Navient to Acquire Earnest

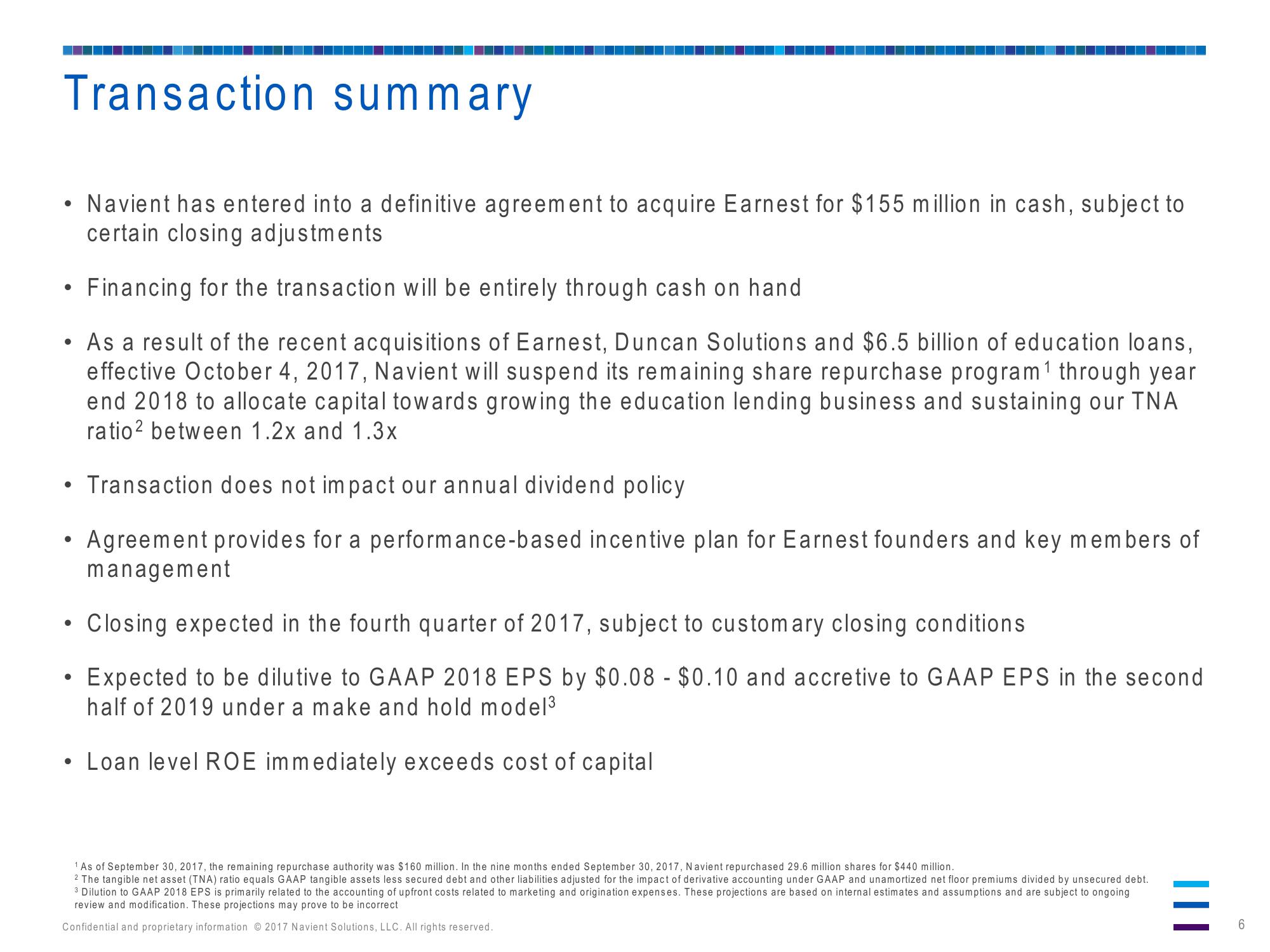

Transaction summary

Navient has entered into a definitive agreement to acquire Earnest for $155 million in cash, subject to

certain closing adjustments

• Financing for the transaction will be entirely through cash on hand

As a result of the recent acquisitions of Earnest, Duncan Solutions and $6.5 billion of education loans,

effective October 4, 2017, Navient will suspend its remaining share repurchase program¹ through year

end 2018 to allocate capital towards growing the education lending business and sustaining our TNA

ratio² between 1.2x and 1.3x

●

●

●

●

Closing expected in the fourth quarter of 2017, subject to customary closing conditions

Expected to be dilutive to GAAP 2018 EPS by $0.08 - $0.10 and accretive to GAAP EPS in the second

half of 2019 under a make and hold model³

• Loan level ROE immediately exceeds cost of capital

Transaction does not impact our annual dividend policy

Agreement provides for a performance-based incentive plan for Earnest founders and key members of

management

●

¹ As of September 30, 2017, the remaining repurchase authority was $160 million. In the nine months ended September 30, 2017, Navient repurchased 29.6 million shares for $440 million.

2 The tangible net asset (TNA) ratio equals GAAP tangible assets less secured debt and other liabilities adjusted for the impact of derivative accounting under GAAP and unamortized net floor premiums divided by unsecured debt.

3 Dilution to GAAP 2018 EPS is primarily related to the accounting of upfront costs related to marketing and origination expenses. These projections are based on internal estimates and assumptions and are subject to ongoing

review and modification. These projections may prove to be incorrect

Confidential and proprietary information 2017 Navient Solutions, LLC. All rights reserved.

6View entire presentation