Hanmi Financial Results Presentation Deck

Net Income

$20.6M

●

●

Diluted EPS

$0.67

●

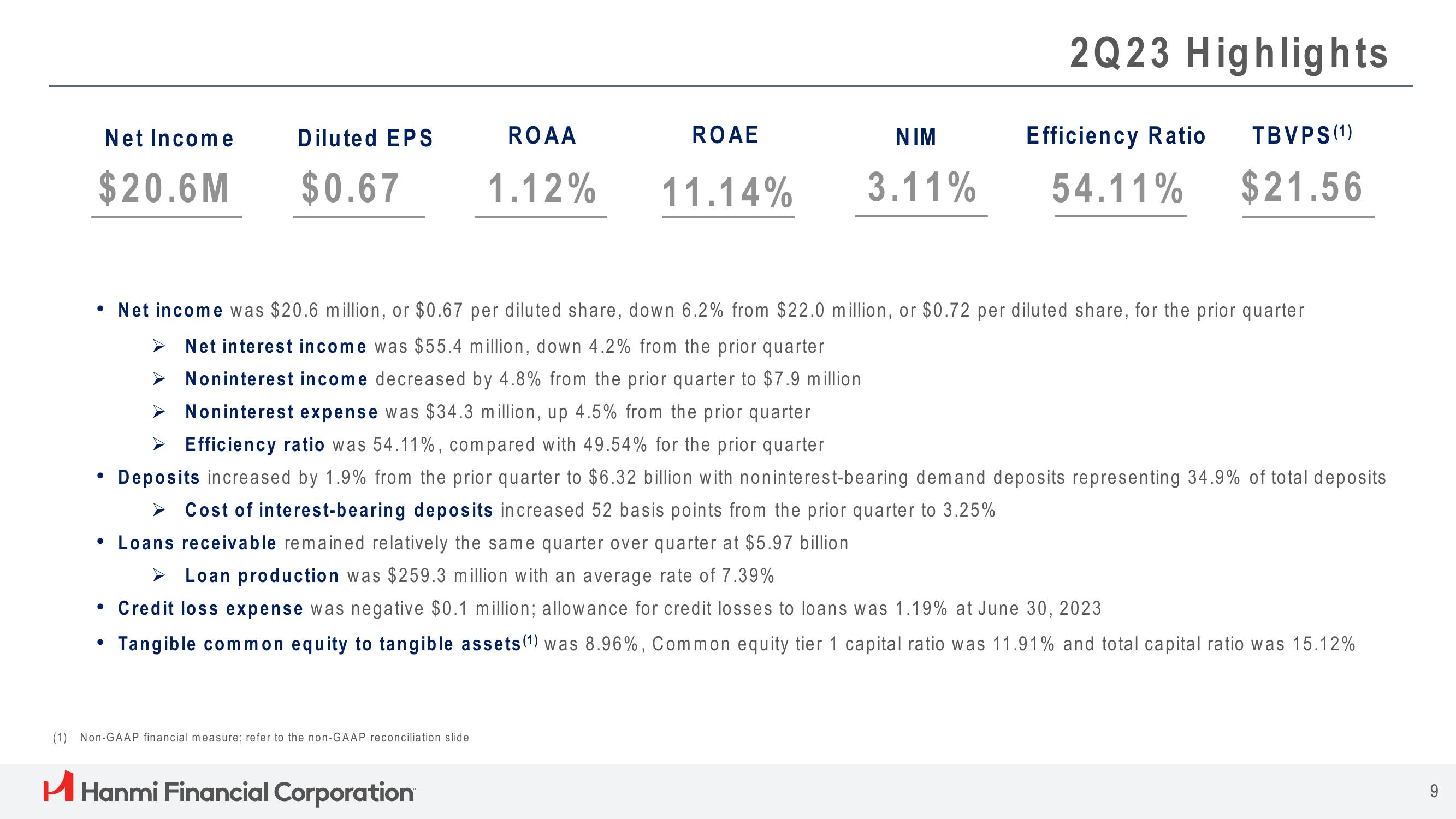

• Net income was $20.6 million, or $0.67 per diluted share, down 6.2% from $22.0 million, or $0.72 per diluted share, for the prior quarter

➤ Net interest income was $55.4 million, down 4.2% from the prior quarter

➤ Noninterest income decreased by 4.8% from the prior quarter to $7.9 million

➤ Noninterest expense was $34.3 million, up 4.5% from the prior quarter

Efficiency ratio was 54.11%, compared with 49.54% for the prior quarter

Deposits increased by 1.9% from the prior quarter to $6.32 billion with noninterest-bearing demand deposits representing 34.9% of total deposits

➤ Cost of interest-bearing deposits increased 52 basis points from the prior quarter to 3.25%

• Loans receivable remained relatively the same quarter over quarter at $5.97 billion

➤ Loan production was $259.3 million with an average rate of 7.39%

Credit loss expense was negative $0.1 million; allowance for credit losses to loans was 1.19% at June 30, 2023

Tangible common equity to tangible assets (1) was 8.96%, Common equity tier 1 capital ratio was 11.91% and total capital ratio was 15.12%

(1) Non-GAAP financial measure; refer to the non-GAAP reconciliation slide

ROAA

1.12%

H Hanmi Financial Corporation

ROAE

11.14%

NIM

3.11%

2Q23 Highlights

Efficiency Ratio TBVPS (1)

$21.56

54.11%

9View entire presentation