Zegna Results Presentation Deck

Non-IFRS Financial Measures

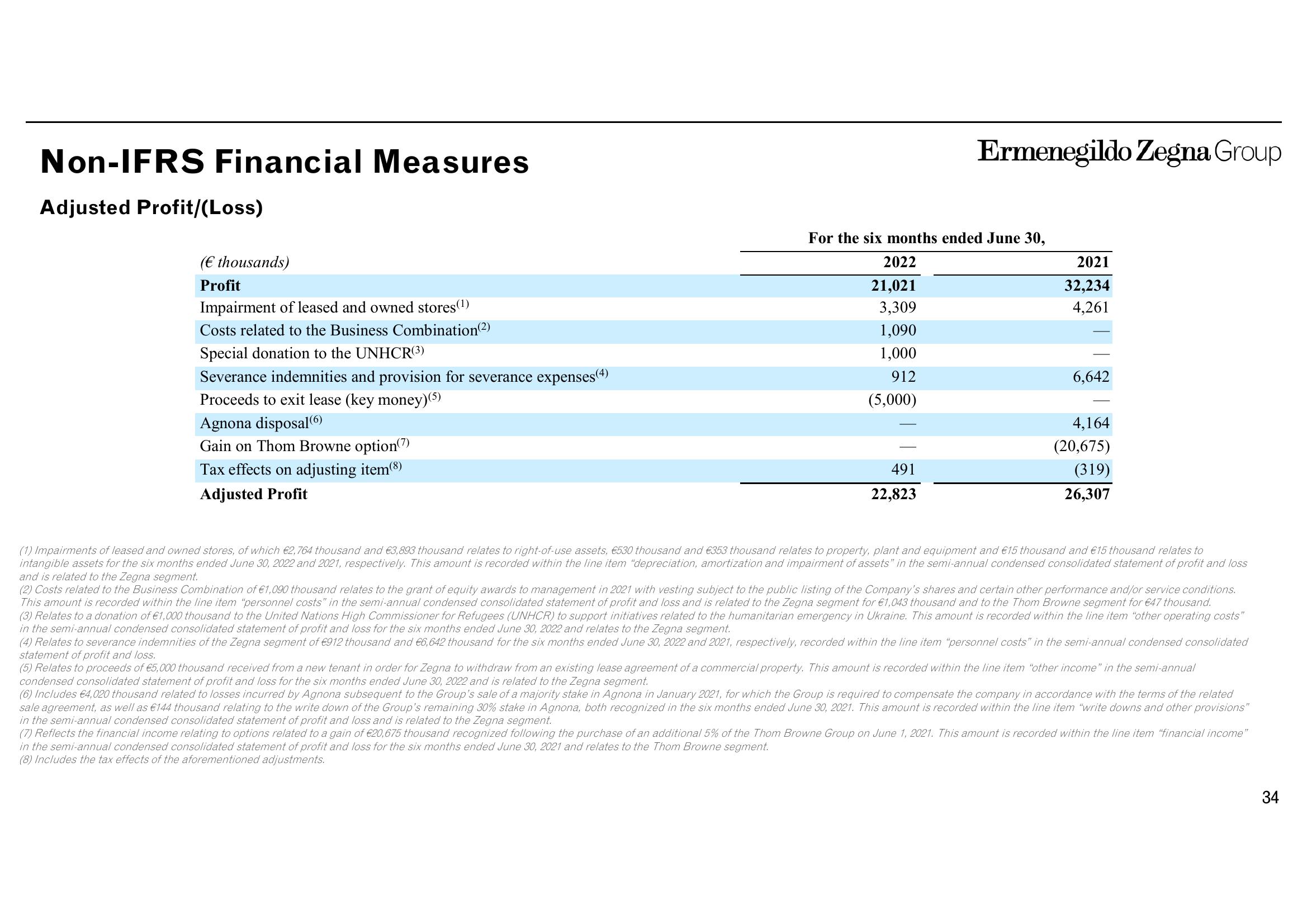

Adjusted Profit/(Loss)

(€ thousands)

Profit

Impairment of leased and owned stores(¹)

Costs related to the Business Combination (2)

Special donation to the UNHCR(3)

Severance indemnities and provision for severance expenses(4)

Proceeds to exit lease (key money)(5)

Agnona disposal(6)

Gain on Thom Browne option(7)

Tax effects on adjusting item(8)

Adjusted Profit

Ermenegildo Zegna Group

For the six months ended June 30,

2022

21,021

3,309

1,090

1,000

912

(5,000)

491

22,823

2021

32,234

4,261

6,642

4,164

(20,675)

(319)

26,307

(1) Impairments of leased and owned stores, of which €2,764 thousand and €3,893 thousand relates to right-of-use assets, €530 thousand and €353 thousand relates to property, plant and equipment and €15 thousand and €15 thousand relates to

intangible assets for the six months ended June 30, 2022 and 2021, respectively. This amount is recorded within the line item "depreciation, amortization and impairment of assets" in the semi-annual condensed consolidated statement of profit and loss

and is related to the Zegna segment.

(2) Costs related to the Business Combination of €1,090 thousand relates to the grant of equity awards to management in 2021 with vesting subject to the public listing of the Company's shares and certain other performance and/or service conditions.

This amount is recorded within the line item "personnel costs" in the semi-annual condensed consolidated statement of profit and loss and is related to the Zegna segment for €1,043 thousand and to the Thom Browne segment for €47 thousand.

(3) Relates to a donation of €1,000 thousand to the United Nations High Commissioner for Refugees (UNHCR) to support initiatives related to the humanitarian emergency in Ukraine. This amount is recorded within the line item "other operating costs"

in the semi-annual condensed consolidated statement of profit and loss for the six months ended June 30, 2022 and relates to the Zegna segment.

(4) Relates to severance indemnities of the Zegna segment of €912 thousand and €6,642 thousand for the six months ended June 30, 2022 and 2021, respectively, recorded within the line item "personnel costs" in the semi-annual condensed consolidated

statement of profit and loss.

(5) Relates to proceeds of €5,000 thousand received from a new tenant in order for Zegna to withdraw from an existing lease agreement of a commercial property. This amount is recorded within the line item "other income" in the semi-annual

condensed consolidated statement of profit and loss for the six months ended June 30, 2022 and is related to the Zegna segment.

(6) Includes €4,020 thousand related to losses incurred by Agnona subsequent to the Group's sale of a majority stake in Agnona in January 2021, for which the Group is required to compensate the company in accordance with the terms of the related

sale agreement, as well as €144 thousand relating to the write down of the Group's remaining 30% stake in Agnona, both recognized in the six months ended June 30, 2021. This amount is recorded within the line item "write downs and other provisions"

in the semi-annual condensed consolidated statement of profit and loss and is related to the Zegna segment.

(7) Reflects the financial income relating to options related to a gain of €20,675 thousand recognized following the purchase of an additional 5% of the Thom Browne Group on June 1, 2021. This amount is recorded within the line item "financial income"

in the semi-annual condensed consolidated statement of profit and loss for the six months ended June 30, 2021 and relates to the Thom Browne segment.

(8) Includes the tax effects of the aforementioned adjustments.

34View entire presentation