Kinnevik Results Presentation Deck

Intro

Net Asset Value

A STABLE BUT FRAGILE START TO 2023

In H1 2023, the Nasdaq 100 had one of its best starts of the year ever,

returning almost 40 percent. Around 90 percent of the gain was propelled

by the large tech giants. This concentration of returns was underpinned by

positive sentiment around these businesses' earnings prowess, "do more

with less" messaging, and perhaps most importantly their showcasing

of real-world applications of artificial intelligence. Beneath these mega

caps, stock market performance was more mixed and less uniformly

positive. This is reflected in our unlisted portfolio's peer universe, in which

the weighted-average share price movement was up in low-single digit

percentages during the quarter, compared to a 4 percent decline in the

underlying valuations of our private businesses.

We saw minor positive movements in our software peers and more

muted developments elsewhere in our comparable universe. We exert

some caution in reflecting H1 2023 public market multiple expansion in

valuing our businesses considering the still prevailing market uncerta-

inty and the continued increase in correlation between profitability and

valuation multiples. As a consequence, the average premiums ascribed

to our faster growing businesses has shrunk meaningfully during 2023 to

date. In Q2, the weighted-average peer multiple remained unchanged

compared to 3 percent multiple contraction in our unlisted portfolio.

Key revisions of financial outlooks in this quarter pertain to Oda closing

its operations in Germany and Finland, and of Village MD consolidating its

footprint to accelerate profitability after the acquisition of Summit Health.

Elsewhere in the private portfolio, expectations on growth rates and

profitability remained largely unchanged on average. When factoring in

changes in the private portfolio's composition in the quarter, the average

expected growth rate of the portfolio remained unchanged in the quarter

even with the downward adjustments of forecasts at Oda and VillageMD.

