SoftBank Results Presentation Deck

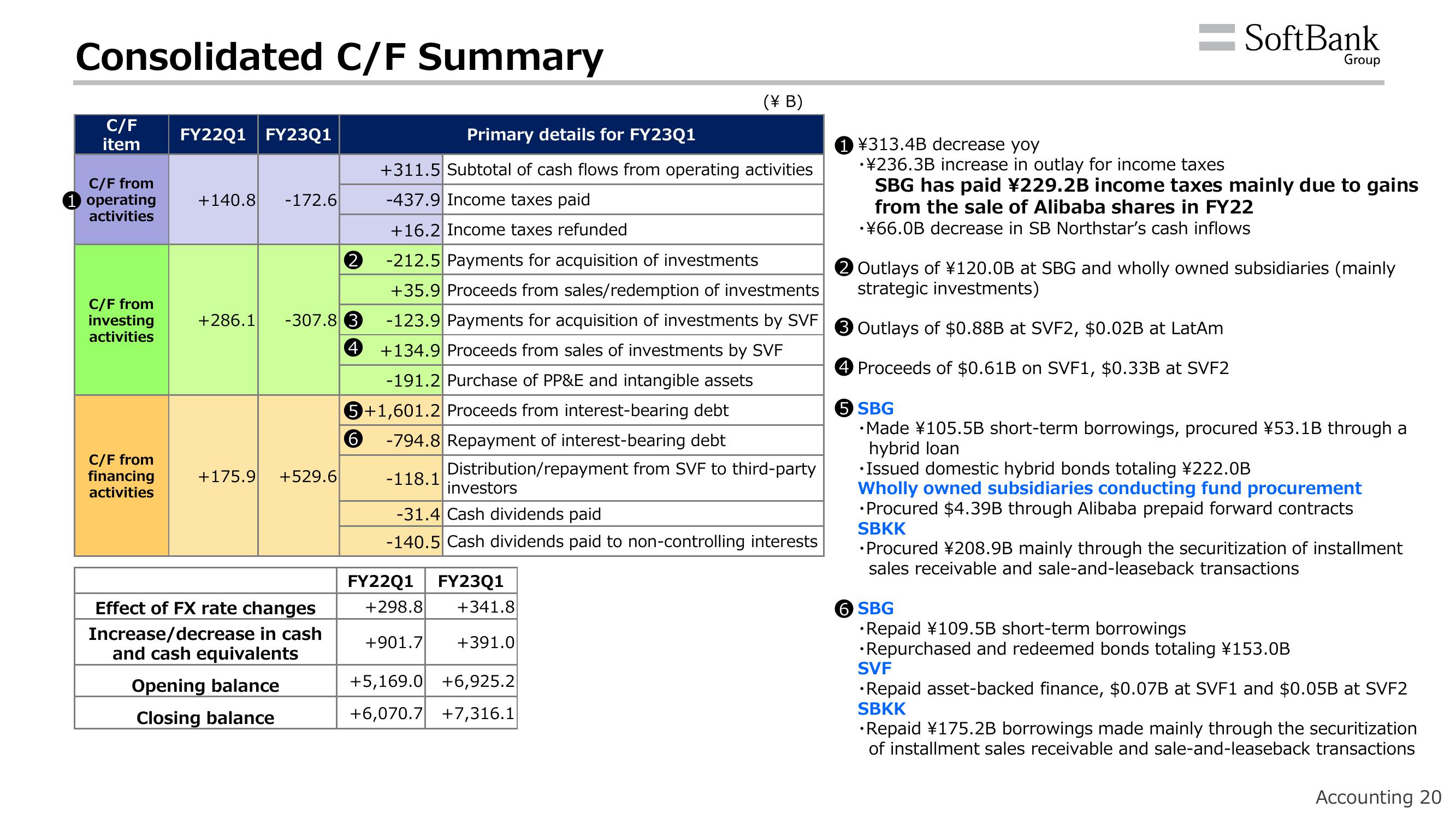

Consolidated C/F Summary

C/F

item

C/F from

operating

activities

C/F from

investing

activities

C/F from

financing

activities

FY22Q1 FY23Q1

+140.8 -172.6

+175.9 +529.6

+286.1 -307.8 3

4

Effect of FX rate changes

Increase/decrease in cash

and cash equivalents

Opening balance

Closing balance

Primary details for FY23Q1

+311.5 Subtotal of cash flows from operating activities

-437.9 Income taxes paid

+16.2 Income taxes refunded

-212.5 Payments for acquisition of investments

+35.9 Proceeds from sales/redemption of investments

-123.9 Payments for acquisition of investments by SVF

+134.9 Proceeds from sales of investments by SVF

-191.2 Purchase of PP&E and intangible assets

5+1,601.2 Proceeds from interest-bearing debt

6 -794.8 Repayment of interest-bearing debt

Distribution/repayment from SVF to third-party

-118.1

2

(\B)

investors

-31.4 Cash dividends paid

-140.5 Cash dividends paid to non-controlling interests

FY22Q1 FY23Q1

+298.8 +341.8

+901.7 +391.0

+5,169.0 +6,925.2

+6,070.7 +7,316.1

=SoftBank

Group

1 ¥313.4B decrease yoy

•¥236.3B increase in outlay for income taxes

SBG has paid ¥229.2B income taxes mainly due to gains

from the sale of Alibaba shares in FY22

•¥66.0B decrease in SB Northstar's cash inflows

2 Outlays of ¥120.0B at SBG and wholly owned subsidiaries (mainly

strategic investments)

3 Outlays of $0.88B at SVF2, $0.02B at LatAm

4 Proceeds of $0.61B on SVF1, $0.33B at SVF2

5 SBG

•Made ¥105.5B short-term borrowings, procured ¥53.1B through a

hybrid loan

•Issued domestic hybrid bonds totaling ¥222.0B

Wholly owned subsidiaries conducting fund procurement

• Procured $4.39B through Alibaba prepaid forward contracts

SBKK

• Procured ¥208.9B mainly through the securitization of installment

sales receivable and sale-and-leaseback transactions

6 SBG

•Repaid ¥109.5B short-term borrowings

•Repurchased and redeemed bonds totaling ¥153.0B

SVF

•Repaid asset-backed finance, $0.07B at SVF1 and $0.05B at SVF2

SBKK

•Repaid ¥175.2B borrowings made mainly through the securitization

of installment sales receivable and sale-and-leaseback transactions

Accounting 20View entire presentation