Investor Presentation

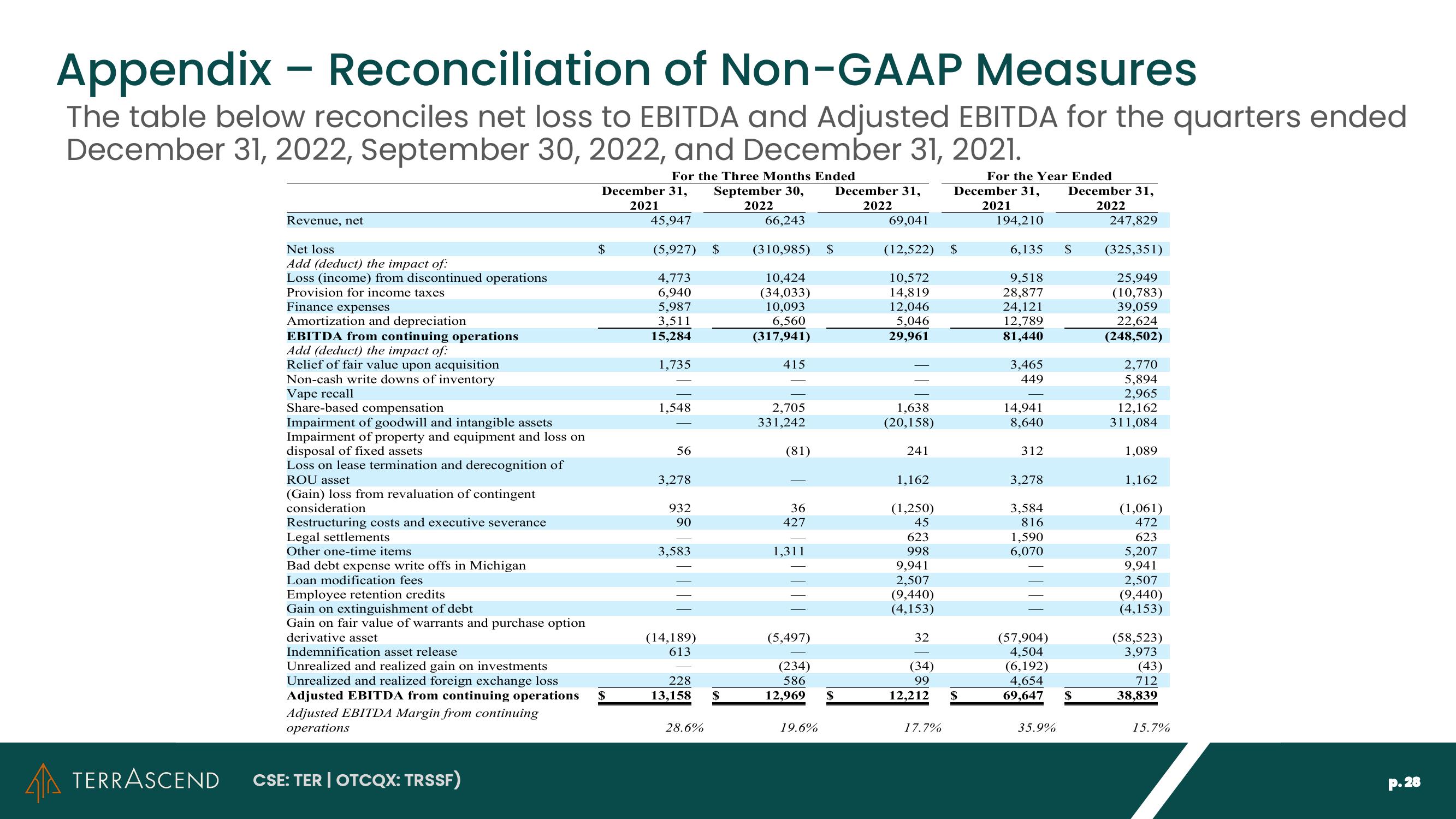

Appendix - Reconciliation of Non-GAAP Measures

The table below reconciles net loss to EBITDA and Adjusted EBITDA for the quarters ended

December 31, 2022, September 30, 2022, and December 31, 2021.

For the Three Months Ended

September 30,

2022

For the Year Ended

December 31, December 31,

2021

2022

66,243

194,210

(310,985) $

10,424

(34,033)

10,093

6,560

(317,941)

6,135

9,518

28,877

24,121

12,789

81,440

4 TERRASCEND

Revenue, net

Net loss

Add (deduct) the impact of:

Loss (income) from discontinued operations

Provision for income taxes

Finance expenses

Amortization and depreciation

EBITDA from continuing operations

Add (deduct) the impact of:

Relief of fair value upon acquisition

Non-cash write downs of inventory

Vape recall

Share-based compensation

Impairment of goodwill and intangible assets

Impairment of property and equipment and loss on

disposal of fixed assets

Loss on lease termination and derecognition of

ROU asset

(Gain) loss from revaluation of contingent

consideration

Restructuring costs and executive severance

Legal settlements

Other one-time items

Bad debt expense write offs in Michigan

Loan modification fees

Employee retention credits

Gain on extinguishment of debt

Gain on fair value of warrants and purchase option

derivative asset

December 31,

2021

CSE: TER | OTCQX: TRSSF)

$

Indemnification asset release

Unrealized and realized gain on investments

Unrealized and realized foreign exchange loss

Adjusted EBITDA from continuing operations $

Adjusted EBITDA Margin from continuing

operations

45,947

(5,927)

4,773

6,940

5,987

3,511

15,284

1,735

1,548

56

3,278

932

90

3,583

(14,189)

613

228

13,158

28.6%

$

$

415

2,705

331,242

(81)

36

427

1,311

(5,497)

(234)

586

12,969

19.6%

December 31,

2022

$

69,041

(12,522) $

10,572

14,819

12,046

5,046

29,961

1,638

(20,158)

241

1,162

(1,250)

45

623

998

9,941

2,507

(9,440)

(4,153)

32

(34)

99

12,212

17.7%

$

3,465

449

14,941

8,640

312

3,278

3,584

816

1,590

6,070

(57,904)

4,504

(6,192)

4,654

69,647

35.9%

$

$

247,829

(325,351)

25,949

(10,783)

39,059

22,624

(248,502)

2,770

5,894

2,965

12,162

311,084

1,089

1,162

(1,061)

472

623

5,207

9,941

2,507

(9,440)

(4,153)

(58,523)

3,973

(43)

712

38,839

15.7%

P.28View entire presentation