Paysafe Results Presentation Deck

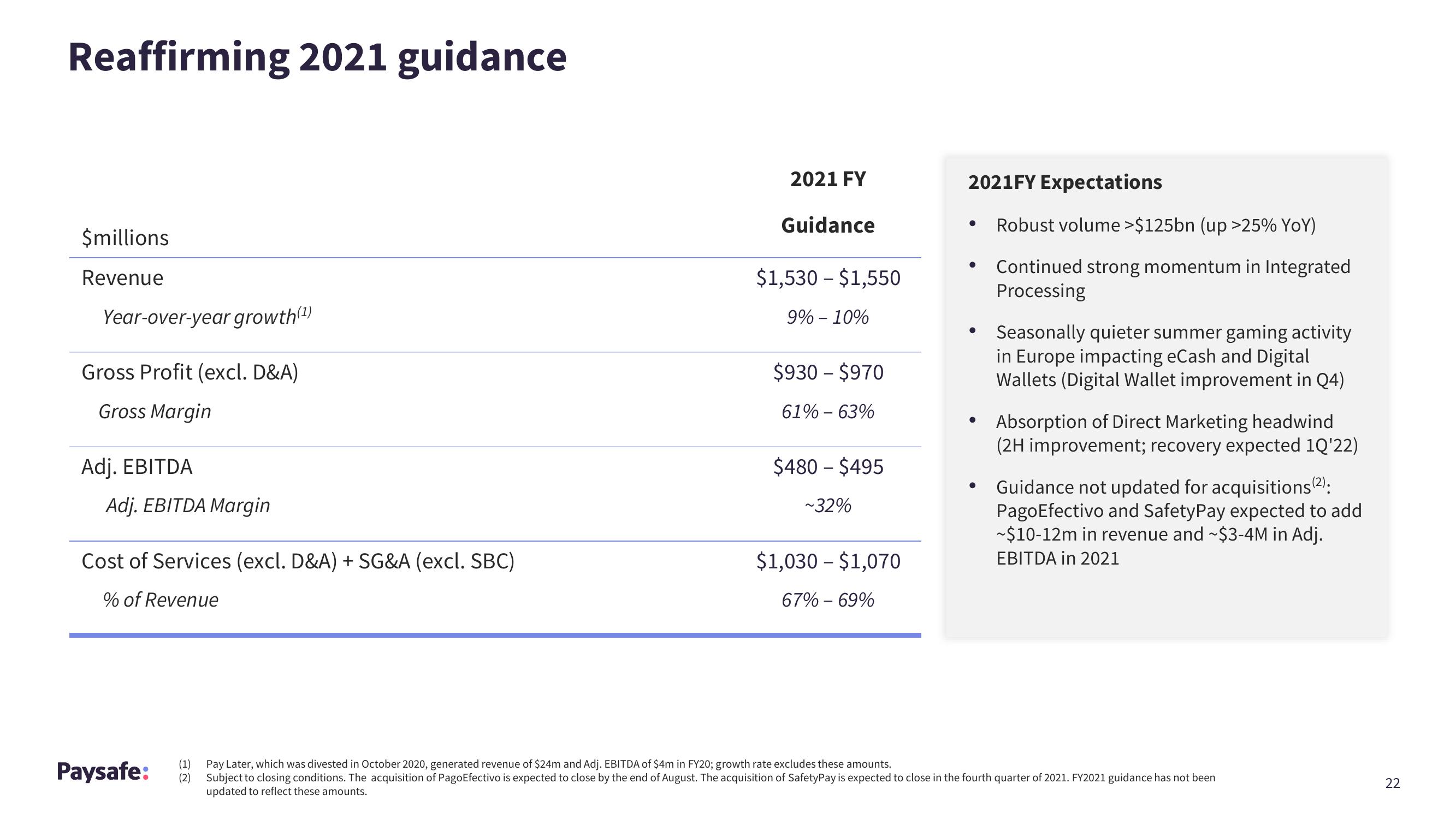

Reaffirming 2021 guidance

$millions

Revenue

Year-over-year growth(¹)

Gross Profit (excl. D&A)

Gross Margin

Adj. EBITDA

Adj. EBITDA Margin

Cost of Services (excl. D&A) + SG&A (excl. SBC)

% of Revenue

Paysafe:

(1)

(2)

2021 FY

Guidance

$1,530 - $1,550

9% - 10%

$930-$970

61% -63%

$480 - $495

~32%

$1,030 - $1,070

67% -69%

2021FY Expectations

Robust volume >$125bn (up >25% YoY)

Continued strong momentum in Integrated

Processing

●

●

Seasonally quieter summer gaming activity

in Europe impacting eCash and Digital

Wallets (Digital Wallet improvement in Q4)

Absorption of Direct Marketing headwind

(2H improvement; recovery expected 1Q'22)

Guidance not updated for acquisitions(²):

PagoEfectivo and SafetyPay expected to add

~$10-12m in revenue and ~$3-4M in Adj.

EBITDA in 2021

Pay Later, which was divested in October 2020, generated revenue of $24m and Adj. EBITDA of $4m in FY20; growth rate excludes these amounts.

Subject to closing conditions. The acquisition of PagoEfectivo is expected to close by the end of August. The acquisition of SafetyPay is expected to close in the fourth quarter of 2021. FY2021 guidance has not been

updated to reflect these amounts.

22View entire presentation