Metals Company SPAC

BETTER METALS FOR EVS

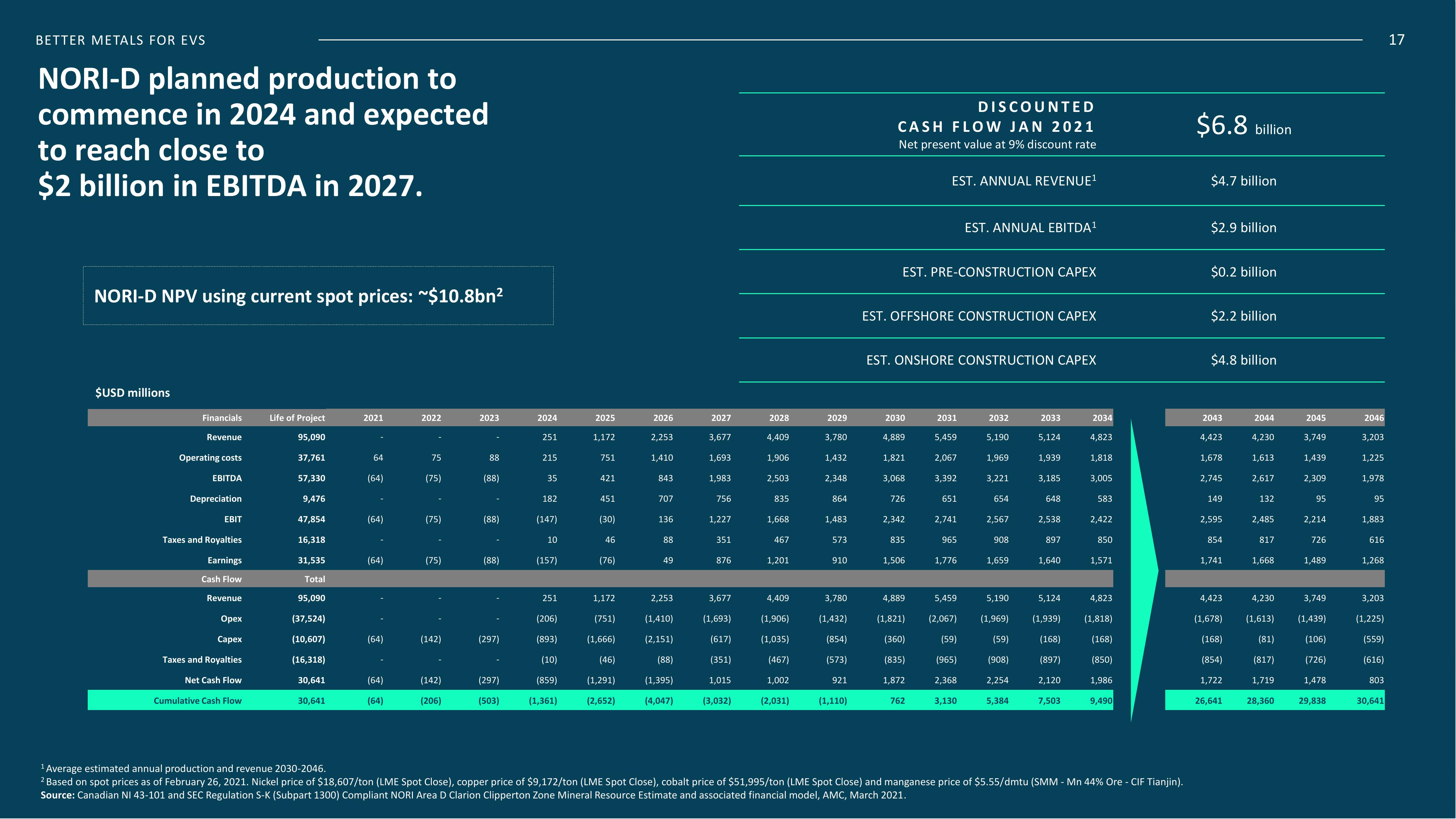

NORI-D planned production to

commence in 2024 and expected

to reach close to

$2 billion in EBITDA in 2027.

