Telia Company Results Presentation Deck

TOWER TRANSACTION SUMMARY

17

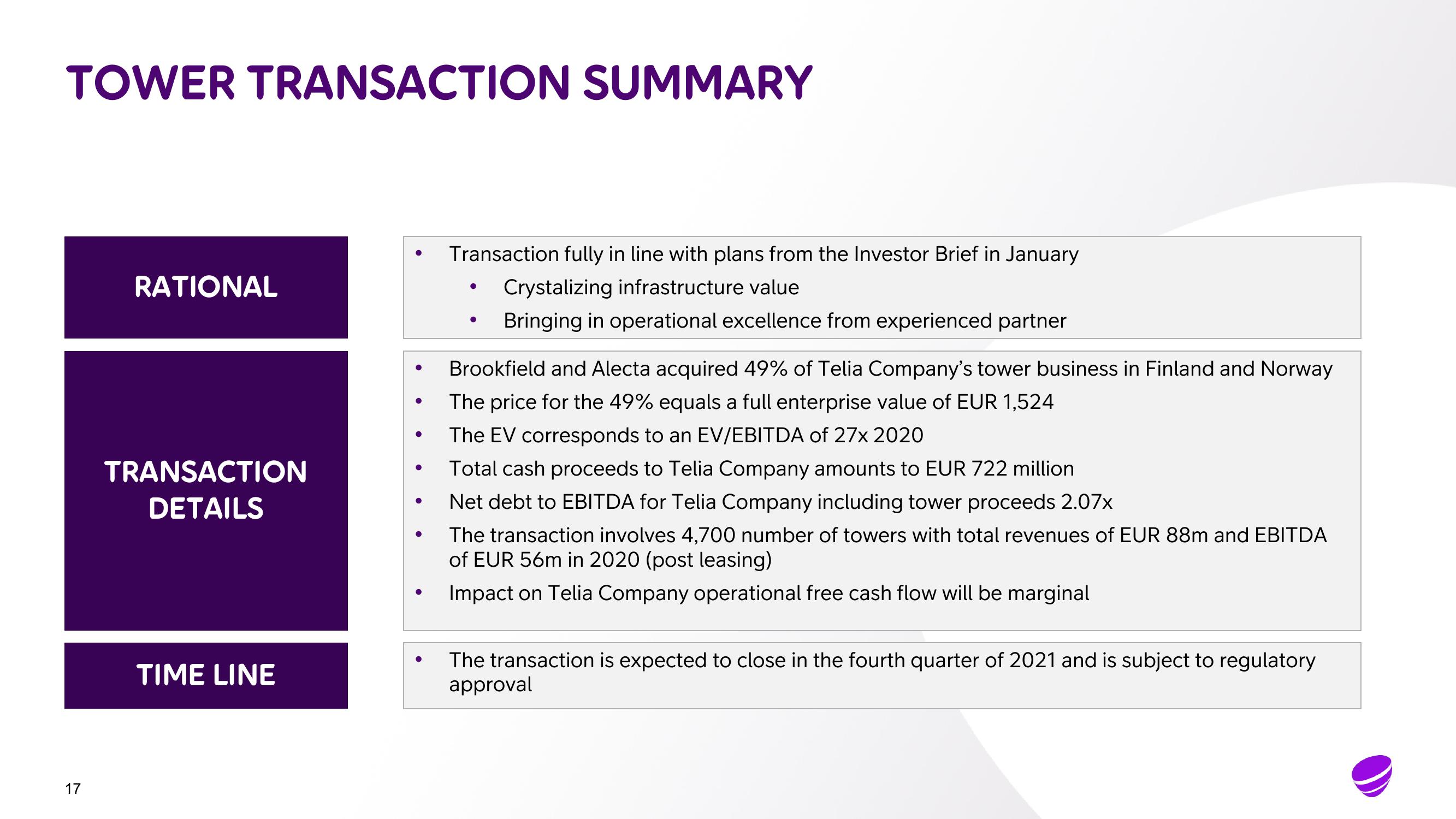

RATIONAL

TRANSACTION

DETAILS

TIME LINE

Transaction fully in line with plans from the Investor Brief in January

Crystalizing infrastructure value

Bringing in operational excellence from experienced partner

Brookfield and Alecta acquired 49% of Telia Company's tower business in Finland and Norway

The price for the 49% equals a full enterprise value of EUR 1,524

The EV corresponds to an EV/EBITDA of 27x 2020

Total cash proceeds to Telia Company amounts to EUR 722 million

Net debt to EBITDA for Telia Company including tower proceeds 2.07x

The transaction involves 4,700 number of towers with total revenues of EUR 88m and EBITDA

of EUR 56m in 2020 (post leasing)

Impact on Telia Company operational free cash flow will be marginal

The transaction is expected to close in the fourth quarter of 2021 and is subject to regulatory

approvalView entire presentation