Commercial Metals Company Investor Presentation Deck

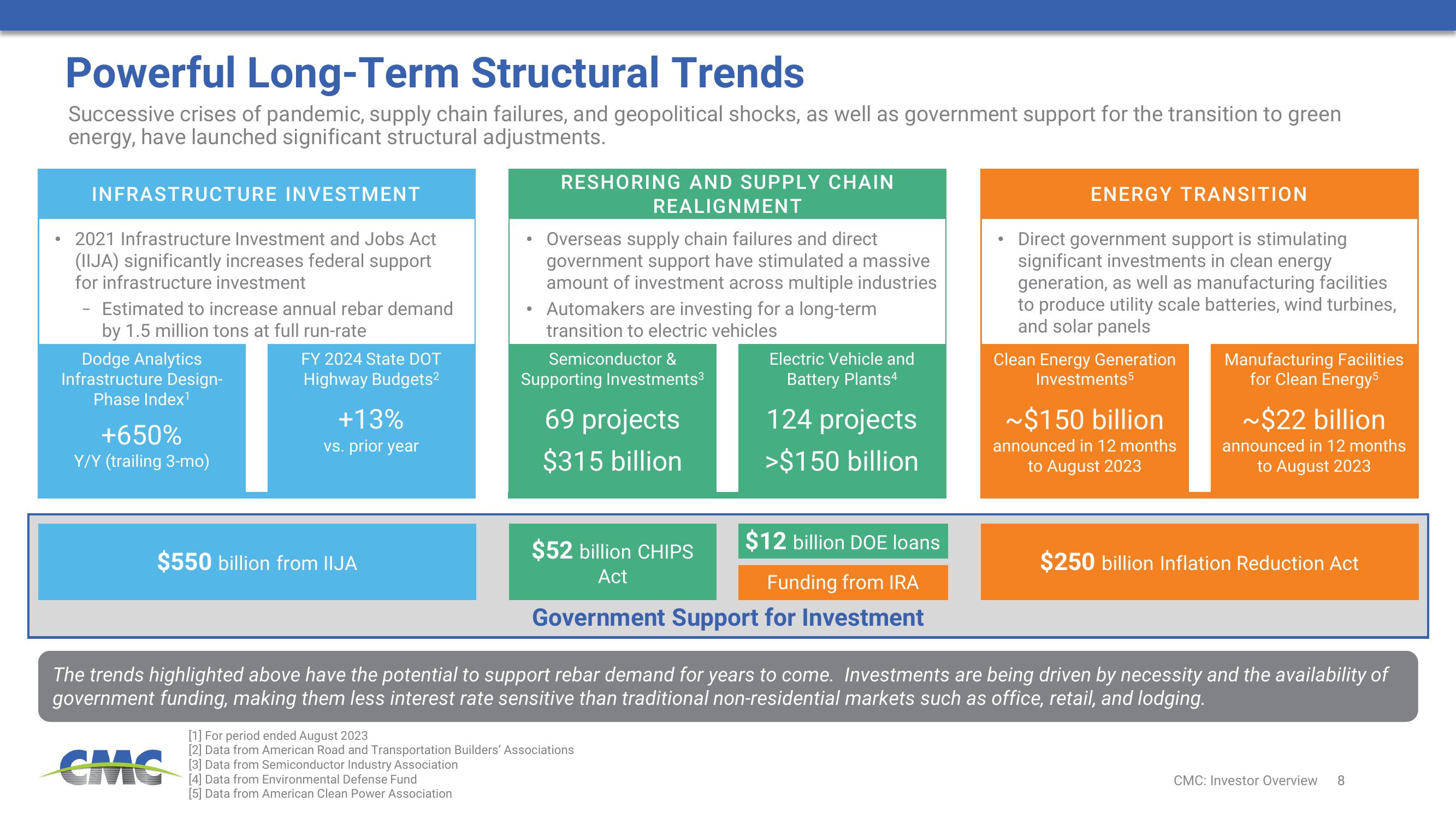

Powerful Long-Term Structural Trends

Successive crises of pandemic, supply chain failures, and geopolitical shocks, as well as government support for the transition to green

energy, have launched significant structural adjustments.

INFRASTRUCTURE INVESTMENT

2021 Infrastructure Investment and Jobs Act

(IIJA) significantly increases federal support

for infrastructure investment

- Estimated to increase annual rebar demand

by 1.5 million tons at full run-rate

Dodge Analytics

Infrastructure Design-

Phase Index¹

+650%

Y/Y (trailing 3-mo)

FY 2024 State DOT

Highway Budgets²

+13%

vs. prior year

$550 billion from IIJA

RESHORING AND SUPPLY CHAIN

REALIGNMENT

Overseas supply chain failures and direct

government support have stimulated a massive

amount of investment across multiple industries

Automakers are investing for a long-term

transition to electric vehicles

Semiconductor &

Supporting Investments³

69 projects

$315 billion

$52 billion CHIPS

Act

Electric Vehicle and

Battery Plants4

$12 billion DOE loans

Funding from IRA

Government Support for Investment

124 projects

>$150 billion

[1] For period ended August 2023

[2] Data from American Road and Transportation Builders' Associations

[3] Data from Semiconductor Industry Association

[4] Data from Environmental Defense Fund

[5] Data from American Clean Power Association

●

ENERGY TRANSITION

Direct government support is stimulating

significant investments in clean energy

generation, as well as manufacturing facilities

to produce utility scale batteries, wind turbines,

and solar panels

Clean Energy Generation

Investments5

~$150 billion

announced in 12 months

to August 2023

Manufacturing Facilities

for Clean Energy5

~$22 billion

announced in 12 months

to August 2023

$250 billion Inflation Reduction Act

The trends highlighted above have the potential to support rebar demand for years to come. Investments are being driven by necessity and the availability of

government funding, making them less interest rate sensitive than traditional non-residential markets such as office, retail, and lodging.

CMC: Investor Overview 8View entire presentation