Proterra SPAC Presentation Deck

INTRODUCTION

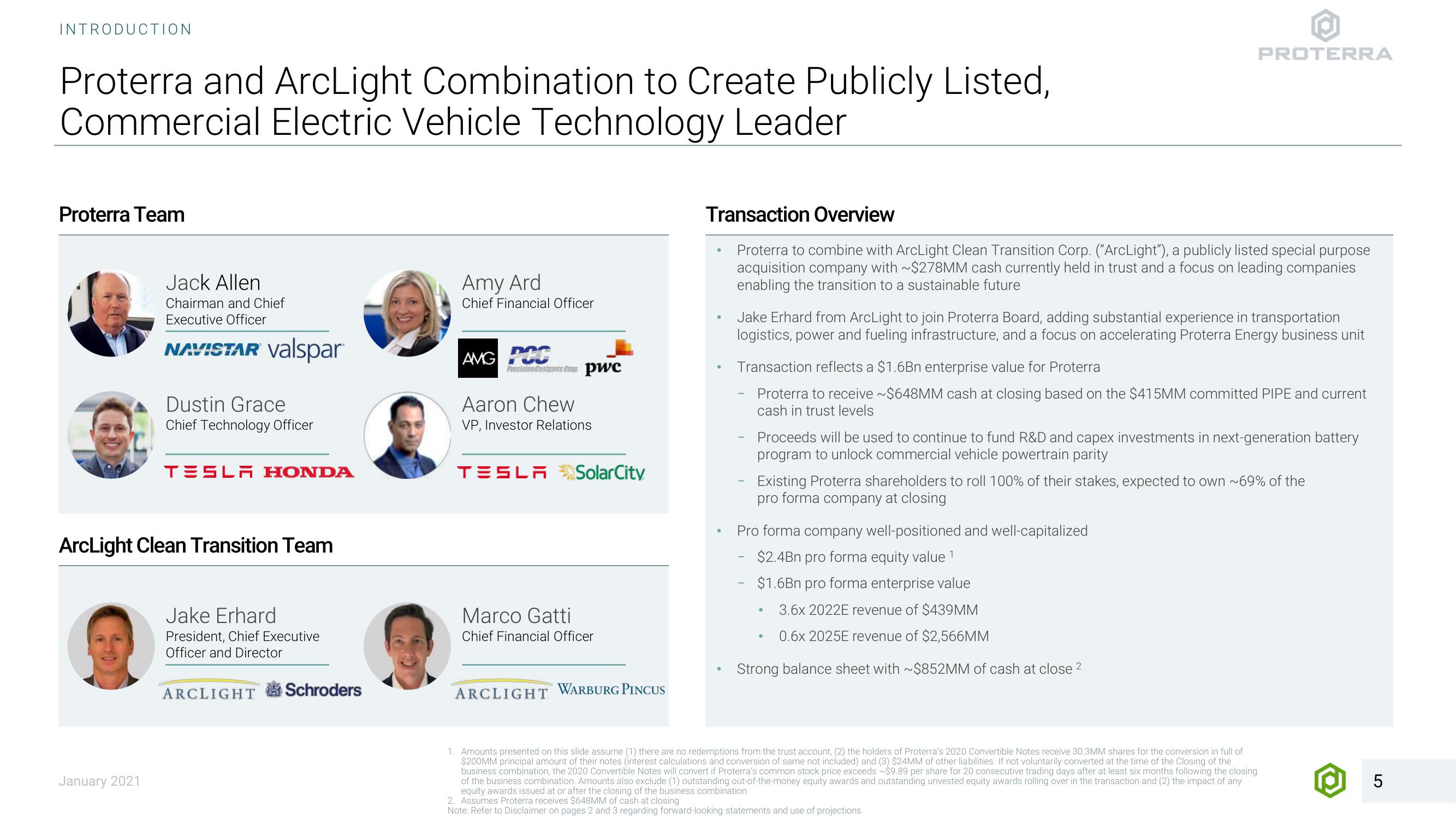

Proterra and ArcLight Combination to Create Publicly Listed,

Commercial Electric Vehicle Technology Leader

Proterra Team

Jack Allen

Chairman and Chief

Executive Officer

NAVISTAR valspar

January 2021

Dustin Grace

Chief Technology Officer

TESLA HONDA

ArcLight Clean Transition Team

Jake Erhard

President, Chief Executive

Officer and Director

ARCLIGHT Schroders

Amy Ard

Chief Financial Officer

AMG PCC

Precision Castroants Com.pwc

Aaron Chew

VP, Investor Relations

TESLA SolarCity

Marco Gatti

Chief Financial Officer

ARCLIGHT WARBURG PINCUS

Transaction Overview

Proterra to combine with ArcLight Clean Transition Corp. ("ArcLight"), a publicly listed special purpose

acquisition company with ~$278MM cash currently held in trust and a focus on leading companies

enabling the transition to a sustainable future

Jake Erhard from ArcLight to join Proterra Board, adding substantial experience in transportation

logistics, power and fueling infrastructure, and a focus on accelerating Proterra Energy business unit

PROTERRA

Transaction reflects a $1.6Bn enterprise value for Proterra

Proterra to receive ~$648MM cash at closing based on the $415MM committed PIPE and current

cash in trust levels

Proceeds will be used to continue to fund R&D and capex investments in next-generation battery

program to unlock commercial vehicle powertrain parity

Existing Proterra shareholders to roll 100% of their stakes, expected to own ~69% of the

pro forma company at closing

Pro forma company well-positioned and well-capitalized

$2.4Bn pro forma equity value 1

$1.6Bn pro forma enterprise value

3.6x 2022E revenue of $439MM

0.6x 2025E revenue of $2,566MM

Strong balance sheet with ~$852MM of cash at close ²

●

1. Amounts presented on this slide assume (1) there are no redemptions from the trust account, (2) the holders of Proterra's 2020 Convertible Notes receive 30.3MM shares for the conversion in full of

$200MM principal amount of their notes (interest calculations and conversion of same not included) and (3) $24MM of other liabilities. If not voluntarily converted at the time of the Closing of the

business combination, the 2020 Convertible Notes will convert if Proterra's common stock price exceeds $9.89 per share for 20 consecutive trading days after at least six months following the closing

of the business combination. Amounts also exclude (1) outstanding out-of-the-money equity awards and outstanding unvested equity awards rolling over in the transaction and (2) the impact of any

equity awards issued at or after the closing of the business combination

2. Assumes Proterra receives $648MM of cash at closing

Note: Refer to Disclaimer on pages 2 and 3 regarding forward-looking statements and use of projections

5View entire presentation