Ashtead Group Results Presentation Deck

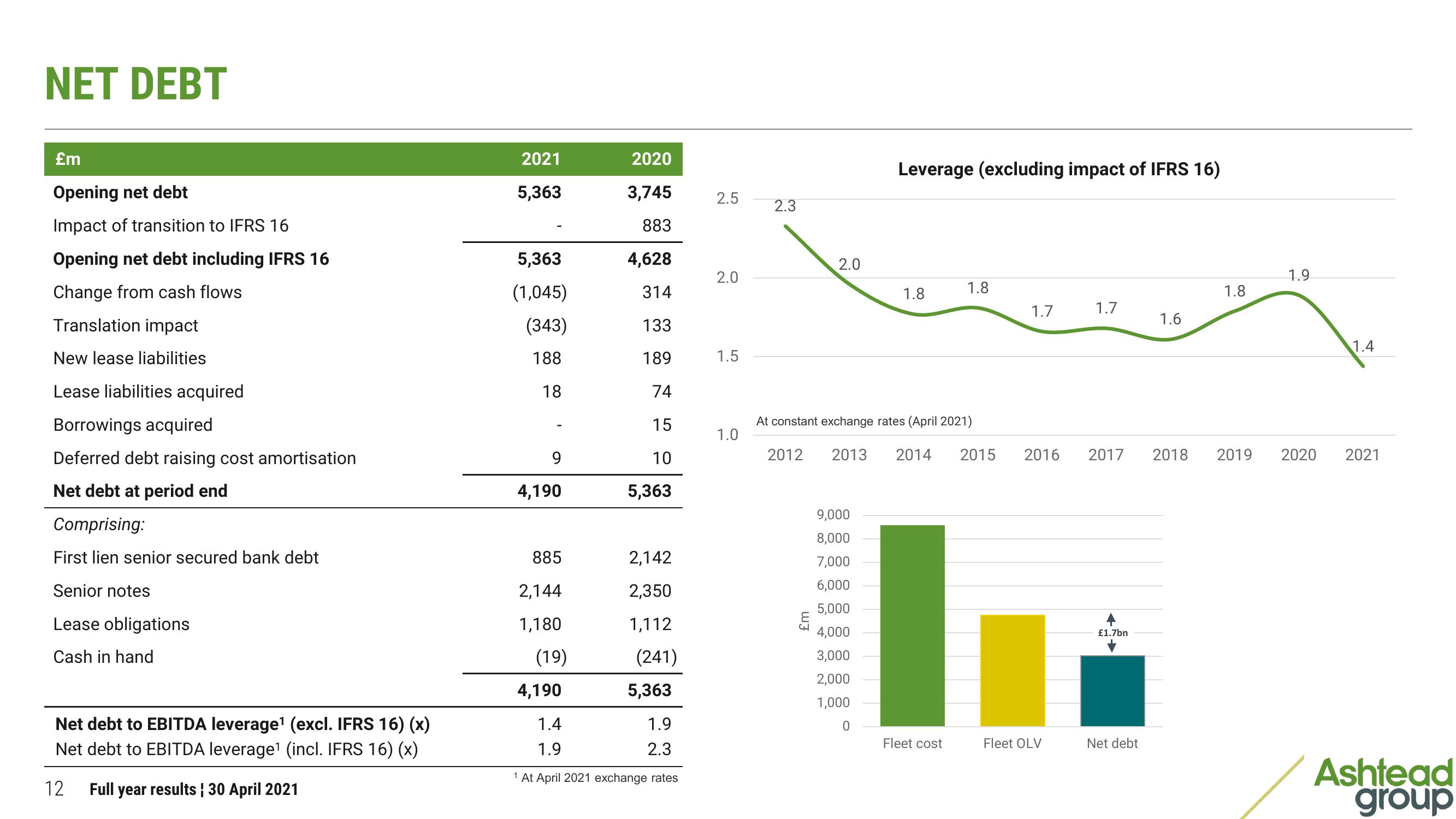

NET DEBT

£m

Opening net debt

Impact of transition to IFRS 16

Opening net debt including IFRS 16

Change from cash flows

Translation impact

New lease liabilities

Lease liabilities acquired

Borrowings acquired

Deferred debt raising cost amortisation

Net debt at period end

Comprising:

First lien senior secured bank debt

Senior notes

Lease obligations

Cash in hand

Net debt to EBITDA leverage¹ (excl. IFRS 16) (x)

Net debt to EBITDA leverage¹ (incl. IFRS 16) (x)

12 Full year results ¦ 30 April 2021

2021

5,363

5,363

(1,045)

(343)

188

18

9

4,190

885

2,144

1,180

2,142

2,350

1,112

(241)

5,363

1.4

1.9

1.9

2.3

1 At April 2021 exchange rates

(19)

2020

3,745

883

4,628

314

133

189

74

15

10

5,363

4,190

2.5

2.0

1.5

1.0

2.3

2.0

€

Leverage (excluding impact of IFRS 16)

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

1.8

At constant exchange rates (April 2021)

2012 2013 2014 2015

1.8

Fleet cost

1.7

2016

Fleet OLV

1.7

£1.7bn

1.6

2017 2018 2019

Net debt

1.8

1.9

1.4

2020 2021

Ashtead

groupView entire presentation