Navitas SPAC Presentation Deck

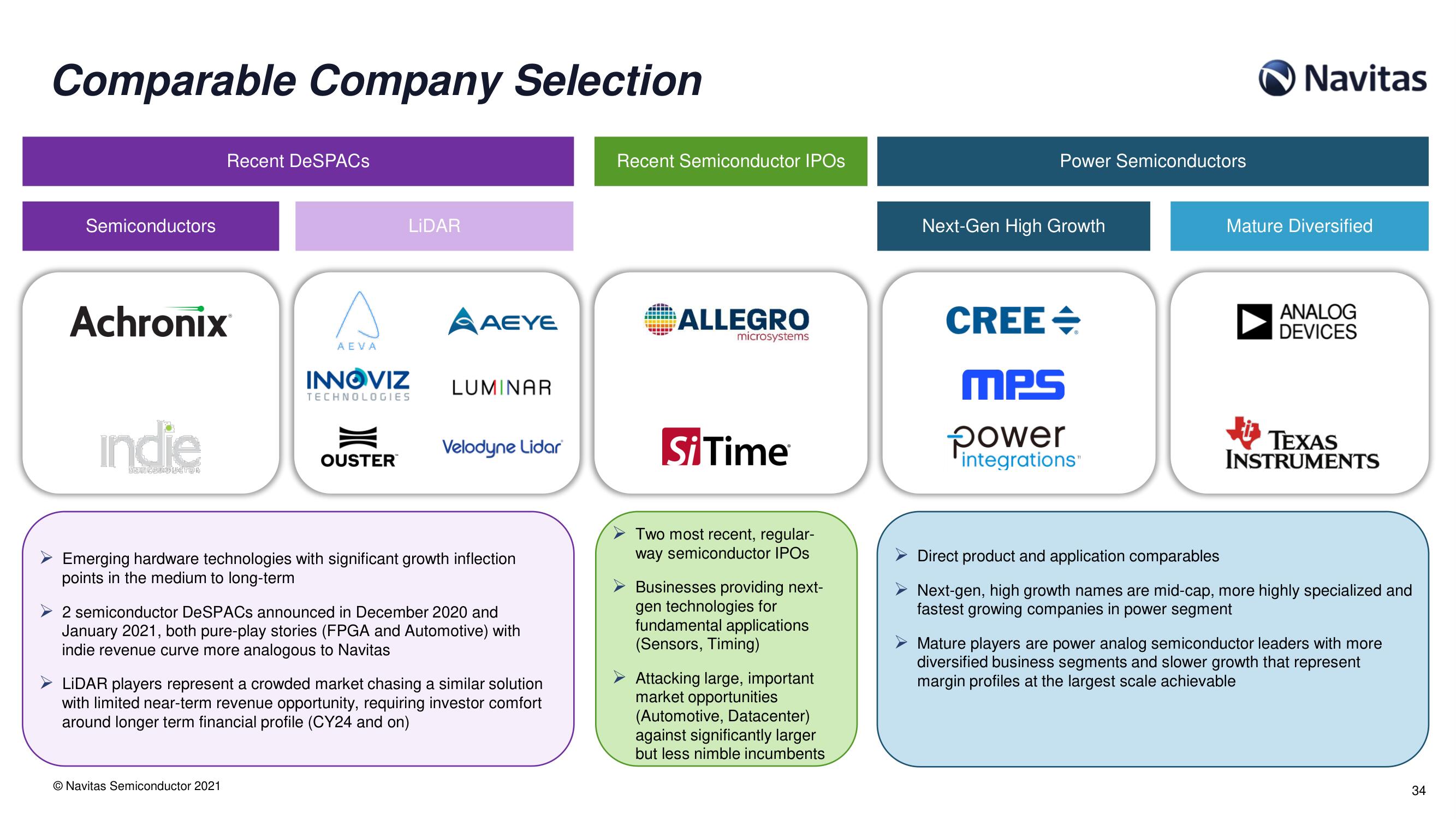

Comparable Company Selection

Semiconductors

Achronix

Indie

Sera CompuCTRO

Recent DeSPACs

AEVA

O Navitas Semiconductor 2021

LIDAR

INNOVIZ

TECHNOLOGIES

OUSTER

AAEYE

LUMINAR

Velodyne Lidar

Emerging hardware technologies with significant growth inflection

points in the medium to long-term

2 semiconductor DeSPACs announced in December 2020 and

January 2021, both pure-play stories (FPGA and Automotive) with

indie revenue curve more analogous to Navitas

LiDAR players represent a crowded market chasing a similar solution

with limited near-term revenue opportunity, requiring investor comfort

around longer term financial profile (CY24 and on)

Recent Semiconductor IPOs

ALLEGRO

microsystems

Si Time

Two most recent, regular-

way semiconductor IPOs

Businesses providing next-

gen technologies for

fundamental applications

(Sensors, Timing)

Attacking large, important

market opportunities

(Automotive, Datacenter)

against significantly larger

but less nimble incumbents

Power Semiconductors

Next-Gen High Growth

CREE +

MPS

power

integrations

Navitas

Mature Diversified

ANALOG

DEVICES

TEXAS

INSTRUMENTS

Direct product and application comparables

Next-gen, high growth names are mid-cap, more highly specialized and

fastest growing companies in power segment

Mature players are power analog semiconductor leaders with more

diversified business segments and slower growth that represent

margin profiles at the largest scale achievable

34View entire presentation