Apollo Global Management Investor Day Presentation Deck

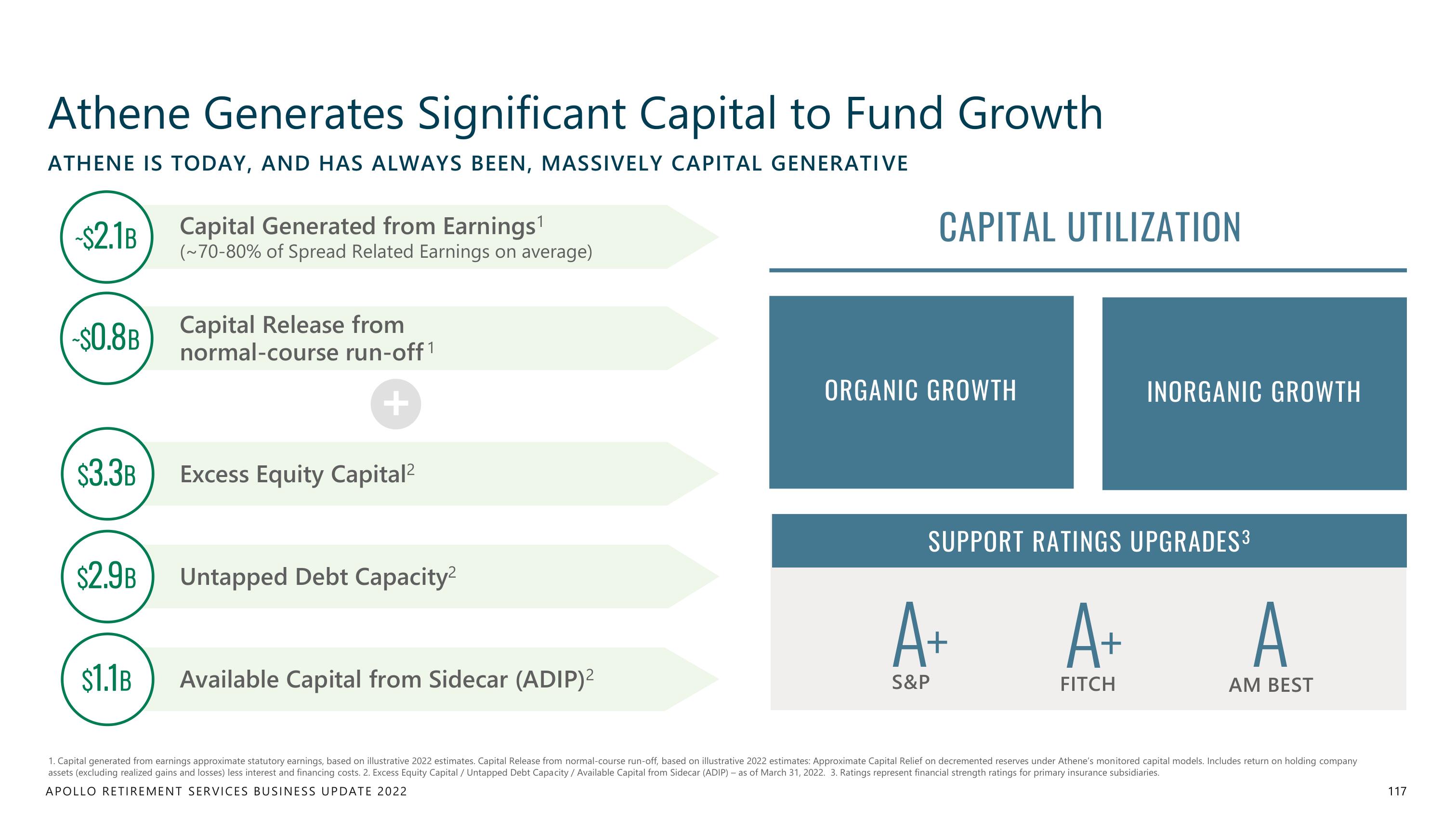

Athene Generates Significant Capital to Fund Growth

ATHENE IS TODAY, AND HAS ALWAYS BEEN, MASSIVELY CAPITAL GENERATIVE

-$2.1B

-$0.8B

$3.3B

$2.9B

$1.1B

Capital Generated from Earnings¹

(~70-80% of Spread Related Earnings on average)

Capital Release from

normal-course run-off 1

+

Excess Equity Capital²

Untapped Debt Capacity²

Available Capital from Sidecar (ADIP)²

CAPITAL UTILIZATION

ORGANIC GROWTH

SUPPORT RATINGS UPGRADES³

A+

S&P

INORGANIC GROWTH

A+

FITCH

A

AM BEST

1. Capital generated from earnings approximate statutory earnings, based on illustrative 2022 estimates. Capital Release from normal-course run-off, based on illustrative 2022 estimates: Approximate Capital Relief on decremented reserves under Athene's monitored capital models. Includes return on holding company

assets (excluding realized gains and losses) less interest and financing costs. 2. Excess Equity Capital / Untapped Debt Capacity / Available Capital from Sidecar (ADIP) - as of March 31, 2022. 3. Ratings represent financial strength ratings for primary insurance subsidiaries.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

117View entire presentation