Disney Investor Presentation Deck

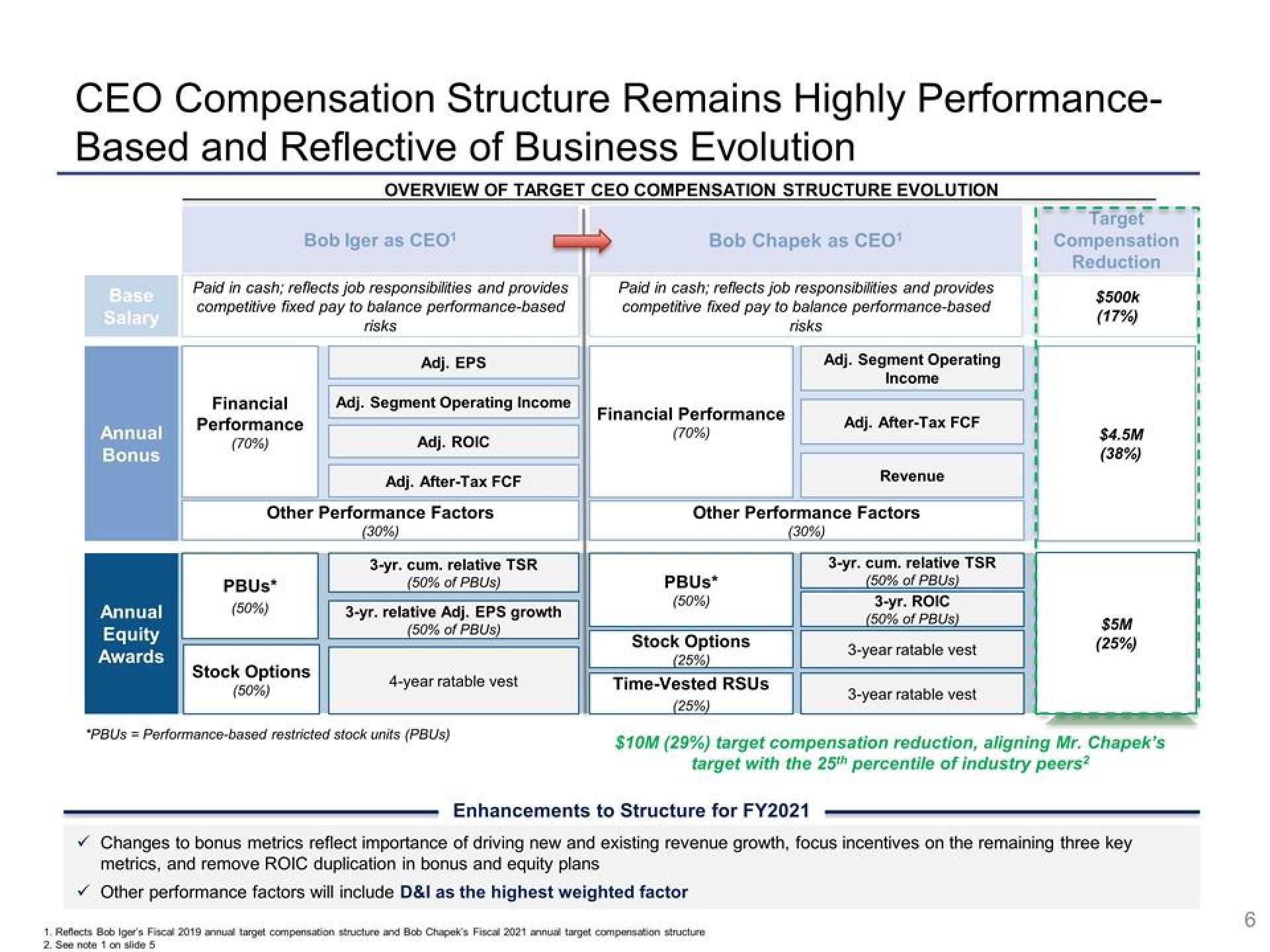

CEO Compensation Structure Remains Highly Performance-

Based and Reflective of Business Evolution

OVERVIEW OF TARGET CEO COMPENSATION STRUCTURE EVOLUTION

Base

Salary

Annual

Bonus

Annual

Equity

Awards

Bob Iger as CEO¹

Paid in cash; reflects job responsibilities and provides

competitive fixed pay to balance performance-based

risks

Financial

Performance

(70%)

PBUS*

(50%)

Adj. EPS

Adj. Segment Operating Income

Adj. ROIC

Other Performance Factors

(30%)

Stock Options

(50%)

Adj. After-Tax FCF

3-yr. cum. relative TSR

(50% of PBUS)

3-yr. relative Adj. EPS growth

(50% of PBUS)

4-year ratable vest

*PBUS = Performance-based restricted stock units (PBUS)

Bob Chapek as CEO¹

Paid in cash; reflects job responsibilities and provides

competitive fixed pay to balance performance-based

risks

Financial Performance

(70%)

PBUS*

(50%)

Stock Options

(25%)

Adj. Segment Operating

Income

Other Performance Factors

(30%)

Adj. After-Tax FCF

Revenue

1. Reflects Bob Iger's Fiscal 2019 annual target compensation structure and Bob Chapek's Fiscal 2021 annual target compensation structure

2. See note 1 on slide 5

3-yr. cum. relative TSR

(50% of PBUS)

3-yr. ROIC

(50% of PBUS)

3-year ratable vest

Target

Compensation

Reduction

3-year ratable vest

$500k

(17%)

$4.5M

(38%)

Time-Vested RSUS

(25%)

$10M (29%) target compensation reduction, aligning Mr. Chapek's

target with the 25th percentile of industry peers²

$5M

(25%)

Enhancements to Structure for FY2021

✓ Changes to bonus metrics reflect importance of driving new and existing revenue growth, focus incentives on the remaining three key

metrics, and remove ROIC duplication in bonus and equity plans

✓ Other performance factors will include D&I as the highest weighted factor

(2)View entire presentation