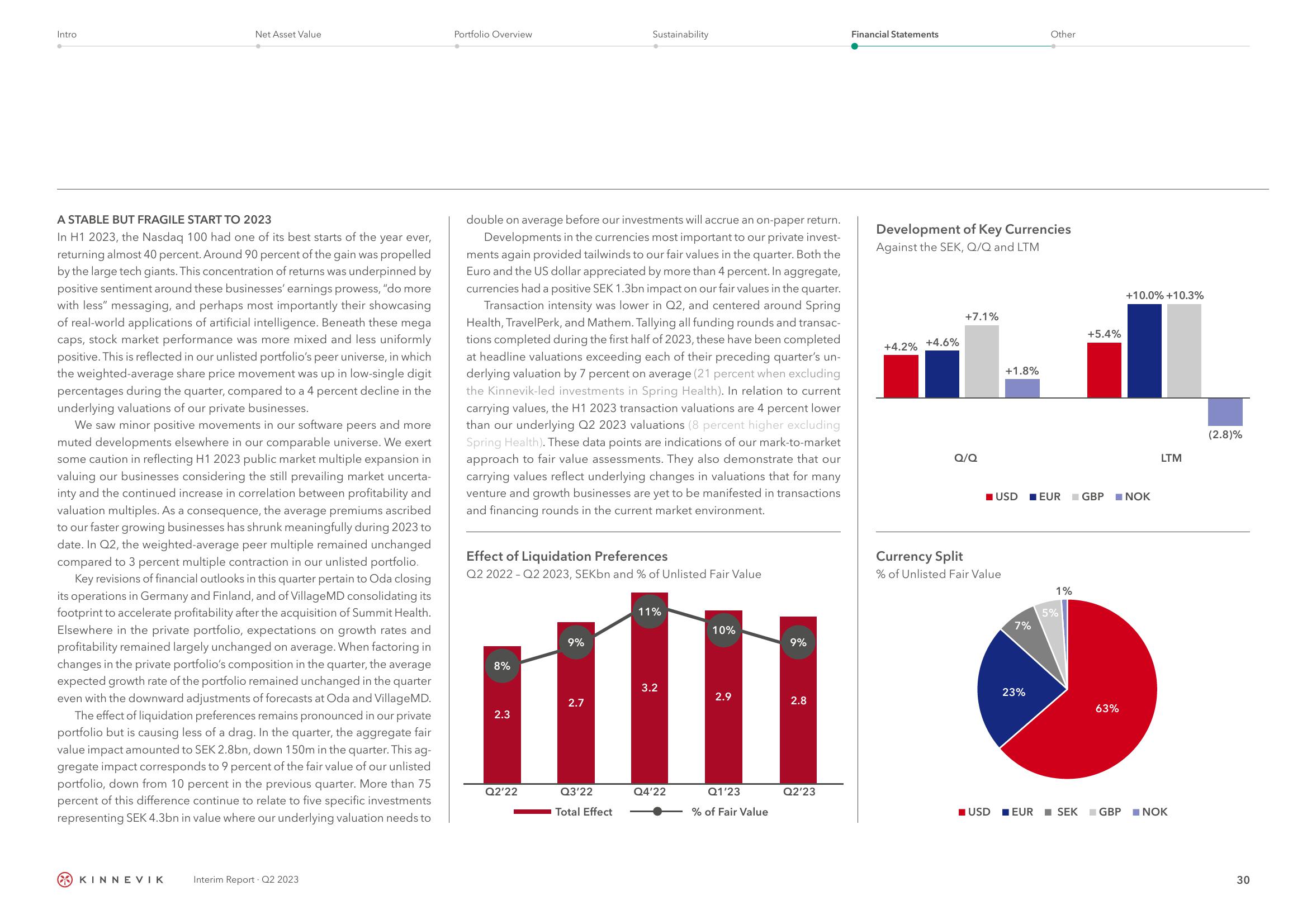

The effect of liquidation preferences remains pronounced in our private

portfolio but is causing less of a drag. In the quarter, the aggregate fair

value impact amounted to SEK 2.8bn, down 150m in the quarter. This ag-

gregate impact corresponds to 9 percent of the fair value of our unlisted

portfolio, down from 10 percent in the previous quarter. More than 75

percent of this difference continue to relate to five specific investments

representing SEK 4.3bn in value where our underlying valuation needs to

KINNEVIK

Interim Report Q2 2023

Portfolio Overview

double on average before our investments will accrue an on-paper return.

Developments in the currencies most important to our private invest-

ments again provided tailwinds to our fair values in the quarter. Both the

Euro and the US dollar appreciated by more than 4 percent. In aggregate,

currencies had a positive SEK 1.3bn impact on our fair values in the quarter.

Transaction intensity was lower in Q2, and centered around Spring

Health, TravelPerk, and Mathem. Tallying all funding rounds and transac-

tions completed during the first half of 2023, these have been completed

at headline valuations exceeding each of their preceding quarter's un-

derlying valuation by 7 percent on average (21 percent when excluding

the Kinnevik-led investments in Spring Health). In relation to current

carrying values, the H1 2023 transaction valuations are 4 percent lower

than our underlying Q2 2023 valuations (8 percent higher excluding

Spring Health). These data points are indications of our mark-to-market

approach to fair value assessments. They also demonstrate that our

carrying values reflect underlying changes in valuations that for many

venture and growth businesses are yet to be manifested in transactions

and financing rounds in the current market environment.

Effect of Liquidation Preferences

Q2 2022-Q2 2023, SEKbn and % of Unlisted Fair Value

8%

2.3

Q2'22

9%

Sustainability

2.7

Q3'22

Total Effect

11%

3.2

Q4'22

10%

2.9

Q1'23

% of Fair Value

9%

2.8

Q2'23

Financial Statements

Development of Key Currencies

Against the SEK, Q/Q and LTM

+4.2%

+4.6%

+7.1%

Q/Q

Currency Split

% of Unlisted Fair Value

USD

+1.8%

Other

USD EUR GBP

7%

23%

1%

5%

+5.4%

EUR SEK

63%

GBP

+10.0% +10.3%

NOK

LTM

NOK

(2.8)%

30View entire presentation