HHR Mergers and Acquisitions Presentation Deck

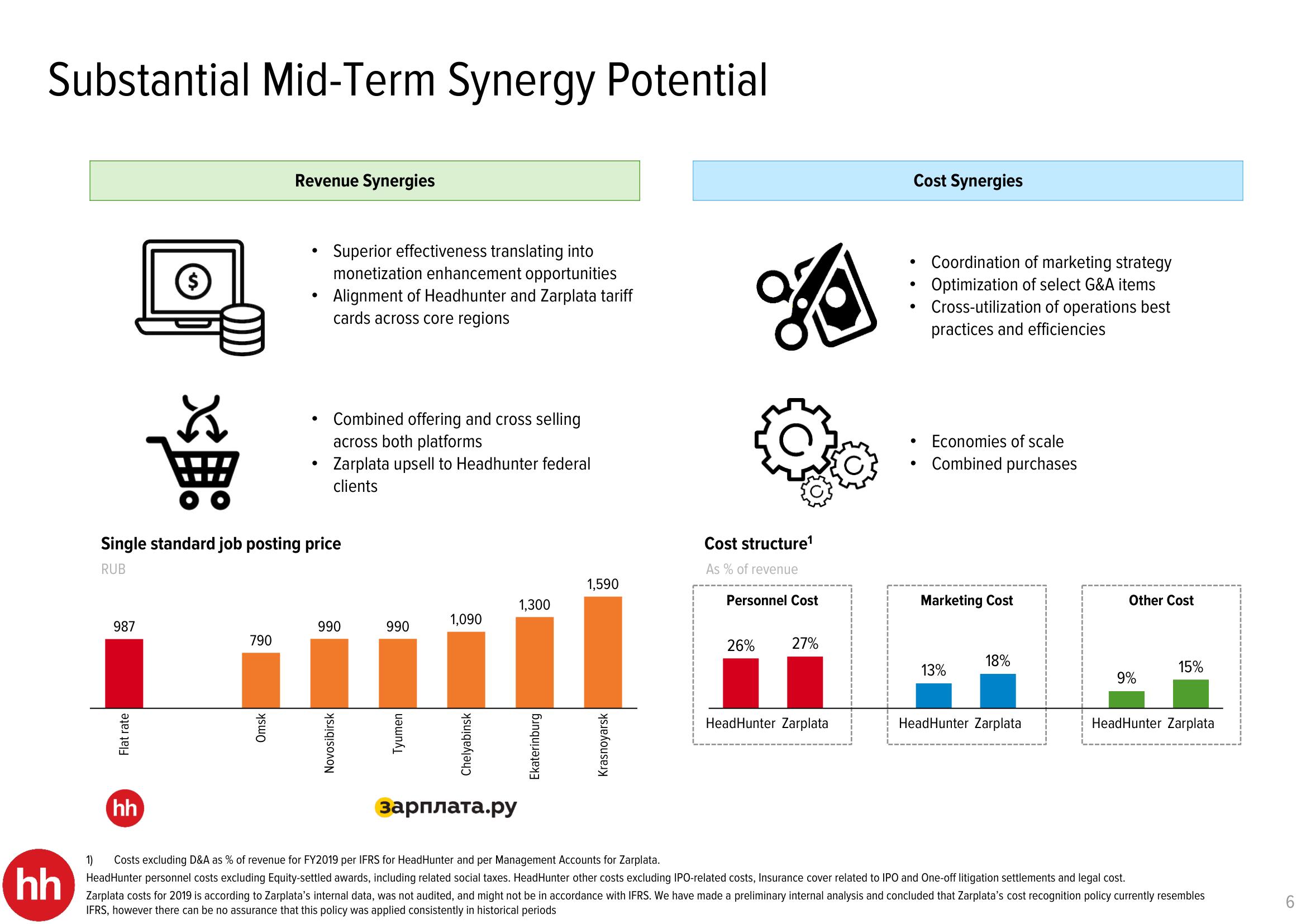

Substantial Mid-Term Synergy Potential

hh

987

Flat rate

$

hh

P

790

Revenue Synergies

Omsk

●

●

Single standard job posting price

RUB

●

●

Superior effectiveness translating into

monetization enhancement opportunities

Alignment of Headhunter and Zarplata tariff

cards across core regions

Combined offering and cross selling

across both platforms

Zarplata upsell to Headhunter federal

clients

990

Novosibirsk

990

Tyumen

1,090

Chelyabinsk

зарплата.ру

1,300

Ekaterinburg

1,590

Krasnoyarsk

Cost structure¹

As % of revenue

Personnel Cost

26%

27%

HeadHunter Zarplata

Cost Synergies

●

●

Coordination of marketing strategy

Optimization of select G&A items

Cross-utilization of operations best

practices and efficiencies

Economies of scale

Combined purchases

Marketing Cost

13%

18%

HeadHunter Zarplata

Other Cost

9%

15%

HeadHunter Zarplata

1) Costs excluding D&A as % of revenue for FY2019 per IFRS for HeadHunter and per Management Accounts for Zarplata.

HeadHunter personnel costs excluding Equity-settled awards, including related social taxes. HeadHunter other costs excluding IPO-related costs, Insurance cover related to IPO and One-off litigation settlements and legal cost.

Zarplata costs for 2019 is according to Zarplata's internal data, was not audited, and might not be in accordance with IFRS. We have made a preliminary internal analysis and concluded that Zarplata's cost recognition policy currently resembles

IFRS, however there can be no assurance that this policy was applied consistently in historical periods

6View entire presentation