Tudor, Pickering, Holt & Co Investment Banking

Transaction Tax Implications

At AMGP Proposal

[1]

121

131

1

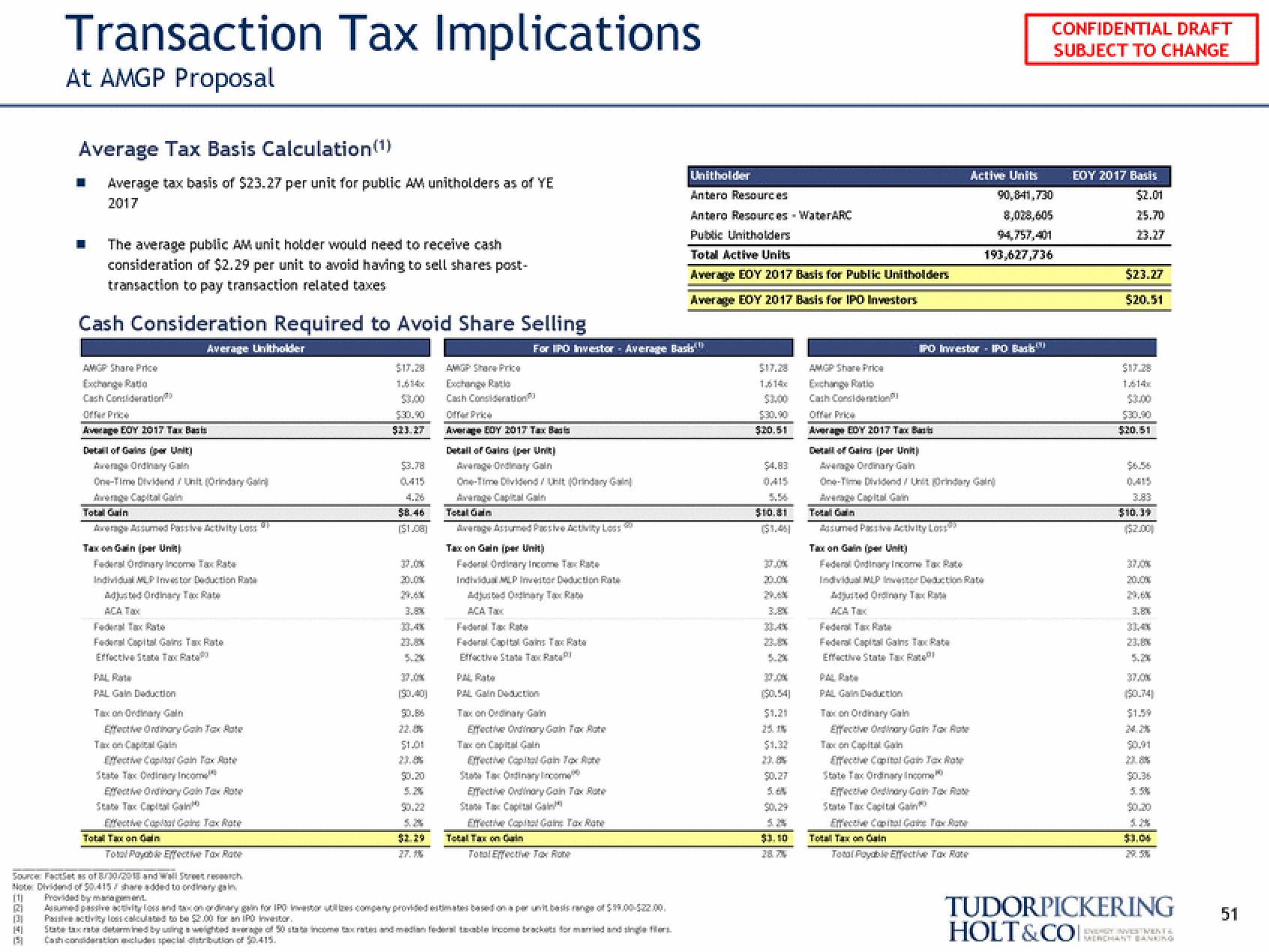

Average Tax Basis Calculation (1)

■ Average tax basis of $23.27 per unit for public AM unitholders as of YE

2017

■

The average public AM unit holder would need to receive cash

consideration of $2.29 per unit to avoid having to sell shares post-

transaction to pay transaction related taxes

Cash Consideration Required to Avoid Share Selling

Average Unitholder

AMGP Share Price

Exchange Ratio

Cash Consideration

Offer Price

Average EDY 2017 Tax Basis

Detail of Gains (per Unit)

