Affirm Results Presentation Deck

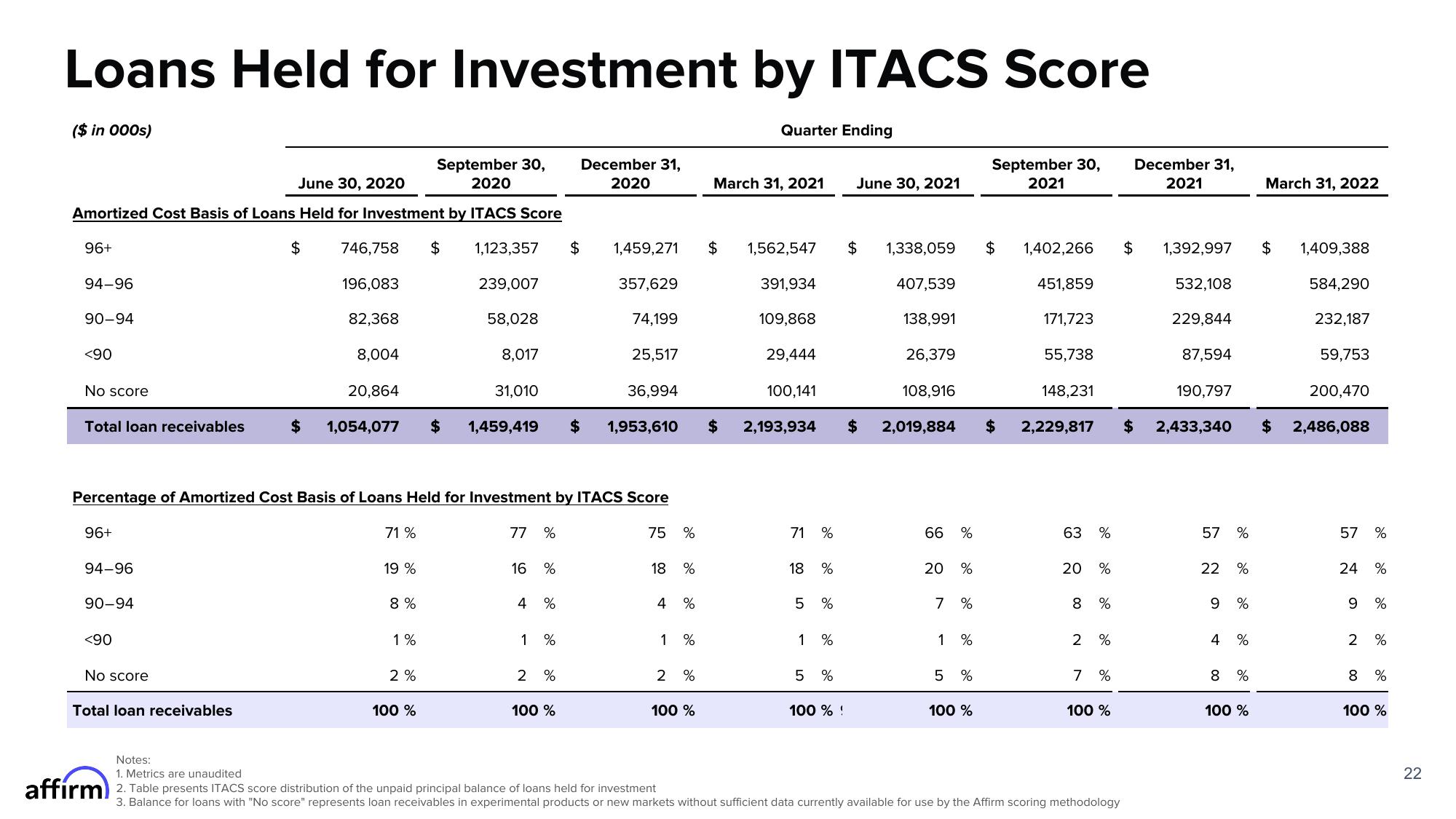

Loans Held for Investment by ITACS Score

($ in 000s)

September 30,

2020

June 30, 2020

Amortized Cost Basis of Loans Held for Investment by ITACS Score

746,758 $ 1,123,357

239,007

96+

94-96

90-94

<90

No score

Total loan receivables

96+

94-96

90-94

<90

No score

$

Total loan receivables

196,083

82,368

8,004

20,864

71 %

Percentage of Amortized Cost Basis of Loans Held for Investment by ITACS Score

77 %

19 %

8%

1%

58,028

2%

8,017

100 %

31,010

$ 1,054,077 $ 1,459,419 $ 1,953,610

16 %

4 %

1%

$

2 %

December 31,

2020

100 %

74,199

1,459,271 $ 1,562,547

357,629

25,517

36,994

75 %

18 %

4 %

1%

2 %

Quarter Ending

100 %

March 31, 2021

391,934

109,868

29,444

100,141

$ 2,193,934

71 %

18 %

5 %

1 %

5 %

100 % !

June 30, 2021

$ 1,338,059

407,539

138,991

26,379

108,916

$ 2,019,884

66

20

1

%

5

do

7 %

%

%

%

100 %

September 30,

2021

$ 1,402,266

451,859

171,723

55,738

148,231

$ 2,229,817

63 %

20 %

8 %

2 %

7 %

100 %

Notes:

1. Metrics are unaudited

affirm 2. Table presents ITACS score distribution of the unpaid principal balance of loans held for investment

3. Balance for loans with "No score" represents loan receivables in experimental products or new markets without sufficient data currently available for use by the Affirm scoring methodology

December 31,

2021

$ 1,392,997

532,108

229,844

87,594

190,797

$ 2,433,340

57 %

22 %

9 %

4 %

8 %

100 %

March 31, 2022

$

1,409,388

584,290

232,187

59,753

200,470

$ 2,486,088

57 %

24 %

9

%

2 %

8%

100 %

22View entire presentation