NORI-D NPV using current spot prices: ~$10.8bn²

$USD millions

Financials

Revenue

Operating costs

EBITDA

Depreciation

EBIT

Taxes and Royalties

Earnings

Cash Flow

Revenue

Opex

Capex

Taxes and Royalties

Net Cash Flow

Cumulative Cash Flow

Life of Project

95,090

37,761

57,330

9,476

47,854

16,318

31,535

Total

95,090

(37,524)

(10,607)

(16,318)

30,641

30,641

2021

64

(64)

(64)

(64)

(64)

(64)

(64)

2022

75

(75)

(75)

(75)

(142)

(142)

(206)

2023

88

(88)

(88)

(88)

(297)

(297)

(503)

2024

251

215

35

182

(147)

10

(157)

251

(206)

(893)

(10)

(859)

(1,361)

2025

1,172

751

421

451

(30)

46

(76)

1,172

(751)

(1,666)

(46)

(1,291)

(2,652)

2026

2,253

1,410

843

707

136

88

49

2,253

(1,410)

(2,151)

(88)

(1,395)

(4,047)

2027

3,677

1,693

1,983

756

1,227

351

876

3,677

(1,693)

(617)

(351)

1,015

(3,032)

2028

4,409

1,906

2,503

835

1,668

467

1,201

4,409

(1,906)

(1,035)

(467)

1,002

(2,031)

2029

3,780

1,432

2,348

864

1,483

573

910

3,780

(1,432)

(854)

(573)

921

(1,110)

DISCOUNTED

CASH FLOW JAN 2021

Net present value at 9% discount rate

EST. ANNUAL REVENUE¹

EST. PRE-CONSTRUCTION CAPEX

EST. OFFSHORE CONSTRUCTION CAPEX

2030

4,889

1,821

3,068

726

2,342

835

1,506

EST. ONSHORE CONSTRUCTION CAPEX

762

2031

5,459

2,067

3,392

651

EST. ANNUAL EBITDA¹

2,741

965

1,776

2032

5,190

1,969

3,221

654

2,567

908

1,659

4,889

5,190

5,459

(1,821) (2,067) (1,969)

(360)

(59)

(965)

(59)

(908)

(835)

1,872

2,368

2,254

3,130

5,384

2033

5,124

1,939

3,185

648

2,538

897

1,640

5,124

(1,939)

(168)

(897)

2,120

7,503

2034

4,823

1,818

3,005

583

2,422

850

1,571

4,823

(1,818)

(168)

(850)

1,986

9,490

¹ Average estimated annual production and revenue 2030-2046.

2 Based on spot prices as of February 26, 2021. Nickel price of $18,607/ton (LME Spot Close), copper price of $9,172/ton (LME Spot Close), cobalt price of $51,995/ton (LME Spot Close) and manganese price of $5.55/dmtu (SMM - Mn 44% Ore - CIF Tianjin).

Source: Canadian NI 43-101 and SEC Regulation S-K (Subpart 1300) Compliant NORI Area D Clarion Clipperton Zone Mineral Resource Estimate and associated financial model, AMC, March 2021.

$6.8 billion

$4.7 billion

$2.9 billion

$0.2 billion

$2.2 billion

$4.8 billion

2043

4,423

1,678

2,745

149

2,595

854

1,741

4,423

(1,678)

(168)

(854)

1,722

26,641

2044

4,230

1,613

2,617

132

2,485

817

1,668

4,230

(1,613)

(81)

(817)

1,719

28,360

2045

3,749

1,439

2,309

95

2,214

726

1,489

3,749

(1,439)

(106)

(726)

1,478

29,838

2046

3,203

1,225

1,978

95

1,883

616

1,268

3,203

(1,225)

(559)

(616)

803

30,641

17View entire presentation