Ares US Real Estate Opportunity Fund III

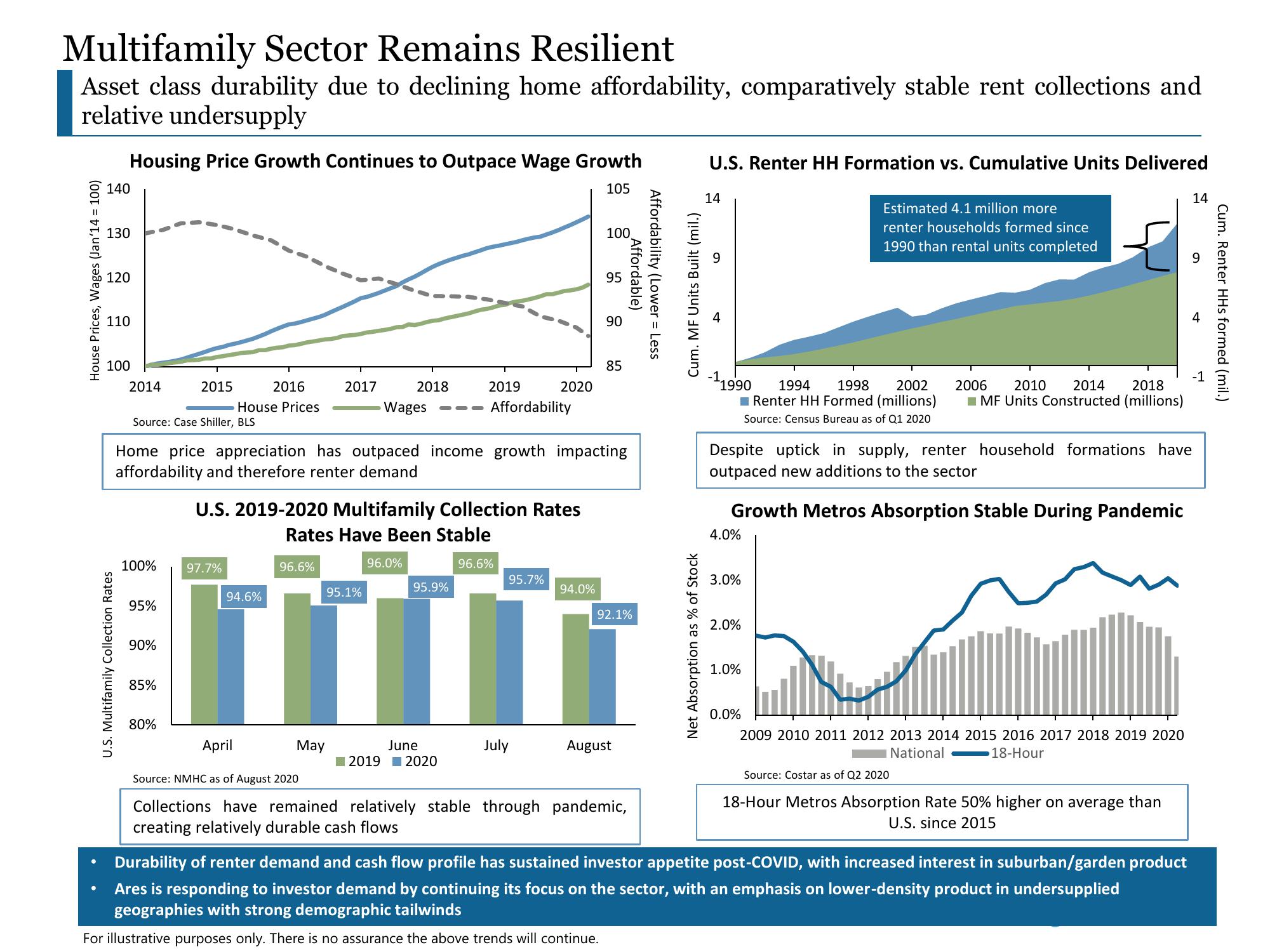

Multifamily Sector Remains Resilient

Asset class durability due to declining home affordability, comparatively stable rent collections and

relative undersupply

House Prices, Wages (Jan'14 = 100)

140

●

130

Housing Price Growth Continues to Outpace Wage Growth

105

120

110

100

U.S. Multifamily Collection Rates

2014

Source: Case Shiller, BLS

100%

95%

90%

2015

85%

80%

2016

House Prices

97.7%

94.6%

April

2017

Home price appreciation has outpaced income growth impacting

affordability and therefore renter demand

96.6%

U.S. 2019-2020 Multifamily Collection Rates

Rates Have Been Stable

95.1%

May

2018

Wages

96.0%

T

2019

95.9%

June

2019 2020

Affordability

2020

96.6%

95.7%

July

94.0%

100

95

90

85

Affordable)

Affordability (Lower = Less

92.1%

August

Source: NMHC as of August 2020

Collections have remained relatively stable through pandemic,

creating relatively durable cash flows

Cum. MF Units Built (mil.)

Net Absorption as % of Stock

U.S. Renter HH Formation vs. Cumulative Units Delivered

14

-11990

4.0%

3.0%

Despite uptick in supply, renter household formations have

outpaced new additions to the sector

Growth Metros Absorption Stable During Pandemic

2.0%

1.0%

Estimated 4.1 million more

renter households formed since

1990 than rental units completed

0.0%

1994

2002

1998

Renter HH Formed (millions)

Source: Census Bureau as of Q1 2020

2006

2014

2018

2010

■MF Units Constructed (millions)

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

National

18-Hour

Source: Costar as of Q2 2020

18-Hour Metros Absorption Rate 50% higher on average than

U.S. since 2015

Durability of renter demand and cash flow profile has sustained investor appetite post-COVID, with increased interest in suburban/garden product

Ares is responding to investor demand by continuing its focus on the sector, with an emphasis on lower-density product in undersupplied

geographies with strong demographic tailwinds

For illustrative purposes only. There is no assurance the above trends will continue.

14

Cum. Renter HHs formed (mil.)View entire presentation