Babylon SPAC Presentation Deck

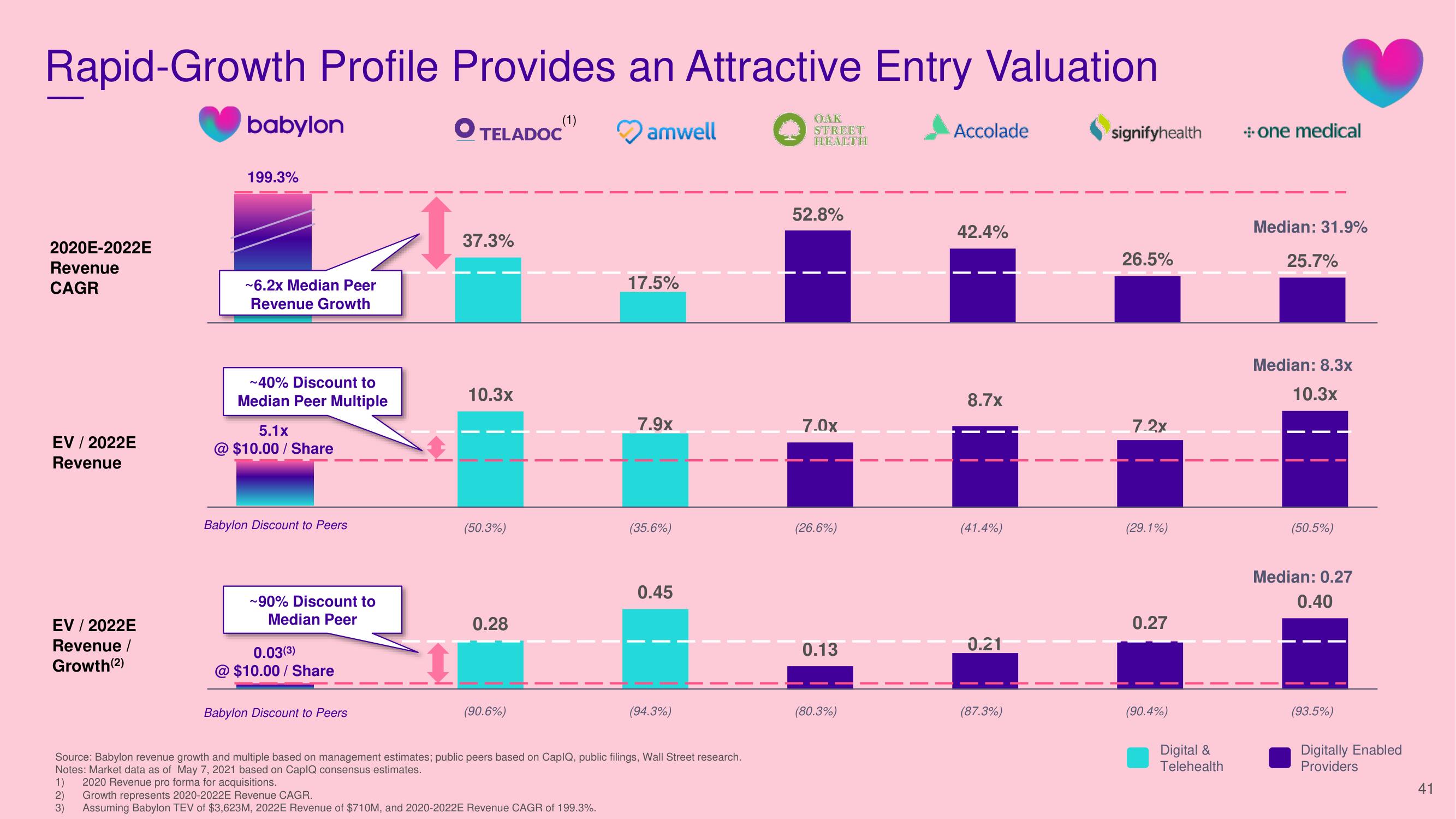

Rapid-Growth Profile Provides an Attractive Entry Valuation

TELADOC"¹

2020E-2022E

Revenue

CAGR

EV / 2022E

Revenue

EV / 2022E

Revenue /

Growth (2)

babylon

2)

3)

199.3%

~6.2x Median Peer

Revenue Growth

~40% Discount to

Median Peer Multiple

5.1x

@$10.00/Share

Babylon Discount to Peers

~90% Discount to

Median Peer

0.03(³3)

@$10.00/Share

Babylon Discount to Peers

O

37.3%

10.3x

(50.3%)

0.28

(90.6%)

amwell

Growth represents 2020-2022E Revenue CAGR.

Assuming Babylon TEV of $3,623M, 2022E Revenue of $710M, and 2020-2022E Revenue CAGR of 199.3%.

17.5%

7.9x

(35.6%)

0.45

Source: Babylon revenue growth and multiple based on management estimates; public peers based on CapIQ, public filings, Wall Street research.

Notes: Market data as of May 7, 2021 based on CapIQ consensus estimates.

1) 2020 Revenue pro forma for acquisitions.

(94.3%)

OAK

STREET

HEALTH

52.8%

7.0x

(26.6%)

0.13

(80.3%)

Accolade

42.4%

8.7x

(41.4%)

0.21

(87.3%)

signifyhealth

26.5%

7.2x

(29.1%)

0.27

(90.4%)

Digital &

Telehealth

• one medical

Median: 31.9%

25.7%

Median: 8.3x

10.3x

(50.5%)

Median: 0.27

0.40

(93.5%)

Digitally Enabled

Providers

41View entire presentation