OppFi Results Presentation Deck

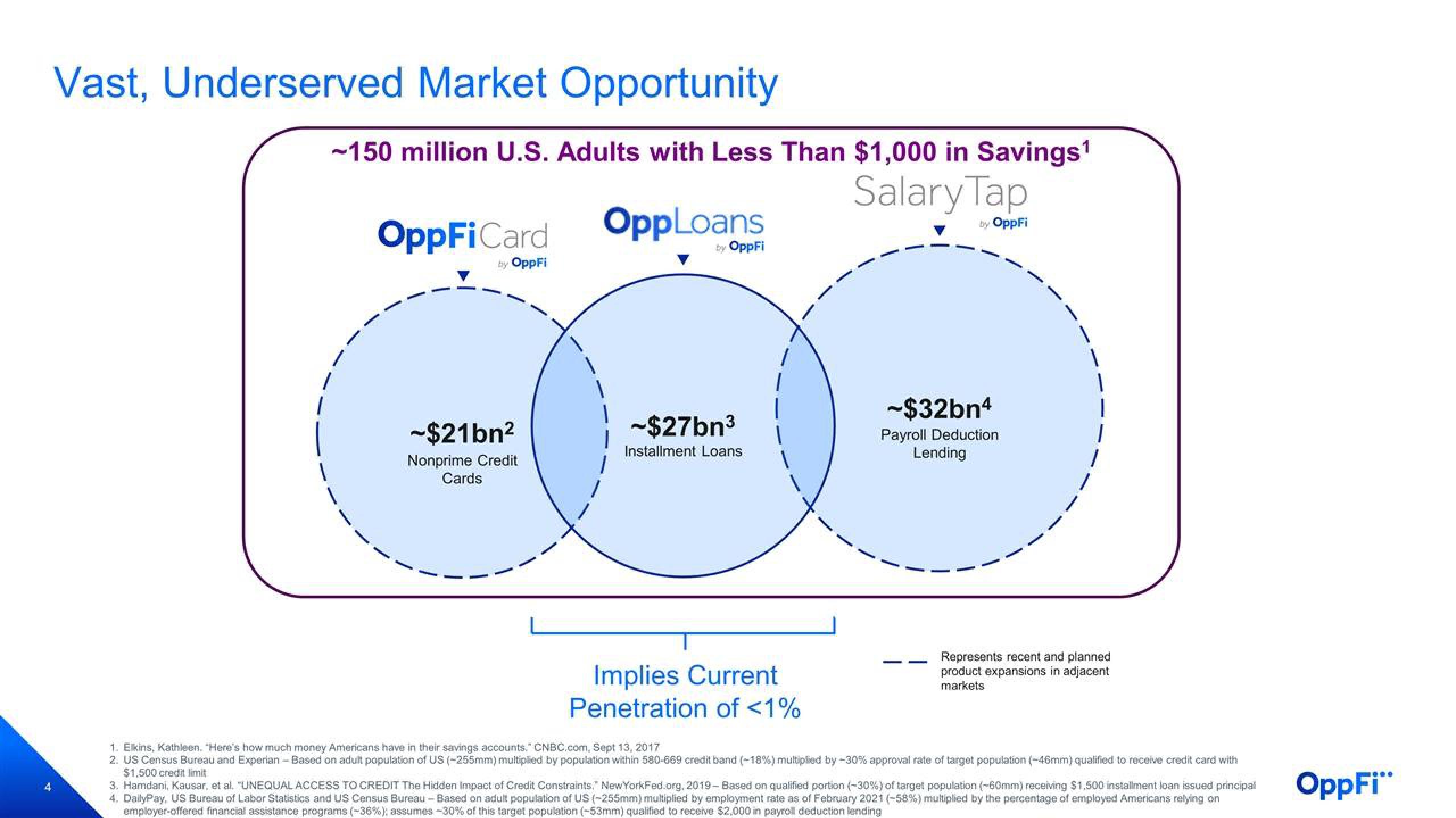

Vast, Underserved Market Opportunity

1

~150 million U.S. Adults with Less Than $1,000 in Savings¹

Salary Tap

by OppFi

|

1

OppFi Card

by OppFi

-$21bn²

Nonprime Credit

Cards

|

OppLoans

by OppFi

-$27bn³

Installment Loans

Implies Current

Penetration of <1%

-$32bn4

Payroll Deduction

Lending

|

|

1

|

|

Represents recent and planned

product expansions in adjacent

markets

1. Elkins, Kathleen. "Here's how much money Americans have in their savings accounts." CNBC.com, Sept 13, 2017

2. US Census Bureau and Experian - Based on adult population of US (-255mm) multiplied by population within 580-669 credit band (-18%) multiplied by -30% approval rate of target population (-46mm) qualified to receive credit card with

$1,500 credit limit

3. Hamdani, Kausar, et al. "UNEQUAL ACCESS TO CREDIT The Hidden Impact of Credit Constraints." New YorkFed.org, 2019-Based on qualified portion (-30%) of target population (-60mm) receiving $1,500 installment loan issued principal

4. DailyPay, US Bureau of Labor Statistics and US Census Bureau-Based on adult population of US (-255mm) multiplied by employment rate as of February 2021 ( -58%) multiplied by the percentage of employed Americans relying on

employer-offered financial assistance programs (-36%); assumes -30% of this target population (-53mm) qualified to receive $2,000 in payroll deduction lending

OppFi"View entire presentation