Spirit Mergers and Acquisitions Presentation Deck

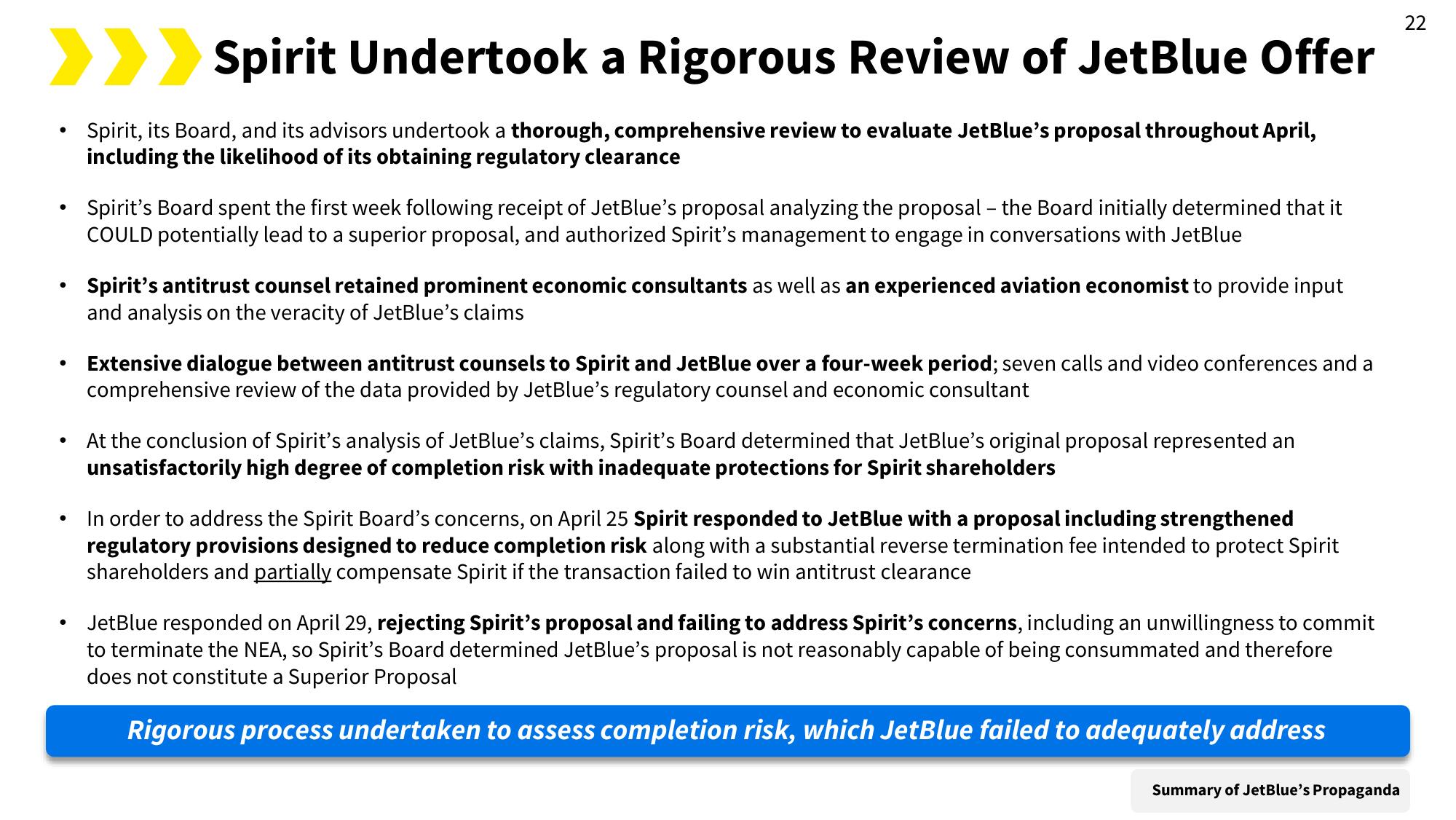

>> Spirit Undertook a Rigorous Review of JetBlue Offer

Spirit, its Board, and its advisors undertook a thorough, comprehensive review to evaluate JetBlue's proposal throughout April,

including the likelihood of its obtaining regulatory clearance

●

●

●

●

Spirit's Board spent the first week following receipt of JetBlue's proposal analyzing the proposal - the Board initially determined that it

COULD potentially lead to a superior proposal, and authorized Spirit's management to engage in conversations with JetBlue

Spirit's antitrust counsel retained prominent economic consultants as well as an experienced aviation economist to provide input

and analysis on the veracity of JetBlue's claims

Extensive dialogue between antitrust counsels to Spirit and JetBlue over a four-week period; seven calls and video conferences and a

comprehensive review of the data provided by JetBlue's regulatory counsel and economic consultant

At the conclusion of Spirit's analysis of JetBlue's claims, Spirit's Board determined that JetBlue's original proposal represented an

unsatisfactorily high degree of completion risk with inadequate protections for Spirit shareholders

In order to address the Spirit Board's concerns, on April 25 Spirit responded to JetBlue with a proposal including strengthened

regulatory provisions designed to reduce completion risk along with a substantial reverse termination fee intended to protect Spirit

shareholders and partially compensate Spirit if the transaction failed to win antitrust clearance

JetBlue responded on April 29, rejecting Spirit's proposal and failing to address Spirit's concerns, including an unwillingness to commit

to terminate the NEA, so Spirit's Board determined JetBlue's proposal is not reasonably capable of being consummated and therefore

does not constitute a Superior Proposal

Rigorous process undertaken to assess completion risk, which JetBlue failed to adequately address

Summary of JetBlue's Propaganda

22View entire presentation