Engine No. 1 Activist Presentation Deck

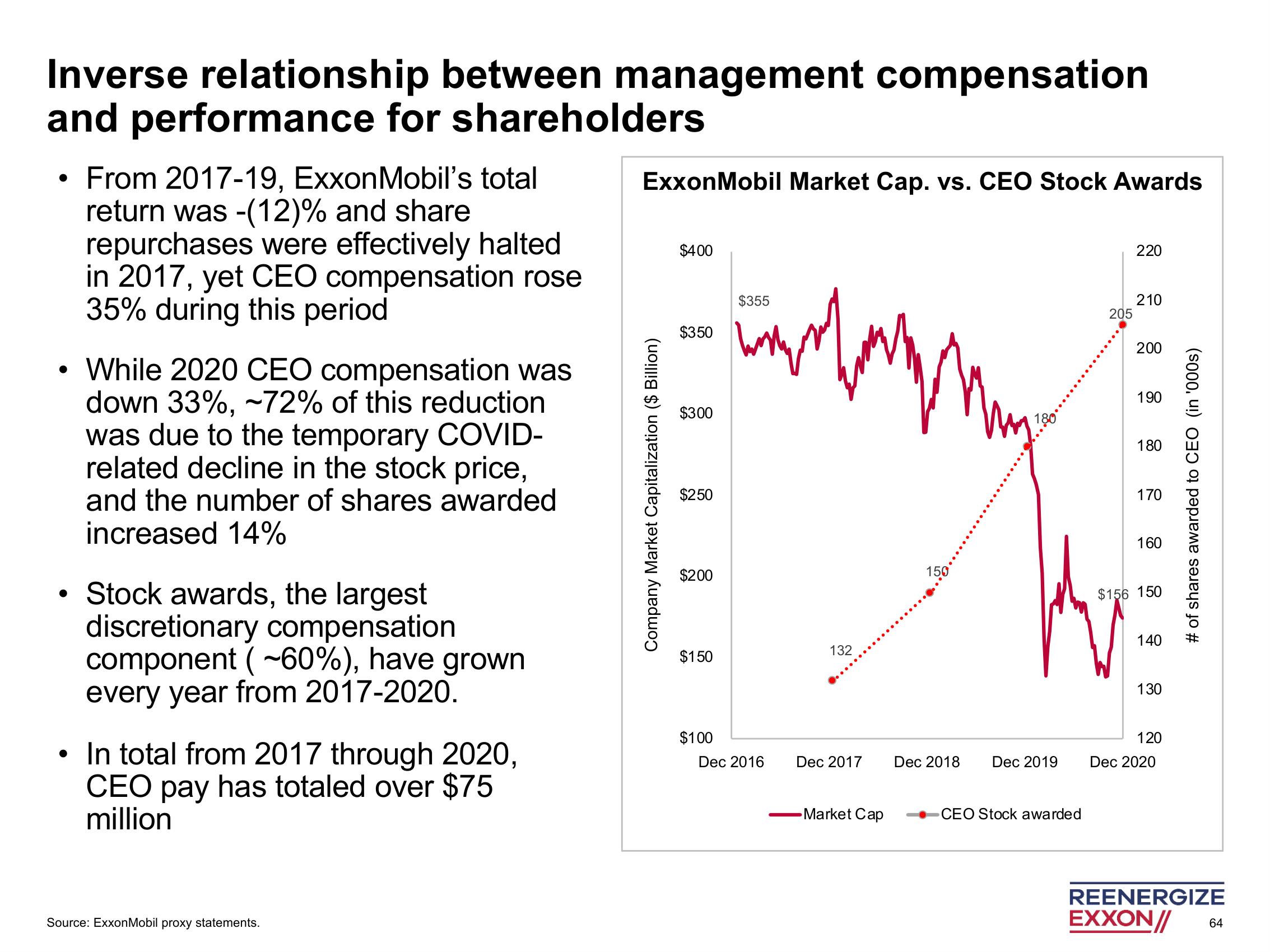

Inverse relationship between management compensation

and performance for shareholders

●

●

From 2017-19, ExxonMobil's total

return was -(12)% and share

repurchases were effectively halted

in 2017, yet CEO compensation rose

35% during this period

While 2020 CEO compensation was

down 33%, ~72% of this reduction

was due to the temporary COVID-

related decline in the stock price,

and the number of shares awarded

increased 14%

Stock awards, the largest

discretionary compensation

component (~60%), have grown

every year from 2017-2020.

• In total from 2017 through 2020,

CEO pay has totaled over $75

million

Source: ExxonMobil proxy statements.

ExxonMobil Market Cap. vs. CEO Stock Awards

Company Market Capitalization ($ Billion)

$400

$350

$300

$250

$200

$150

$100

inform

$355

Dec 2016

132

Dec 2017

Market Cap

150

Dec 2018

Dec 2019

CEO Stock awarded

205

220

210

200

190

180

170

160

$156 150

140

130

120

Dec 2020

# of shares awarded to CEO (in '000s)

REENERGIZE

EXXON//

64View entire presentation