HSBC Results Presentation Deck

Global Banking and Markets

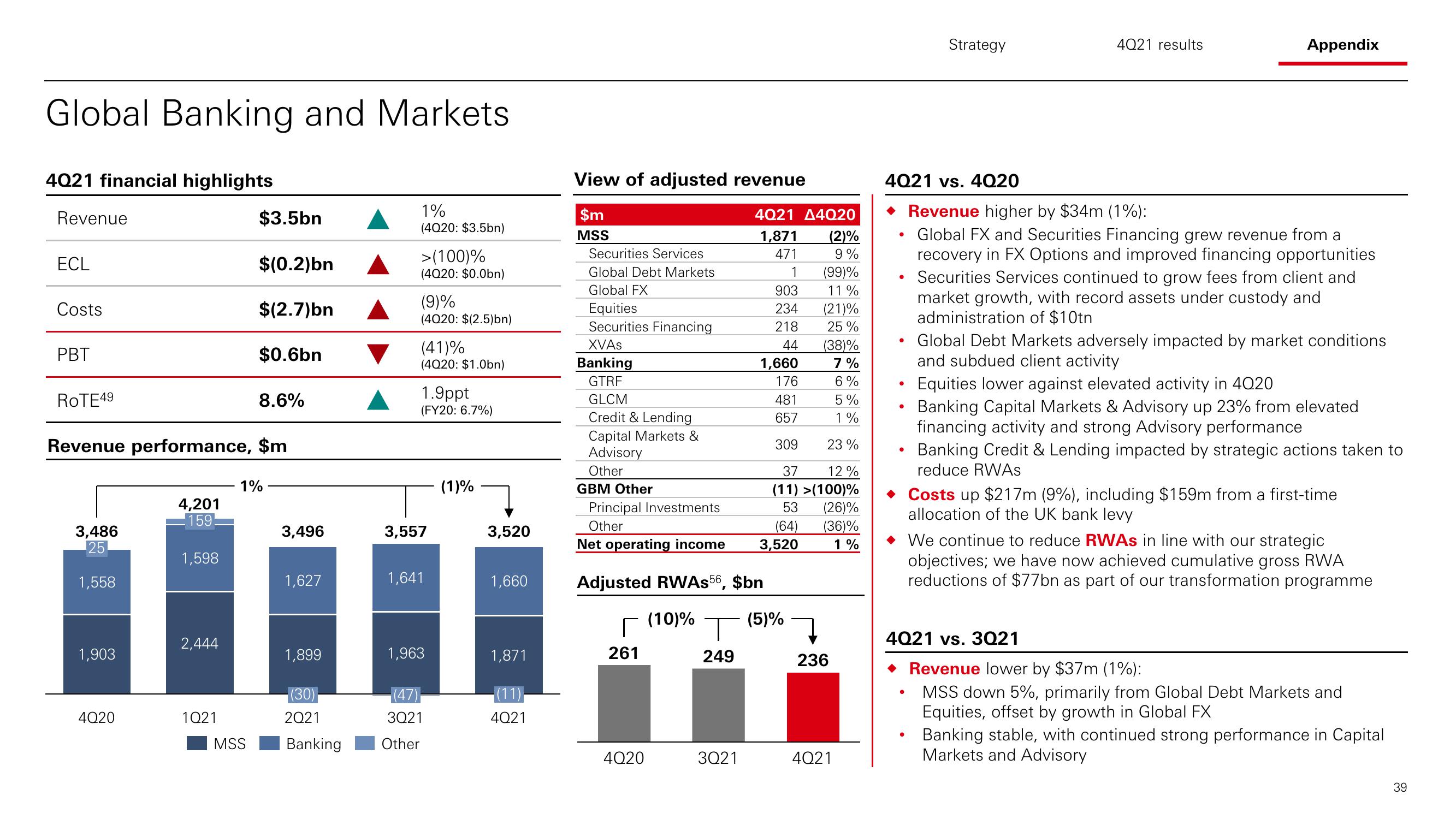

4021 financial highlights

Revenue

ECL

Costs

PBT

ROTE 49

3,486

25

1,558

Revenue performance, $m

1,903

4Q20

4,201

159

1,598

2,444

1Q21

$3.5bn

$(0.2)bn

$(2.7)bn

$0.6bn

8.6%

MSS

1%

3,496

1,627

1,899

(30)

2Q21

Banking

1%

(4020: $3.5bn)

>(100)%

(4020: $0.0bn)

(9)%

(4020: $(2.5)bn)

(41)%

(4020: $1.0bn)

Other

1.9ppt

(FY20: 6.7%)

3,557

1,641

1,963

(47)

3Q21

(1)%

3,520

1,660

1,871

(11)

4Q21

View of adjusted revenue

$m

MSS

Securities Services

Global Debt Markets

Global FX

Equities

Securities Financing

XVAS

Banking

GTRF

GLCM

Credit & Lending

Capital Markets &

Advisory

Other

GBM Other

Principal Investments

Other

Net operating income

Adjusted RWAs 56, $bn

(10)%

୮ T

249

261

4Q20

4021 A4020

1,871 (2)%

471

9%

1 (99)%

903

11%

234 (21)%

218 25%

44 (38)%

1,660 7%

6%

176

481

5%

657

1%

309

23 %

12%

37

(11)>(100)%

53 (26)%

(64) (36)%

3,520 1%

3Q21

(5)%

236

4Q21

●

●

4Q21 vs. 4Q20

◆ Revenue higher by $34m (1%):

Global FX and Securities Financing grew revenue from a

recovery in FX Options and improved financing opportunities

●

Strategy

●

4021 results

Appendix

Securities Services continued to grow fees from client and

market growth, with record assets under custody and

administration of $10tn

Global Debt Markets adversely impacted by market conditions

and subdued client activity

Equities lower against elevated activity in 4020

Banking Capital Markets & Advisory up 23% from elevated

financing activity and strong Advisory performance

Banking Credit & Lending impacted by strategic actions taken to

reduce RWAS

◆ Costs up $217m (9%), including $159m from a first-time

allocation of the UK bank levy

◆We continue to reduce RWAS in line with our strategic

objectives; we have now achieved cumulative gross RWA

reductions of $77bn as part of our transformation programme

4021 vs. 3Q21

◆ Revenue lower by $37m (1%):

MSS down 5%, primarily from Global Debt Markets and

Equities, offset by growth in Global FX

Banking stable, with continued strong performance in Capital

Markets and Advisory

39View entire presentation