Blackwells Capital Activist Presentation Deck

CASE STUDY - COLONY CREDIT

Overview

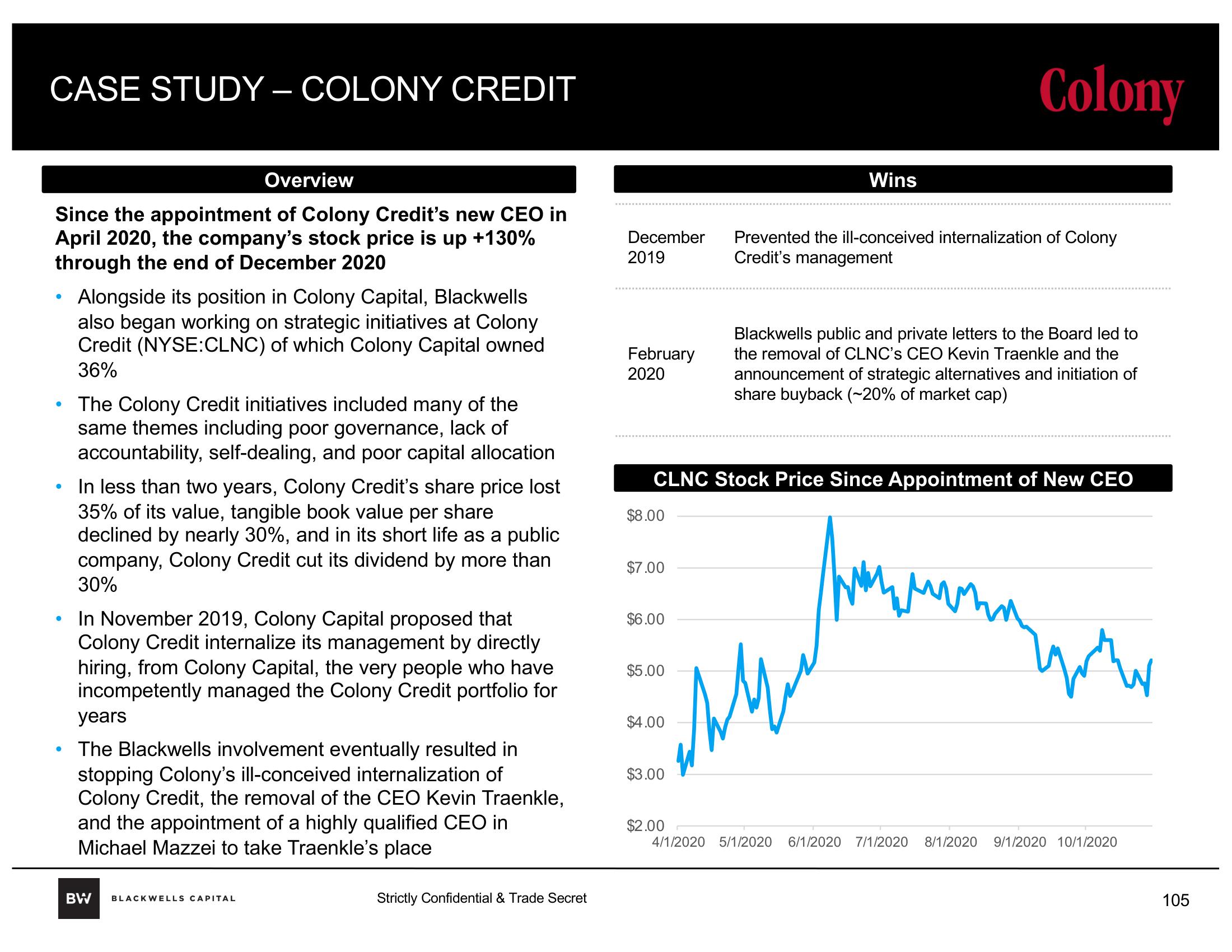

Since the appointment of Colony Credit's new CEO in

April 2020, the company's stock price is up +130%

through the end of December 2020

●

●

Alongside its position in Colony Capital, Blackwells

also began working on strategic initiatives at Colony

Credit (NYSE:CLNC) of which Colony Capital owned

36%

The Colony Credit initiatives included many of the

same themes including poor governance, lack of

accountability, self-dealing, and poor capital allocation

In less than two years, Colony Credit's share price lost

35% of its value, tangible book value per share

declined by nearly 30%, and in its short life as a public

company, Colony Credit cut its dividend by more than

30%

In November 2019, Colony Capital proposed that

Colony Credit internalize its management by directly

hiring, from Colony Capital, the very people who have

incompetently managed the Colony Credit portfolio for

years

The Blackwells involvement eventually resulted in

stopping Colony's ill-conceived internalization of

Colony Credit, the removal of the CEO Kevin Traenkle,

and the appointment of a highly qualified CEO in

Michael Mazzei to take Traenkle's place

BW

BLACKWELLS CAPITAL

Strictly Confidential & Trade Secret

December

2019

February

2020

$8.00

$7.00

$6.00

CLNC Stock Price Since Appointment of New CEO

$5.00

$4.00

$3.00

Wins

$2.00

Colony

Prevented the ill-conceived internalization of Colony

Credit's management

Blackwells public and private letters to the Board led to

the removal of CLNC's CEO Kevin Traenkle and the

announcement of strategic alternatives and initiation of

share buyback (~20% of market cap)

ми

you

W

4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020

105View entire presentation