Average Ordinary Gain

One-Time Dividend/Unit (Orindary Gain

Jerg CapAtal Gailm

Total Gain

Average Assumed Passive Activity Loss

Taxon Gain (per Unit)

Federal Ordinary Income Tax Rate

Individual MLP Investor Deduction Rasa

Adjusted Ordinary Tax Rate

ACA Tax

Federal Capital Gains Tax Rate

Effective State Tax Rate

PAL R

PAL Gain Deduction

Taxon Ordinary Gain

Effective Ordinary Gal Tax Rate

Taxon Capital Gain

Effective Capital Gain Tax Rate

State Tax Ordinary Income

Effective Ordinary Gin Tax Rate

State Tax Capital Gain

Effective Capital Gains Tax Rate

Total Tax ondain

TotalPay Effective Tax Rate

$17.28

53.00

$30.90

$23.27

53.78

$8.46

($1.08)

20.0%

3.8%

$0.86

$1.01

27.1%

AMGP Share Price

Exchange Ratio

Cash Consideration

For IPO Investor Average Basis

Offer Price

Average BDY 2017 Tax Basis

Detail of Gains (per unit)

Average Ordinary Gain

One-Time Dividend / Unit (Orindary Ga

ivierage Capital Gain

Total Gain

Average Assumed Pacsive Activity Loss

Tax on Gain (per Unit)

Federal Ordinary Income Tax Rate

Individual MLP Investor Deduction Rate

Adjud Ordinary Tax Rate

ACA Tax

Federal Tax Rate

Federal Capital Gains Tax Rate

Effective State Tax Rate

PAL Rate

PAL Gain Deduction

Taxon Ordinary Gain

Effective Ordinary Gain Tax Rate

Taxon Capital Gain

Effective Capital Gain Tax Rate

State Tax Ordinary Incom

Effective Ordinary Gain Tax Rate

State Ta Capital Ga

Effective Capital Gaine Tax Rate

Total Taxon Gain

Total Effective Tax Rate

Source: FactSet as of 30/2015 and Wall Street research

Note Dividend of 50.415/ share added to ordinary gain

Provided by managemen

Assumed passive activity loss and taxon ordinary gain for IPO Investor utilizes company provided estimates based on a par unit basis range of $19.00-$22.00.

Passive activity loss calculated to be $2.00 for an IPO Investor.

Unitholder

Antero Resources

Antero Resources - Water ARC

Public Unitholders

Total Active Units

Average EOY 2017 Basis for Public Unitholders

Average EOY 2017 Basis for IPO Investors

Staxa determined by using weighted average of 50 state income tax rates and median federal taxable income brackets for married and single flors.

Cashconsideration excludes special distribution of $0.415.

1.614x

$20.51

$4.83

5.56

$10.81

3.8%

37.0%

$1.21

$1.32

$0.27

$0.29

AMGP Share Price

Exchange Ratio

Cash Consideration

Offer Price

Average EDY 2017 Tax Bas

சிச்சாம் Ciapital. Galin

Detail of Gains (per Unit)

Average Ordinary Gain

One-Time Dividend / Unit Orindary Gin

Total Gain

Assumed Passive Activity Lo

IPO Investor IPO Back

Federal Capital Gains Tax Rate

Effective State Tax Rate

PAL Rate

PAL Gain Deduction

Tax on Gain (per Unit)

Federal Ordinary Income Tax Rate

Individual MLP Investor Deduction Rate

Adjusted Ordinary Tax Rat

ACA Tax

Taxon Ordinary Gain

Effective Ordinary Gain Tax Rate

Taxon Capital Gain

Effective Capital Gain Tax Rate

State Tax Ordinary Income

Active Units

Effective Ordinary Gain Tax Ra

State Tax Capital Ga

Total Tax on Gain

90,841,730

8,028,605

94,757,401

193,627,736

TotalPayable Effective Tax Rate

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

EDY 2017 Basis

$2.01

25.70

23.27

$23.27

$20.51

$17.28

$3.00

$30.90

5:20.51

3.83

$10.39

($2.00)

37.00

3.8%

23.00

(30.74

$1.59

$0.36

5.5%

$0.20

5.2%

$3.04

29.5%

TUDORPICKERING 51

HOLT&COCHANT BANKINGView entire presentation