WPP Investor Day Presentation Deck

●

●

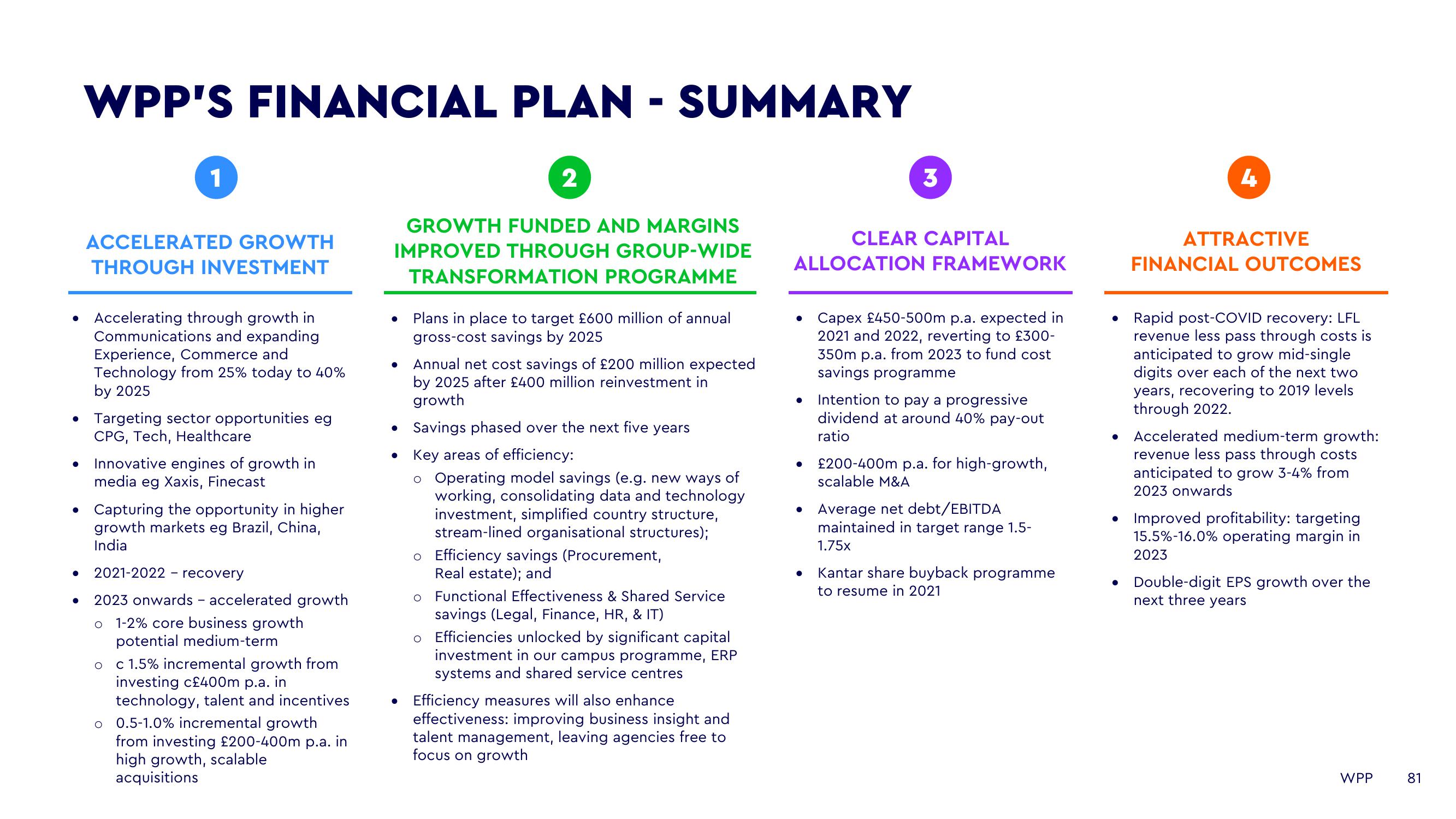

WPP'S FINANCIAL PLAN- SUMMARY

1

●

ACCELERATED GROWTH

THROUGH INVESTMENT

• Targeting sector opportunities eg

CPG, Tech, Healthcare

Accelerating through growth in

Communications and expanding

Experience, Commerce and

Technology from 25% today to 40%

by 2025

Innovative engines of growth in

media eg Xaxis, Finecast

• Capturing the opportunity in higher

growth markets eg Brazil, China,

India

2021-2022 - recovery

2023 onwards - accelerated growth

O 1-2% core business growth

potential medium-term

O

c 1.5% incremental growth from

investing c£400m p.a. in

technology, talent and incentives

O 0.5-1.0% incremental growth

from investing £200-400m p.a. in

high growth, scalable

acquisitions

2

GROWTH FUNDED AND MARGINS

IMPROVED THROUGH GROUP-WIDE

TRANSFORMATION PROGRAMME

●

Plans in place to target £600 million of annual

gross-cost savings by 2025

●

Annual net cost savings of £200 million expected

by 2025 after £400 million reinvestment in

growth

• Savings phased over the next five years

Key areas of efficiency:

o Operating model savings (e.g. new ways of

working, consolidating data and technology

investment, simplified country structure,

stream-lined organisational structures);

Efficiency savings (Procurement,

Real estate); and

o Functional Effectiveness & Shared Service

savings (Legal, Finance, HR, & IT)

o Efficiencies unlocked by significant capital

investment in our campus programme, ERP

systems and shared service centres

Efficiency measures will also enhance

effectiveness: improving business insight and

talent management, leaving agencies free to

focus on growth

CLEAR CAPITAL

ALLOCATION FRAMEWORK

●

3

●

Capex £450-500m p.a. expected in

2021 and 2022, reverting to £300-

350m p.a. from 2023 to fund cost

savings programme

Intention to pay a progressive

dividend at around 40% pay-out

ratio

£200-400m p.a. for high-growth,

scalable M&A

Average net debt/EBITDA

maintained in target range 1.5-

1.75x

Kantar share buyback programme

to resume in 2021

4

ATTRACTIVE

●

FINANCIAL OUTCOMES

• Rapid post-COVID recovery: LFL

revenue less pass through costs is

anticipated to grow mid-single

digits over each of the next two

years, recovering to 2019 levels

through 2022.

● Accelerated medium-term growth:

revenue less pass through costs

anticipated to grow 3-4% from

2023 onwards

Improved profitability: targeting

15.5%-16.0% operating margin in

2023

Double-digit EPS growth over the

next three years

WPP

81View entire presentation