Vale Results Presentation Deck

Vale's Performance in 2022: Finance

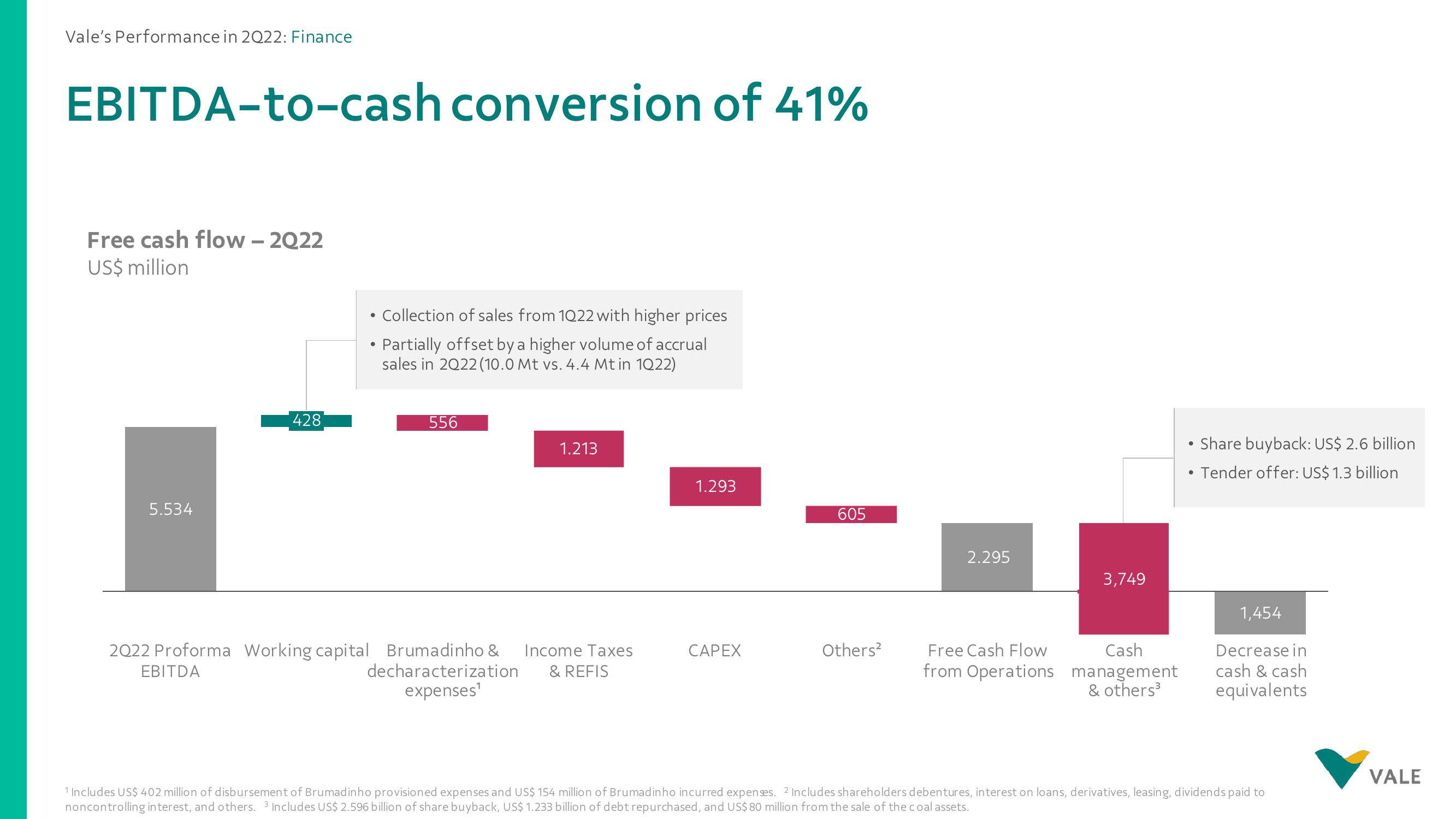

EBITDA-to-cash conversion of 41%

Free cash flow - 2022

US$ million

5.534

428

Collection of sales from 1022 with higher prices

• Partially offset by a higher volume of accrual

sales in 2022 (10.0 Mt vs. 4.4 Mt in 1Q22)

556

2022 Proforma Working capital Brumadinho &

EBITDA

1.213

Income Taxes

decharacterization & REFIS

expenses¹

1.293

CAPEX

605

Others²

2.295

Free Cash Flow

from Operations

3,749

Cash

management

& others³

●

Share buyback: US$ 2.6 billion

Tender offer: US$ 1.3 billion

1,454

Decrease in

cash & cash

equivalents

1 Includes US$ 402 million of disbursement of Brumadinho provisioned expenses and US$ 154 million of Brumadinho incurred expenses. 2 Includes shareholders debentures, interest on loans, derivatives, leasing, dividends paid to

noncontrolling interest, and others. 3 Includes US$ 2.596 billion of share buyback, US$ 1.233 billion of debt repurchased, and US$ 80 million from the sale of the coal assets.

VALEView entire presentation