J.P.Morgan Investment Banking Pitch Book

APPENDIX

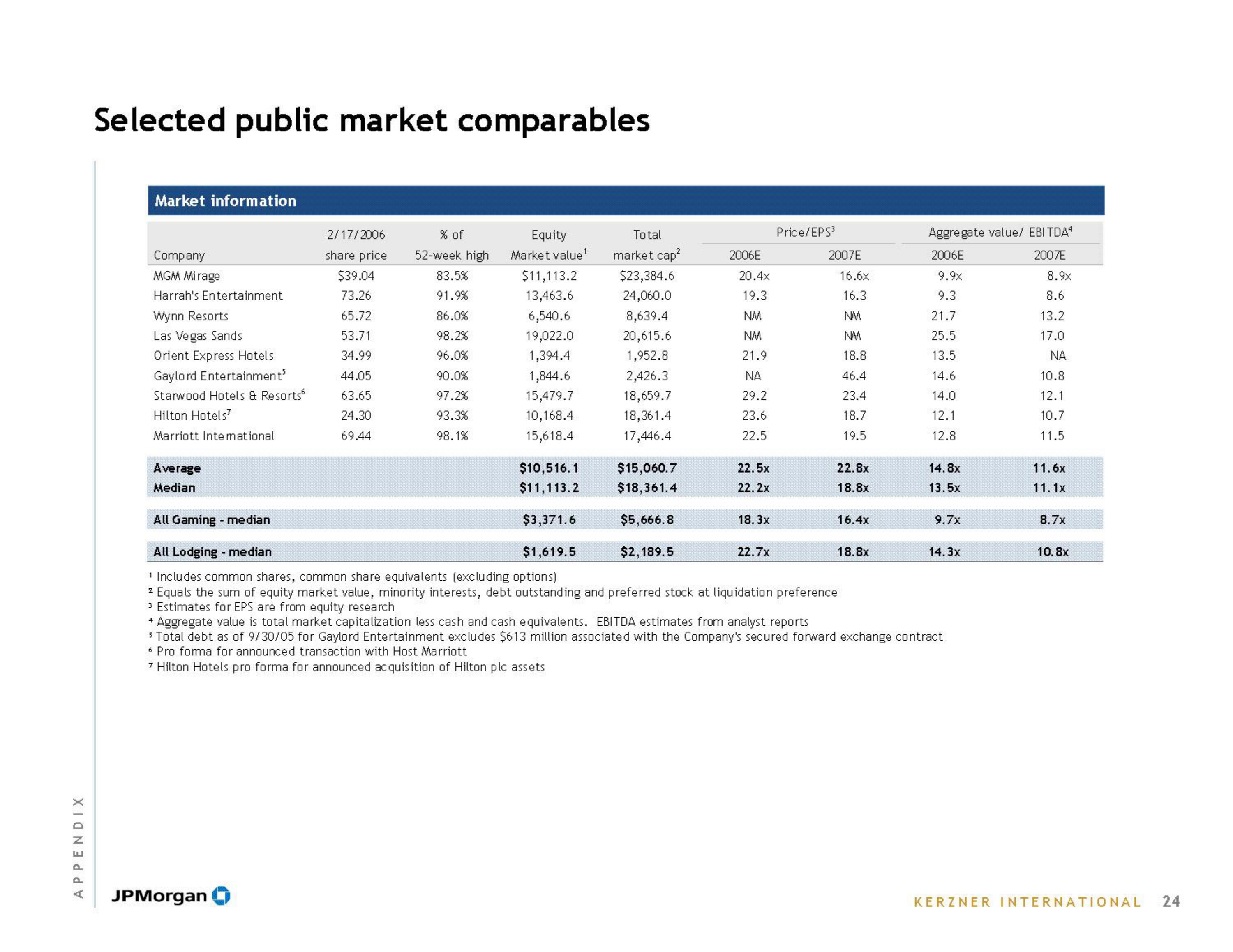

Selected public market comparables

Market information

Company

MGM Mirage

Harrah's Entertainment

Wynn Resorts

Las Vegas Sands

Orient Express Hotels

Gaylord Entertainment'

Starwood Hotels & Resorts

Hilton Hotels?

Marriott Inte mational

Average

Median

2/17/2006

share price

$39.04

73.26

JPMorgan

65.72

53.71

34.99

44.05

63.65

24.30

69.44

% of

52-week high

83.5%

91.9%

86.0%

98.2%

96.0%

90.0%

97.2%

93.3%

98.1%

Equity

Market value¹

$11,113.2

13,463.6

6,540.6

19,022.0

1,394.4

1,844.6

15,479.7

10,168.4

15,618.4

Total

market cap²

$23,384.6

24,060.0

8,639.4

20,615.6

1,952.8

2,426.3

18,659.7

18,361.4

17,446.4

$15,060.7

$18,361.4

$5,666.8

$2,189.5

2006E

20.4x

19.3

NM

NM

21.9

NA

29.2

23.6

22.5

22.5x

22. 2x

18.3x

Price/EPS³

$10,516.1

$11,113.2

All Gaming - median

$3,371.6

All Lodging - median

$1,619.5

¹ Includes common shares, common share equivalents (excluding options)

2 Equals the sum of equity market value, minority interests, debt outstanding and preferred stock at liquidation preference

3 Estimates for EPS are from equity research

4 Aggregate value is total market capitalization less cash and cash equivalents. EBITDA estimates from analyst reports

5 Total debt as of 9/30/05 for Gaylord Entertainment excludes $613 million associated with the Company's secured forward exchange contract

Pro forma for announced transaction with Host Marriott

7 Hilton Hotels pro forma for announced acquisition of Hilton plc assets

22.7x

2007E

16.6x

16.3

NM

NM

18.8

46.4

23.4

18.7

19.5

22.8x

18.8x

16.4x

Aggregate value/ EBITDA¹

2006E

2007E

9.9x

9.3

21.7

25.5

13.5

14.6

14.0

12.1

12.8

18.8x

14.8x

13.5x

9.7x

14.3x

8.9x

8.6

13.2

17.0

ΝΑ

10.8

12.1

10.7

11.5

11.6x

11.1x

8.7x

10.8x

KERZNER INTERNATIONAL 24View entire presentation