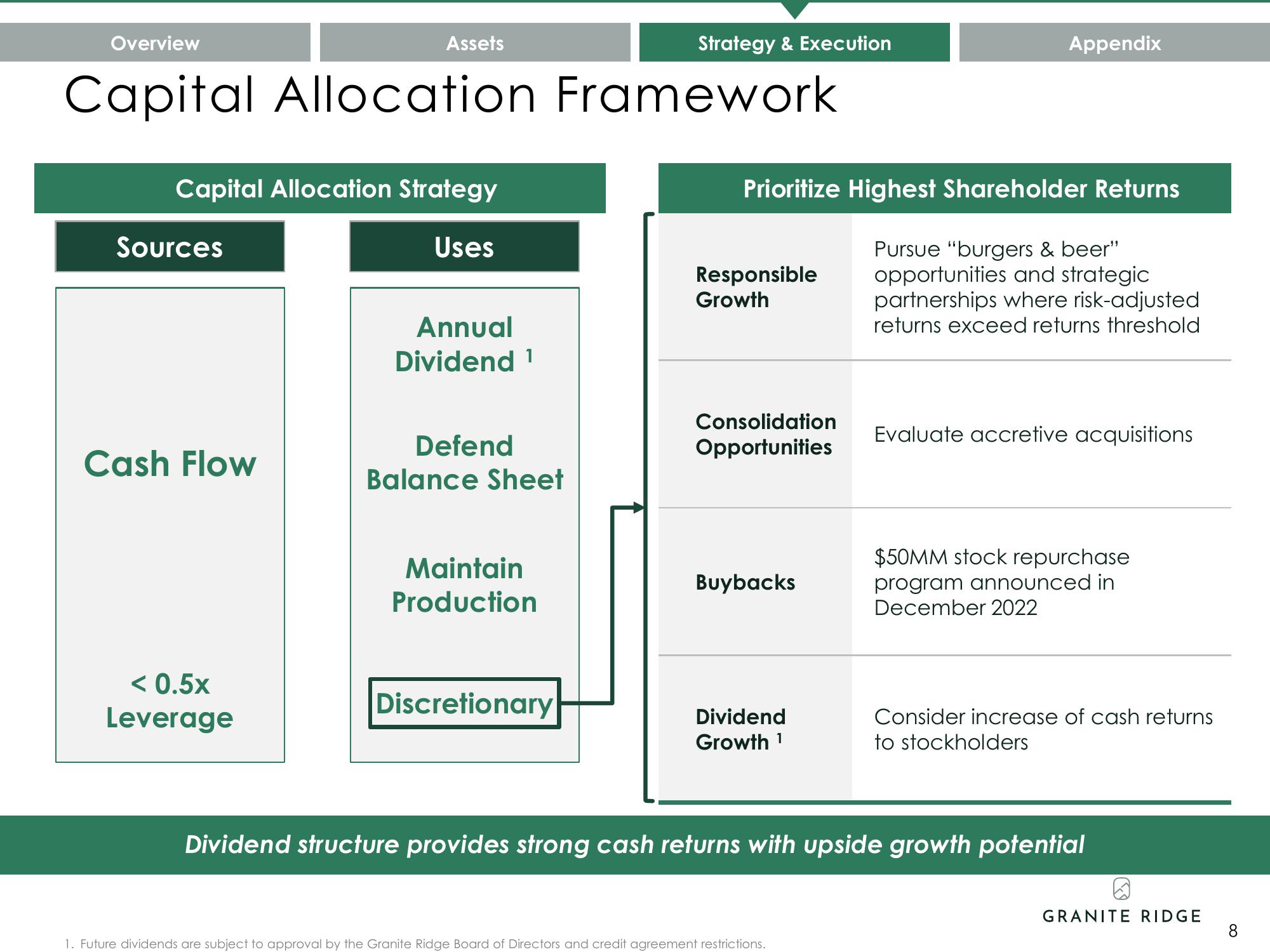

Capital Allocation Framework

Capital Allocation Strategy

Uses

Sources

Cash Flow

Assets

< 0.5x

Leverage

Annual

Dividend ¹

Defend

Balance Sheet

Maintain

Production

Discretionary

Prioritize Highest Shareholder Returns

Responsible

Growth

Consolidation

Opportunities

Buybacks

Dividend

Growth 1

Appendix

1. Future dividends are subject to approval by the Granite Ridge Board of Directors and credit agreement restrictions.

Pursue "burgers & beer"

opportunities and strategic

partnerships where risk-adjusted

returns exceed returns threshold

Evaluate accretive acquisitions

$50MM stock repurchase

program announced in

December 2022

Consider increase of cash returns

to stockholders

Dividend structure provides strong cash returns with upside growth potential

GRANITE RIDGE

8View entire presentation