HBT Financial Results Presentation Deck

Loan Portfolio Overview: ACL and Asset Quality

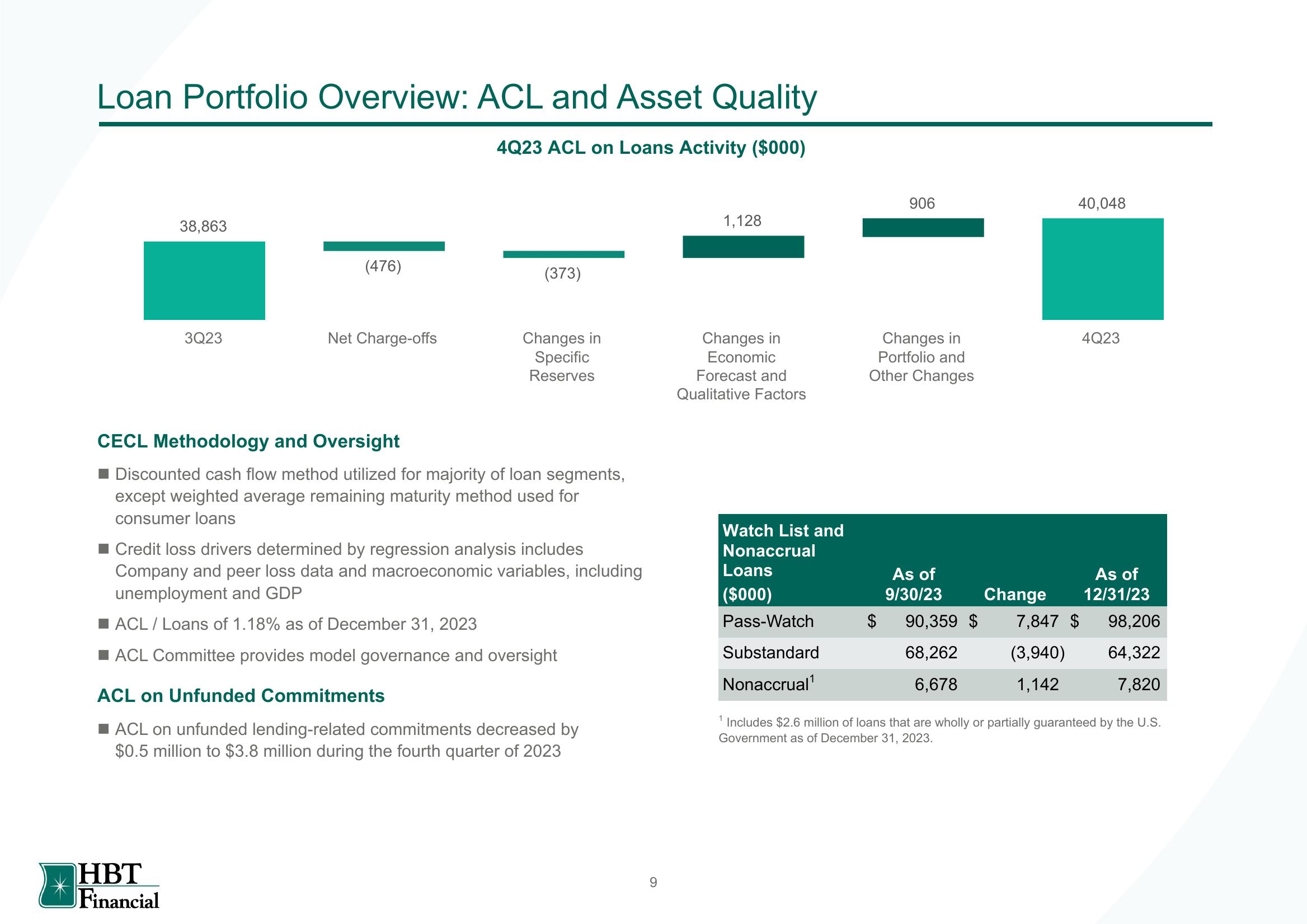

4Q23 ACL on Loans Activity ($000)

38,863

3Q23

(476)

HBT

Financial

Net Charge-offs

(373)

Changes in

Specific

Reserves

CECL Methodology and Oversight

■ Discounted cash flow method utilized for majority of loan segments,

except weighted average remaining maturity method used for

consumer loans

Credit loss drivers determined by regression analysis includes

Company and peer loss data and macroeconomic variables, including

unemployment and GDP

■ACL / Loans of 1.18% as of December 31, 2023

■ACL Committee provides model governance and oversight

ACL on Unfunded Commitments

■ACL on unfunded lending-related commitments decreased by

$0.5 million to $3.8 million during the fourth quarter of 2023

9

1,128

Changes in

Economic

Forecast and

Qualitative Factors

Watch List and

Nonaccrual

Loans

($000)

Pass-Watch

Substandard

Nonaccrual¹

906

Changes in

Portfolio and

Other Changes

As of

9/30/23

$ 90,359 $

68,262

6,678

Change

40,048

7,847 $

(3,940)

1,142

4Q23

As of

12/31/23

98,206

64,322

7,820

1 Includes $2.6 million of loans that are wholly or partially guaranteed by the U.S.

Government as of December 31, 2023.View entire presentation